PV inverter manufacturer SolarEdge Technologies continued quarterly revenue generation trajectory, despite market dynamics, has result in market share gains and achieving Q3 2018 revenue that is higher than its nearest rival SMA Solar, for the first time.

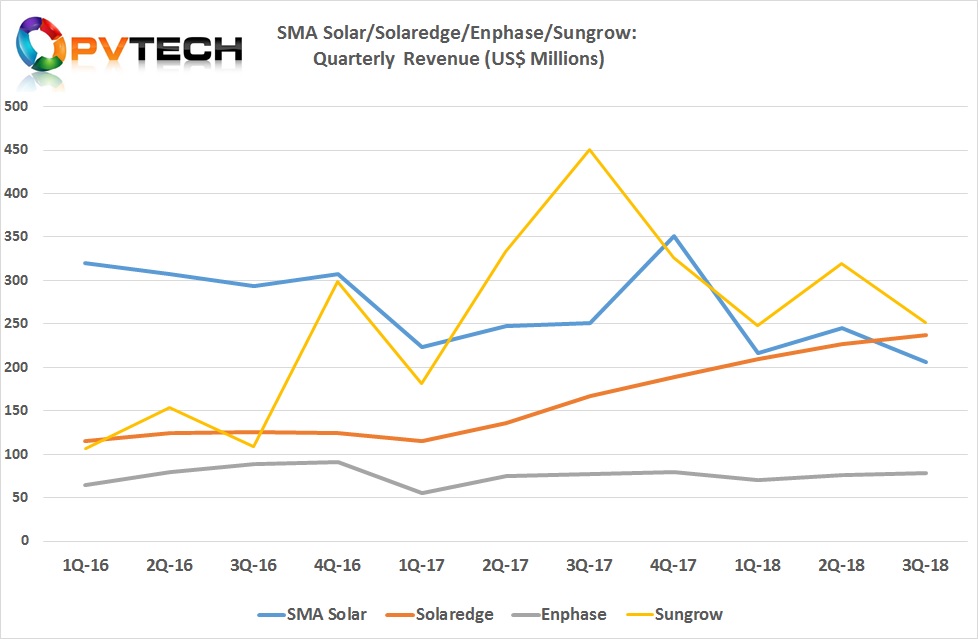

According to the latest PV Tech analysis of four public listed PV inverter manufacturers (Sungrow, SMA Solar, SolarEdge and Enphase), policy volatility across regional (China, India and US) markets as well as downstream industry sectors (utility, commercial and residential) has impacted revenue generation for three of the four companies in the third quarter of 2018.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

As clearly shown in the chart below, SolarEdge recently reported third quarter revenue of US$236.6 million, a 4% increase over the previous quarter, contrasts with its near rivals (Sungrow and SMA Solar), which have been impacted by much greater dependence on the utility-scale PV market and demand issues due to China’s 531 New Deal and product ASP declines that are delaying PV power plant projects until price stability returns.

PV Tech had previously reported that SolarEdge had drastically closed the quarterly revenue gap with SMA Solar in the first quarter of 2018, yet the known spike in mid-year project completions in countries such as China, Japan and India saw the gap increase again in the second quarter.

With a major cut in utility-scale and DG projects in China (excluding Poverty Alleviation and Top Runner) programs from June onwards impacted major China-based inverter supplier and EPC, Sungrow Power Supply in the third quarter.

Sungrow had previously surpassed SMA Solar in the second quarter of 2017.

The challenges in the utility-scale sector has boosted SolarEdge’s ability to continue growth in the commercial and residential space and closed the revenue gap significantly with Sungrow as its revenue takes dive.

However, fourth quarter gains and losses are hard to project, not least due to the typically seasonal strength in the utility-scale market in the quarter. SMA Solar could post at least €225 million in the fourth quarter just to meet the low-range of revenue guidance for the full-year of €800 million to €850 million (US$914 million to US$972 million)

Sungrow could easily see revenue bounce back strongly, due to Top Runner project completions by year-end.

SolarEdge guided fourth quarter 2018 revenue to be within the range of US$245 million to US$255 million, indicating full-year revenue would reach a minimum of around US$918 million.

However, any slips by Sungrow and SMA Solar in the fourth quarter and SolarEdge could out-perform its bigger rivals.

With respect to Enphase, a meaniful spike in revenue is not expected until 2019 with new customer contracts and easing of capacity constraints, unlike 2018 and management's focus on restructuring and rebuilding conditions for growth next year.

As noted before, further volatility in quarterly revenue patterns is almost a given. Keep watching closely!