China-based integrated monocrystalline PV manufacturer Solargiga Energy Holdings' sales have rebounded in the first half of 2017, fuelled by demand in China for high-efficiency wafers including N-type wafers for ‘Top Runner’ PV power plant projects.

Solargiga highlighted that market demand for monocrystalline silicon wafers, high-efficient modules and solar cell’s increased significantly, with production capacity utilization rates at high levels with demand outstripping supply, creating shortages in the supply chain.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Demand for N-type monocrystalline bifacial cells and modules are expected to gain attention from the Chinese market in the near future as China initiates its ‘Super Runner Program,’ according to the company.

The Super Runner Program established through China’s National Energy Bureau has launched an upgraded version of the national Top Runner Program, which is intended to promote the application of advance technology in PV power plants.

Solargiga noted that its core upstream monocrystalline ingot and wafer manufacturing operations had been significantly upgraded in 2016, which impacted capacity utilization rates and knock-on effects of weaker economies of scale as well as long-tern polysilicon supply contracts with minimum volume purchase conditions.

However, the company noted that since the beginning of 2017, ingot and wafer manufacturing operations resumed normal operations with improved efficiencies, also benefiting from the end to long-term polysilicon contracts that carried high purchase prices. The boost in production meant its ability to negotiate new polysilicon supply and better pricing positively impacted its financial performance in the first half of the year.

Solargiga said that monocrystalline ingot and wafer manufacturing capacity stood at 1.2GW, respectively, while solar production stood at 350MW and module assembly capacity was 1.2GW. Wafer manufacturing capacity had increased by 300MW in the reporting period.

The company uses third party solar cell producers (China & Taiwan) to balance with module assembly capacity via ingot and wafer supply deals to its solar cell customers.

As a result of resumed operations Solargiga reported external shipments of monocrystalline silicon ingots was 184.5MW in the first half of 2017, an increase of 152% compared to 73.2MW in the prior year period.

External shipments of monocrystalline silicon wafers were 331.7MW, an increase of 47% compared to 225.5MW in the first half of 2016.

The majority of Solargiga’s solar cell capacity is used internally for its module production.

External PV module shipments were 616.5MW in the first half of the year, an increase of 42%, compared to 434.6MW in the first half of 2016. Solargiga said that increased customer base and volume quantity increases from customers were behind the overall stronger demand.

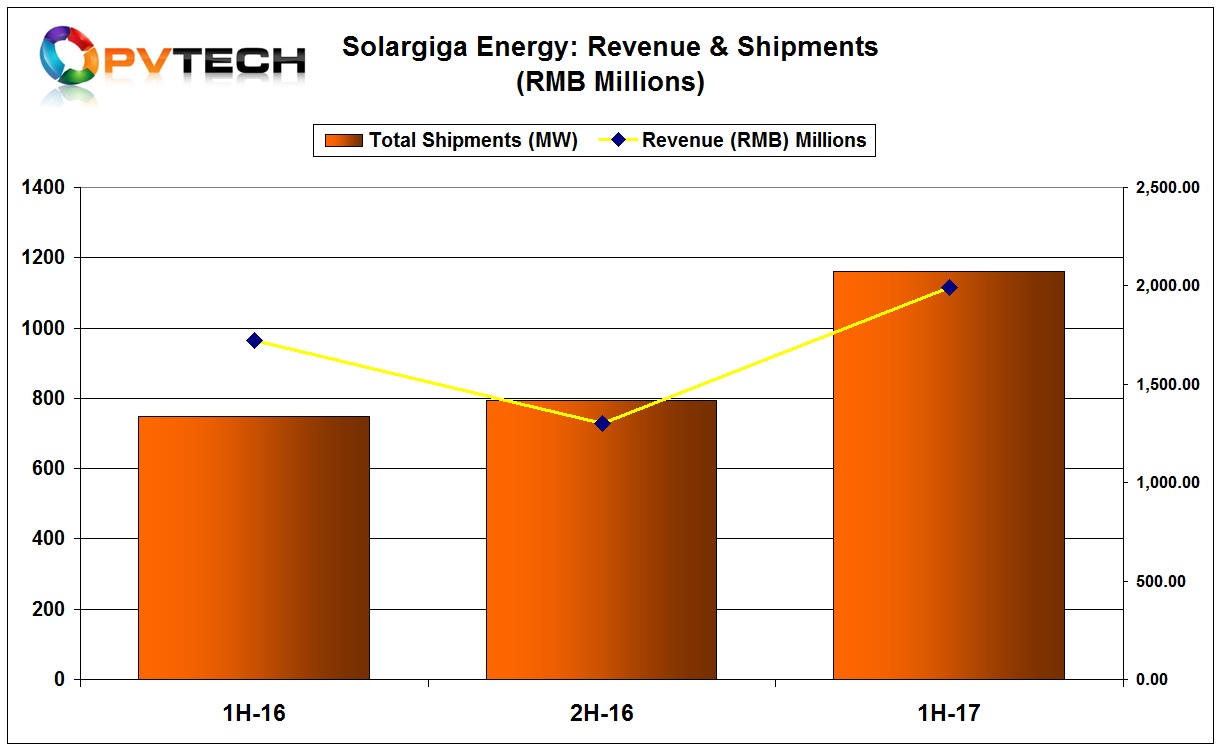

Total shipment volume increased from 749MW in the first half of 2016 to 1,161MW in the first half of 2017, representing an increase of 55%.

Key customers in the reporting period included major Chinese state owned enterprises including, State Power Investment Corporation (SPIC), CGN New Energy Holdings and China Huadian Corporation.

Financial results

Solargiga reported revenue of RMB1,989 million (US$289.6 million) in the first half of 2017, an increase of 15.4% over the prior year period.

Gross profit was RMB305 million (US$45.7 million), an increase of 55.3% from the prior year period. Gross margin increased from 11.4% in the first half of 2016 to 15.3% in the first half of 2017. Earnings before interest, taxes, depreciation and amortization (EBITDA) was RMB271.008 million (US$40.6 million), up from US$20.3 million in the prior year period.

Operating profit increased significantly to RMB181.663 million (US$27.2 million) during the first half of 2017, an increase of 500% compared to the prior year period.

Solargiga noted that it was considering adding new manufacturing capacity at the ingot/wafer level as well as module assembly but did not provide specific plans for expansions.

The company is seeing continued growth in demand for high-efficiency products outside China, including Japan and South-East Asia.