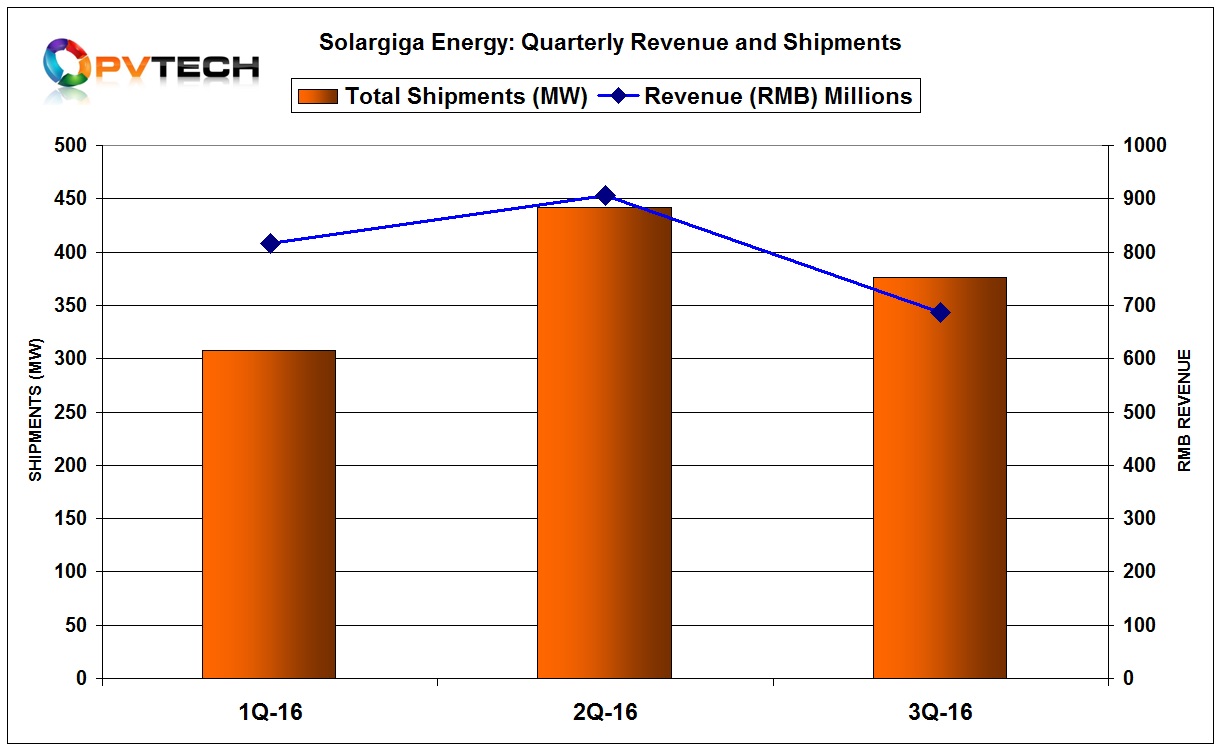

Integrated China-based monocrystalline PV producer, Solargiga Energy Holdings has reported certain unaudited operating figures for the third quarter of 2016, indicating a significant revenue and shipment decline, compared to the previous quarter.

Solargiga reported total preliminary third quarter 2016 revenue of around RMB 687 million (US$102 million), down over 24% (US$134.5) million from the previous quarter.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Revenue for the first nine months of 2016 was RMB 2,410 million (US$357.5 million), up 23.5% (US$289.4 million) from the prior year period.

Total product shipments which included processing service; sales of silicon solar ingots, wafers, cells and photovoltaic modules; and the engineering, procurement and construction of photovoltaic systems service reached 376MW in the third quarter, down around 15% from the previous quarter when shipments reached 442MW.

Shipments in the first nine months of 2016 reached 1,125.5MW, up from 763.9MW in the prior year period, a 47.3% increase from the prior year period.

Solargiga is one of the first China-based producers to provide insight into third quarter financials after a major slowdown in PV project development in China at the end of the second quarter of 2016, which has driven a rapidly developing period of overcapacity, resulting in steep price declines.