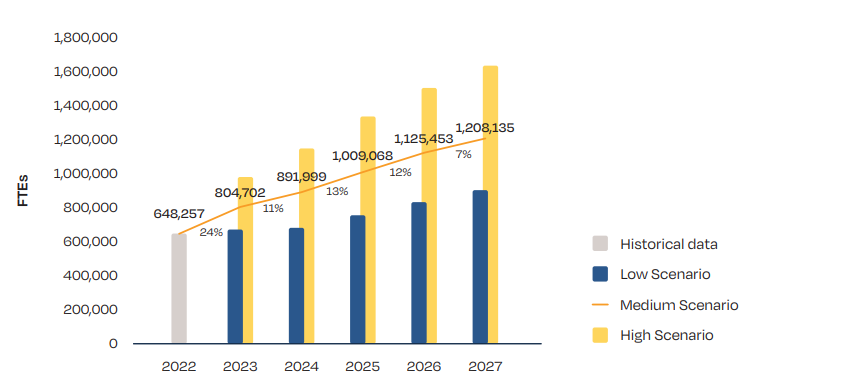

European solar trade body SolarPower Europe has published its latest report into solar jobs in Europe, finding that the sector’s workforce grew from around 466,000 to over 648,000 full-time equivalent positions (FTEs) between the end of 2021 and 2022, a 39% increase.

The group expects this impressive rate of growth to continue over the coming years, and forecasts Europe to deliver over one million solar jobs by 2025. This would be five years ahead of the organisation’s initial plan of reaching one million solar jobs by 2030, and is a testament to growth in installed capacity and interest in new solar projects across the continent.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

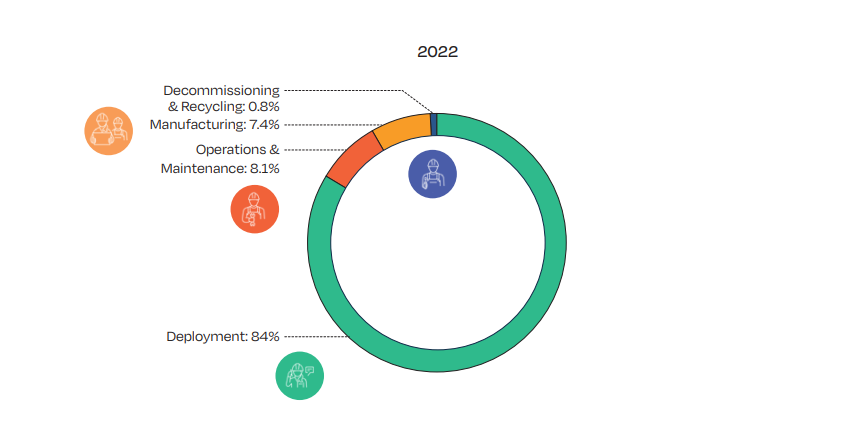

Of the 648,257 jobs in the European solar industry as of the end of 2022, the vast majority were in the deployment sector, which offered 542,406 positions. Behind this sector, 52,376 jobs were available in operations and maintenance, 48,229 in manufacturing and 5,246 in recycling.

Emphasis on deployment

Crucially, the vast majority of the new jobs created were associated with the deployment of solar systems, with the 542,406 jobs available in deployment equal to 84% of all jobs in the European solar sector. This compares to 8% in operations and maintenance, 7% in manufacturing and 1% in decommissioning and manufacturing.

This emphasis on deployment and downstream development is reflected in the considerable growth in the installed capacity in the European solar sector, with the report noting that Europe added 40.2GW of new capacity in 2022, a record for a 12-month period.

However, this imbalance has also contributed to difficulties for the manufacturing sector in particular, which saw its contribution to new jobs overtaken by the operations and maintenance sector for the first time. Challenges for the European manufacturing sector continue to appear: earlier this year, SolarPower Europe called the European manufacturing industry “deeply precarious,” arguing that the import of cheap modules produced in China had all but made a European manufacturing sector financially unviable.

SolarPower Europe also expects this trend to continue over the next five years. The group expects the proportion of jobs tied to deployment to fall slightly over the next few years, from 84% in 2022 to 80% in 2027, while the proportion of jobs in operations and maintenance will increase from 8% to 10% over this period.

The proportion of jobs in manufacturing is set to increase from 7% to 8% over this period, a smaller increase than in operations and maintenance, and one that will still leave the European sector heavily reliant on downstream positions for its workforce.

Policy recommendations

“Looking at the solar skills gap, we’re beginning to tackle quantity, and now we need to re-double our efforts on quality,” said Walburga Hemetsberger, SolarPower Europe CEO, speaking about the imbalance in types of jobs available for European solar workers. “Citizens and businesses must feel confident that their solar project is manufactured, installed, and maintained by properly trained, trustworthy, professionals.”

To address this imbalance, the body makes a number of recommendations in its report, beginning with a call to “assess the lack of workers”, suggesting that national governments and those organising training programmes need to place greater emphasis on positions relevant to the solar sector, such as electricians and construction workers.

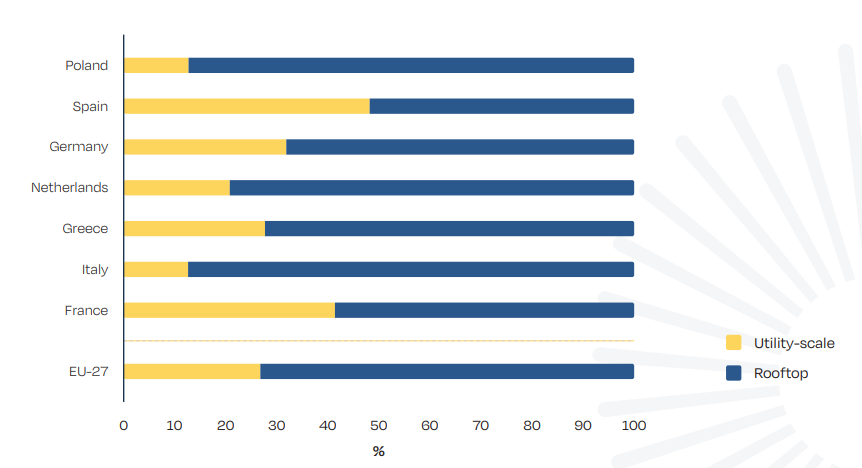

SolarPower Europe also calls on these groups to emphasise the importance of rooftop solar, which remains the dominant force in the European solar sector. According to the group’s figures, rooftop solar accounted for 60% of the continent’s total solar capacity in 2022 and added 25GW of new capacity that year, up from 17GW of new capacity the previous year.

This is reflected in hiring practices in the employment sector, with SolarPower Europe’s latest figures showing that 83% of deployment workers were employed in the rooftop sector.

The body also calls on Europe, as a whole, to work together to help train new generations of solar workers. The report asks for national governments to “facilitate intra-EU movement of workers,” to enable skilled workers to move across the continent to meet the job demands of particular countries, and the group points to programmes such as the Net-Zero Academies, set up under the EU’s Net-Zero Industry Act, as a tool to train new workers that can be employed across the continent.

Encouraging forecasts

Many of these employment imbalances will need to be addressed if SolarPower Europe’s optimistic forecasts for the future of European solar are to be realised. The group’s report includes job forecasts for three scenarios, a “low”, “medium” and “high” scenario, each referring to the extent to which solar power is incorporated into Europe’s energy mix, and even the medium scenario expects the European solar sector to need over one million jobs by 2025.

The high scenario suggests that Europe could have over one million solar jobs by 2023, and the low scenario forecasts the European solar industry to need 903,000 jobs by 2027, a considerable increase of 39% over the number of jobs currently available in the sector.

The group also expects the European manufacturing sector to grow considerably, to 61,725 jobs in the low scenario, 98,171 jobs in the medium scenario and 129,193 jobs in the high scenario by 2027. The latter two scenarios would constitute a more than doubling of the European manufacturing sector, and SolarPower Europe pointed to the work done by organisations such as the European Solar PV Industry Alliance as helping to realise this target.

The alliance aims to expand Europe’s annual manufacturing capacity to 30GW by 2025, up from 8GW of annual module capacity as of 2022, according to McKinsey, a process that would create 400,000 new jobs.

Notably, SolarPower Europe’s latest forecasts are significantly higher than those it made in its 2022 jobs report. Looking only at the medium scenarios put forward in both reports, the 2023 report expects the European solar sector to have 1.1 million FTEs by 2026, a 47% increase over the number of jobs expected in the previous year’s report.

The report has been published at a time of increased interest in securing a reliable supply of jobs for the growing solar industry, in continental Europe, the UK and the US.