TCL Zhonghuan has announced a US$200 million investment into manufacturer Maxeon Solar Technologies.

The transaction comes in the form of 5-year convertible bonds and will be completed via wholly-owned subsidiary Zhonghuan New Investment. The money will mainly be used to support expenditures for Maxeon 7 products, P series products and R&D expenditures.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

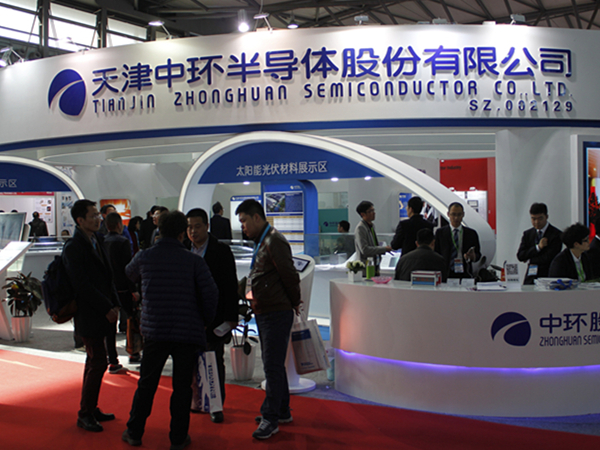

TCL Zhonghuan – formed as electronics manufacturer TCL acquired semiconductor producer Zhonghuan in a 2020 takeover – said that the purchase of the bonds is part of its overseas strategy, which will not only support Maxeon’s growth but will also establish a solid foundation for the international expansion of Zhonghuan.

Globalisation in reverse: rise of local manufacturing

TCL Zhonghuan’s further investment in Maxeon reflects its future strategy on global trade and PV development.

With the outbreak of the Russia-Ukraine war and rising energy prices in various regions, countries are placing ever-growing importance on solar energy, issuing policies to support their own PV supply chains and protect local markets. PV manufacturing outside China has become an acute area of focus.

Recently, the US’ Inflation Reduction Act (IRA), which plans to restore the investment tax credit (ITC) to 30% for PV projects that begin construction before 1 January 2025, as well as a host of other incentives for upstream manufacturing, has renewed hopes for the US PV industry. The IRA is also designed to encourage rooftop PV installations through a 10-year consumer tax credit. The package of incentives is seen as the most aggressive climate support in US history.

In March, SolarPower Europe (SPE) published a proposal on supply chain security, which aims to promote the independence of the European PV industry. In addition, local manufacturing capacity plans in India, Saudi Arabia and other countries and regions have continued to spread. All of these measures reflect a trend towards ‘reversed globalisation’ within the PV industry, whereby countries are increasingly look to onshore or re-shore key parts of the supply chain to protect against future disruptions.

At the same time, foreign trade of PV products is facing more severe challenges. In addition to tariff and patent disputes, barriers to trade such as a product’s carbon footprint as well as environmental product declarations have begun to form, reshaping global competition while increasing the difficulty for PV product exports.

Demand for localised manufacturing of PV products is emerging. Lying in front of the leading Chinese PV companies is the issue of how to achieve better localisation of overseas manufacturing and sales in the tide of anti-globalisation while integrating into the global market.

In the face of a complicated global trade landscape, TCL Zhonghuan’s move looks set to raise the stakes in its overseas development agenda.

Latest technology and global market background

PV companies have adopted different strategies in order to open up the global markets and obtain good overseas supply channels and resources. For TCL Zhonghuan, it is through its investment in Maxeon.

TCL Zhonghuan and Maxeon formed an alliance four years ago. In 2019, Zhonghuan secured a cooperation agreement with Total to spin off Maxeon from solar residential installer SunPower and register Maxeon in Singapore. TCL Zhonghuan became the second largest shareholder of Maxeon with a stake of 28.85%.

Maxeon is a NASDAQ-listed company in the US. Its main business is designing, manufacturing and selling solar modules under the Maxeon and SunPower brands. Its production capacity is distributed in Mexico and Malaysia. The products are widely used in the residential and utility-scale markets.

Maxeon has developed and updated multiple cells and modules based on its IBC solar cell technology. With the rise of distributed market, IBC cells are expected to excel due to higher frontal power generation efficiency and a favorable exterior design free of grid lines.

One of the key tasks of Maxeon’s fund-raising is to promote R&D and manufacturing of the latest generation of Maxeon7 products (IBC technology), which is expected to enhance the competitiveness of its latest series of products and projects.

In addition, TCL Zhonghuan and Maxeon will also share information in terms of manufacturing concepts, which will actively promote the introduction of digital and flexible manufacturing capabilities.

According to TCL Zhonghuan, IBC cells will be an important development direction to improve cell efficiency. Meanwhile, the introduction of laminated tile modules has revolutionised module assembly. Both products are in line with Maxeon’s differentiated product strategy and are hoped to drive Maxeon’s growth.

In this way the company can actively expand oversea sales channels, better realise local production and overseas sales within the trend of countries’ wanting more of the solar supply chain built domestically.

According to forecasts from China’s Photovoltaic Industry Association, global newly installed PV capacity may reach 205~250GW in 2022, which will be a new high. Among them, Europe, the US and emerging countries hold the potential for more than 100-150GW of deployment.

This article was updated on 23/08/2022.

.