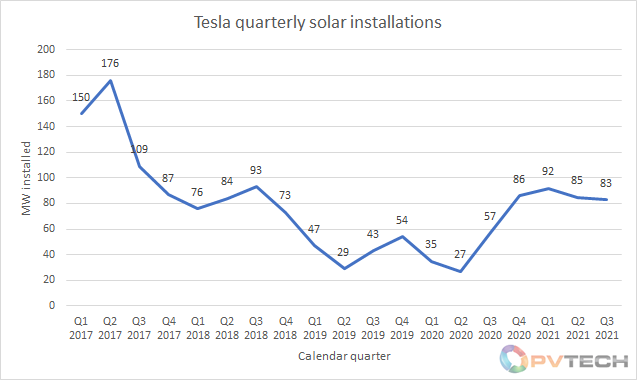

Tesla solar installations jumped by 46% year-on-year but fell slightly sequentially to 83MW in Q3 as the clean tech giant targeting greater profitability from its energy division.

Tesla further noted in its Q3 2021 results release that nearly all solar deployments were catered for by cash/loan purchases rather than other financing mediums, and that installations of its Solar Roof product more than doubled year-on-year and also grew sequentially, however no specific figures for the product were revealed.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Energy storage meanwhile enjoyed another strong quarter, with deployments climbing 71% year-on-year to 1,295MWh. Tesla said it was “very excited about the broader potential” of its Megapack product having recently revealed plans to develop a Megapack factory with a capacity of 40GWh to cater for demand.

Tesla did, however, state that it was continuing to make cost improvements to its energy division, targeting the installation side specifically, to increase its profitability.

Total revenue from Tesla’s energy division stood at US$806 million, up 36% year-on-year, while its cost of revenue stood at US$803 million, leading to a division profit of around US$3 million for the quarter.

By means of comparison, Q2 2021 energy division profit stood at US$20 million.

But supply chain challenges remain, especially a shortage of semiconductors and congestion at ports, which had prevented Tesla from fully utilising factory capacity, the company said. Earlier this year Tesla chief executive Elon Musk lamented the “insane difficulties” the company was experiencing in its supply chain and the company noted within its Q3 results that it believed the company’s engineering and production teams had been dealing with constraints “with ingenuity, agility and flexibility”.