The three largest African commercial and industrial (C&I) solar projects are fuel reduction projects at remote mines. This is mainly due to the extremely high energy demand in mining. Project sizes that are effectively too small are often an obstacle for renewable energy project developers and investors that are new to the C&I segment. Many solar companies that were traditionally involved in large grid-connected plants first looked at mining. However, there are many interesting sectors for C&I beyond mining. Cement plants are normally grid-connected, but falling costs make solar also competitive in this segment. The situation is similar for shopping malls. And both allow for relatively large C&I plants that can be almost as big as the average PV plants in mining. We have selected the largest plants from each of these three attractive segments for our top three African C&I projects countdown.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Top three countdown

Number 3

In South Africa, Mall of Africa has the world’s largest rooftop solar-diesel hybrid solution. Solareff installed the 4.8MW PV plant that covers about 45,000m² of roof space. The grid-connected solar-diesel hybrid plant is fully integrated and can provide excess energy to the grid, which required a complicated administrative process for such a large plant in South Africa. The shopping centre’s developer Atterbury Property wants to use integrated solar-diesel hybrid solutions at more of its properties in the future.

Number 2

In the north of Namibia, a ground-mounted 6.6MW solar plant provides clean energy to a cement factory. SunEQ has signed a 15-year PPA with the factory that belongs to Ohorongo (Pty) Ltd., part of the German Schwenk Group. The grid-connected solar power plant was constructed by Hopsol.

Number 1

IAMGOLD Essakane SA has signed a 15-year power purchase agreement (PPA) with EREN Renewable Energy (now Total Eren). The ground-mounted 15MW solar plant cost more than US$20 million. It was built to reduce fuel consumption of the existing 55MW heavy fuel oil (HFO) power plant at IAMGOLD’s Burkina Faso mine consisting of five Wärtsilä gensets. Wärtsilä was also contracted for the EPC and O&M scope. The plant is the largest on-site solar power plant in mining and the biggest C&I plant in Africa – even without energy storage.

Our top three African C&I projects are all without storage and were all commissioned in 2018. C&I in Africa is booming, and it is getting bigger and bigger. Falling battery prices could increase the clean energy share of C&I projects and make PV plants even bigger.

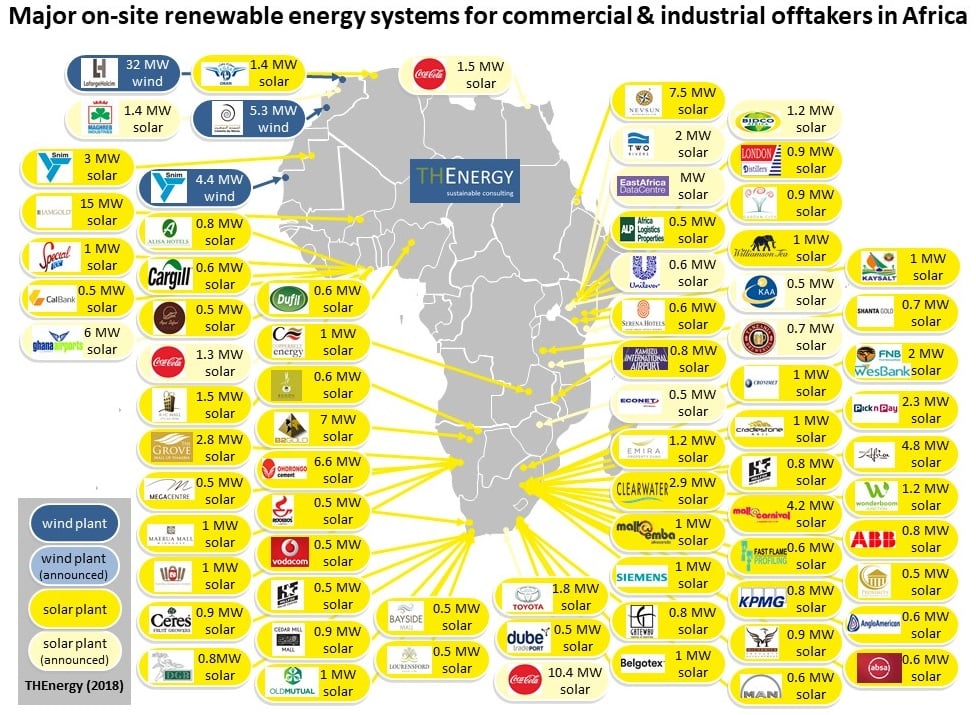

To find out more about the booming C&I segment, a new THEnergy survey examines the drivers for C&I projects. The research also includes an inventory of existing plants of at least 500kW in Africa. The intermediary results are summarised in the following map:

This overview is definitely not finished yet. Please contact THEnergy if you are aware of any mistakes or missing data.

The largest projects are in mining and cement, while food and beverages, office buildings and above all, shopping malls, account for the biggest number of projects. The map also shows that C&I projects often pop up in clusters. The main clusters that have been identified so far are Johannesburg and Cape Town (both South Africa), Nairobi (Kenya), Accra (Ghana), and Windhoek, Namibia. This underlines the importance of pilot projects that demonstrate the advantages in certain regions and sectors.

At the moment, THEnergy is interviewing commercial and industrial offtakers in Africa to find out the key success factors of renewable energy and energy storage adoption. It covers on-grid and off-grid applications throughout the C&I segment. All kinds of off-takers are targeted: from consumers that have already committed to renewables to those who have not had any contact with renewable energy. The survey aims to assist renewable energy companies in optimising their offerings, according to the needs of commercial and industrial customers. It is also conceived in a way to give guidelines to political decision makers on how to set up optimal framework conditions in the energy sector.

Until now, phone interviews with decision makers from mining, food & beverages, fast-moving consumer goods, real estate/shopping centres, and manufacturing have been conducted. We are also looking to speak with offtakers from the banking, telecom, fuel station, hospitality, and chemical/pharmaceutical sectors – just to name a view. During the next weeks, additional interviews will be added.

Are you working for a commercial or industrial off-taker that has operations in Africa? Please participate! The survey takes approximately 15-20 minutes and is conducted by phone. After completion, the results of the survey will be shared with the participants and questions can be asked in a conference call. More details can be found here.