2022 saw the solar PV market enter a ‘new growth dimension’, where 239GW of solar capacity was added across the world representing two thirds of all new renewables capacity. This is according to SolarPower Europe’s Global Market Outlook for solar power 2023-27, which forecasts that strong growth will continue through 2023 and beyond.

China continues to dominate, installing almost 100GW and besting the second-largest market – the US –more than fourfold.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

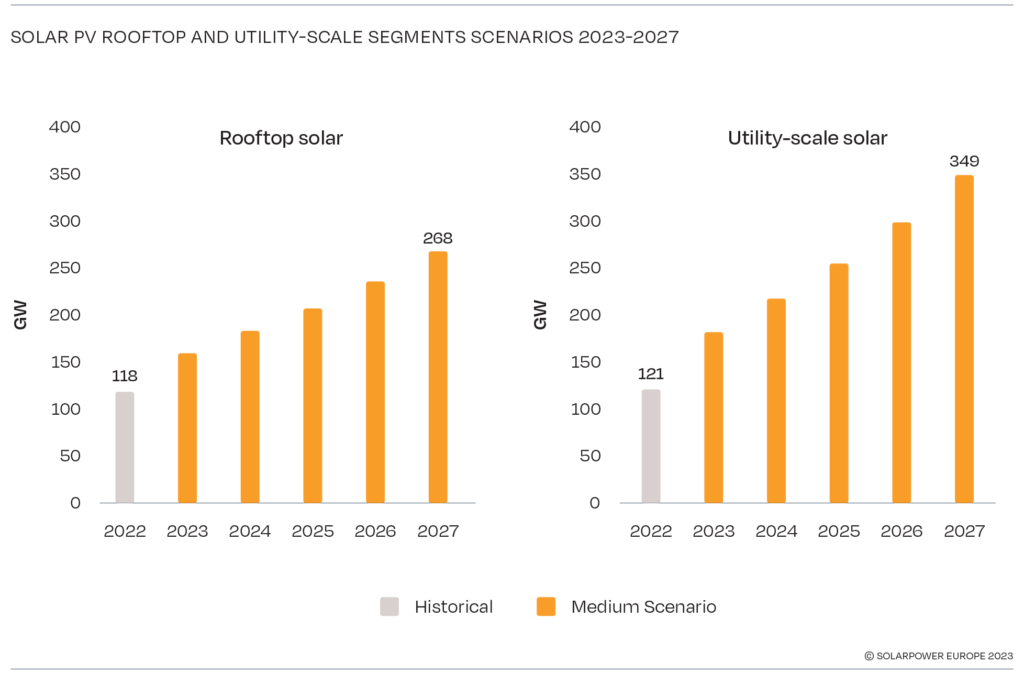

The star performer in the 2022 PV market was the rooftop sector. Utility-scale projects continued to be the largest contributor to capacity additions, but the two sectors were very nearly equal: rooftop installations across the world accounted for 49.5% – 118GW – of new capacity in 2022.

The trend is fairly unsurprising as the effects of the war in Ukraine, the ensuing energy crisis and fluctuating prices have driven consumers to seek energy independence across the world. Australia, Germany and the US all reported booms in their rooftop markets over 2022, and SolarPower Europe’s report also highlighted policy tailwinds in Brazil, Italy and Spain that led their rooftop markets to more than double over the year.

China added 51.1GW of rooftop PV in 2022, representing 54% of its total new capacity and a 29GW increase in real terms from its 2021 figures.

The report expects 2023 to match 2022’s growth rate in the rooftop market, with a slight decline in the years following as energy prices begin to return to normal and utility-scale permitting and prices become once again more favourable. SolarPower Europe expects the rooftop sector to reach 268GW by 2027, more than the total solar market size in 2022.

Utility-scale solar continued its growth trajectory worldwide despite supply chain insecurities, the COVID-19 hangover and inflation causing the first rise in the levelised cost of energy (LCOE) for solar PV in over a decade. Fundamentally, it will take more than that to unseat solar power as the most affordable renewable energy source in most of the world.

Large scale projects grew 41% in 2022 to 121GW, a level that SolarPower Europe said could have been higher were it not for rising module prices and supply fluctuations.

Beyond China’s runaway success, the US saw a 6% decline year-on-year as its ongoing import tariff saga and the module detainments from the Uyghur Forced Labor Prevention Act hampered growth. Utility-scale solar accounted for over 60% of the US market in 2022 – 13.8GW – and the market is still the second largest in the world. The end of 2022 and Q1 2023 have been promising for the US, however, with the first three months of this year the best in its history for solar installations driven largely by a slight loosening of supply constraints.

India was the third-highest installer in 2022, once again managing to resurrect its market despite ongoing challenges in the form of supply issues and project delays. Its market grew by 3.2GW compared with 2021 to 17.4GW, the majority of which was utility-scale, and the module supply crunch brought about by slightly over-zealous policymaking in the form of the basic customs duty (BCD), which applied a steep import tax to foreign modules before a domestic supply base was fully established, is on its way to ending.

The top 5 markets were rounded out by Brazil and Spain, which represented distributed and utility-scale domination respectively. Small-scale and commercial projects were driven by a rush to benefit from Brazil’s favourable net metering policy that’s due to change in 2023. Spain’s mature PPA-driven utility-scale sector continued to perform strongly, adding 5.3GW of unsubsidized, self-managing capacity out of the country’s total 8.4GW in 2022.

SolarPower Europe’s forecast for 2023 predicts a 43% growth rate for the solar sector compared with 2022, and its report suggested that it wouldn’t be unlikely to see solar PV installations pushing 400GW a year by 2024. The International Energy Agency (IEA) reported similar projections last month, predicting that investments into solar PV would outstrip those for oil for the first time ever in 2023.

The Global Market Outlook report did stress, however, that solar still accounted for only 4.5% of global power production in 2022. Whilst solar is growing consistently, and non-renewable sources were at an all-time low last year, the latter still contributed 70.1% of global power production.