In January, Slovakian software provider Solargis launched Evaluate 2.0, the second generation of its 3D power plant design solution. The program is a powerful tool that combines solar and meteorological data to optimise PV plant design and is an example of the greater use of data that is becoming increasingly common in the solar industry.

PV Tech spoke to Solargis CEO about the product at its launch. From solar irradiance monitoring to more sophisticated price forecasting, working with data to optimise operations has become a prerequisite for many asset managers, and, as Suri explains, advancements in data collection and usage technologies have facilitated this.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“We have much better data, we have much better computing power and we don’t have to rely on running software on a PC,” says Suri. “We have cloud-based solutions where we can run much more physically based, complex simulation systems, which can do a very high-quality job in a very fast manner.”

Suri suggests that better use of data, while a challenge in the short term for asset managers who are less familiar with the breadth of information now available, will help deliver the “agile” kind of solutions that are essential for the future of the solar industry.

“Today, the digital, software and data industries can do more to help those who are developing, financing and operating [projects]. We need to develop more agile solutions, which help PV to fit better into the energy mix. It’s a long-term [challenge]; what we’ve done is just build the base.

“For me, this is the first floor of the building; I don’t know how many floors the building is going to have.”

Delivering agile operations

According to Suri, the demand for greater data sophistication and the advancement of technologies to capture and use this data means that now is the time for a rethinking of how data is used in plant design and asset management in the solar industry.

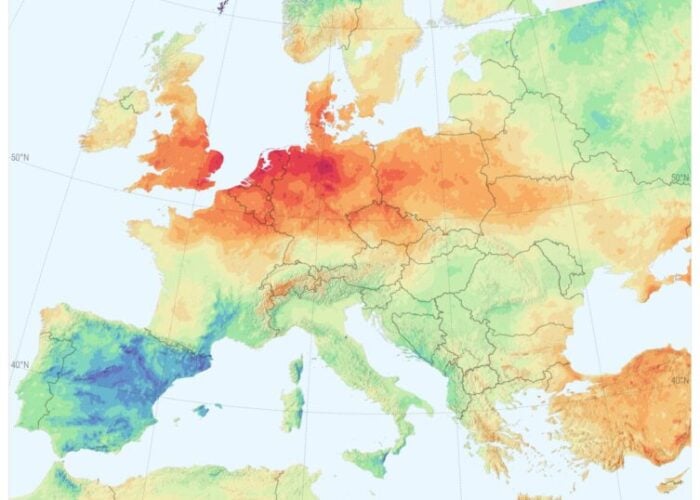

“The current energy simulators are not able to … use high-resolution data,” says Suri. “The typical data product that is used in the industry is hourly TMY [typical meteorological year], and that’s not enough. This is too long; the established practices do not fulfil the requirements of modern PV, because the TMY completely ignores weather extremes, weather events that we are facing today on a practically routine basis.”

This is particularly significant considering the growth of PV projects and investment in the sector. These factors mean that an inefficient operation loses more power than ever before and cuts into an investor’s margins more than in previous years; figures from Raptor Maps suggest that asset underperformance and equipment issues cost the global solar sector a mammoth US$4.6 billion in 2023.

Suri suggests that, as the solar sector and its data components have matured, these losses can be effectively minimised, but the industry has not yet, by and large, moved to a more efficient way of operating.

“Ten or 15 years ago, the satellite data was in its beginnings,” says Suri. “When we started, it took us a few years to create a global database of satellite data; it took us maybe five years. The TMY was established in the very beginnings of PV, and was created from very simplified, very low-resolution data. But somehow, this practice continues until today, even [though] it is not necessary.”

“There is so much further to develop,” continues Suri, highlighting how the greater complexity of PV operations necessitates greater complexity of management systems. “PV simulation is not as simple as it used to be, not just because we are dealing with more complex technologies – like bifacial modules [and] intelligent trackers – but many projects are combined with storage.”

Suri’s comments come amid growing interest in both the storage sector and the co-located solar sector. At this year’s Solar Finance and Investment Europe event in London, speakers discussed the crucial role of storage in the European solar sector, and the latest figures from Bloomberg New Energy Finance suggest that the global energy storage market almost tripled between 2022 and 2023.

According to Suri, the complexities and opportunities that arise from co-location are a good example of greater complexity and granularity in the solar sector, which can be better managed with more sophisticated data use.

“Within one hour, so many things happen, and if you don’t use – at least – 15-minute data, which is today’s standard, or one-minute data, which we will offer in the next releases, then you are lost. You don’t know what, exactly, the battery is doing.”

Operational and financial challenges

However, shifting to a more sophisticated use of data is not simple for the average asset manager, at least not on the scale or to the depth that Suri says is possible.

“Plugging the technical processes into human or financial or project-related processes [is a challenge],” says Suri. “How do companies operate? They need data at the early stages of development to get key information quickly, without going into too many details; but then as the project gets more mature, they want more data.

“They’ll probably want updates to the data they were procuring before. If you offer suddenly all these ideas, [they bring] a lot of new complexities, and you need to resolve them.”

According to Suri, these operational complexities are mirrored by increasingly sophisticated financial models that underpin the work of solar assets. The growing complexities of agreements are reflected in power purchase agreements (PPAs), where more accurate data on price trends has enabled the development of complex instruments such as virtual PPAs or variably priced offtake agreements, but solar developers are struggling to keep up with these innovations.

“You need to deliver electricity, using much more sophisticated business models,” says Suri, comparing the past and present financial obligations of solar operators. “You had to deliver [electricity], and you didn’t really much care what the electricity operator was doing, whether they have the capacity to absorb your electricity or not, but this is not valid anymore.

“We have countries and regions where there is congestion [and] curtailment and delivery needs to be managed according to the needs of the grid operator, and the demand and production has to be synchronised, which means that energy simulation design, optimisation and hybrid projects need to be designed in such a way that you can deliver electricity where needed, when needed.”

This is particularly significant considering the scale of investment in renewable power in general and solar in particular; the International Energy Agency (IEA) estimated that in 2024, the world was set to invest around US$2 trillion in renewable energy, twice as much as in fossil fuels. Investment in the solar sector hit US$503 billion in 2024, compared to US$426 billion for all other electricity generation technologies combined. This is the second consecutive year that PV investment has outpaced all other power generation investments.

With more money than ever flowing into the sector and financiers looking to maximise returns on investment, ensuring a project is financially lucrative, or at least viable, is a key priority for project developers.

Tackling one issue at a time

While working with the depth and complexity of data currently available can present a challenge for asset managers with less experience in this field, Suri suggests that companies should be able to adapt to these issues. Regarding the complexities associated with project finance, for instance, he argues that developers ought to keep their focus on the targets set out in their business plans and work from there.

“Your business plan is to deliver [power] when needed, so you need to follow some strategy where your PV is integrated with storage and start reflecting the market and price signals,” says Suri. “That means that already in the project design and development stage, you need to keep this in mind.”

He also suggests that working with other companies in the industry, each of which brings its own expertise, is essential to managing something as complex and fluid as electricity generation today.

“Our customers are developers, EPCs, operators, manufacturers, financial guys, technical advisors or certification laboratories and authorities,” says Suri. “These are our customers, so over many, many years – as we are not only a data supplier but a consultancy branch – we have offered forecasting services, performance evaluation services, so all this allows us to work with different stakeholders and to understand how they are working and what is needed.

“Of course, we don’t know everything, and storage is a world on its own, but working on various projects – whether it’s forecasting or performance monitoring – working with data and talking to people helps us to understand what the requirements are and what is needed.”