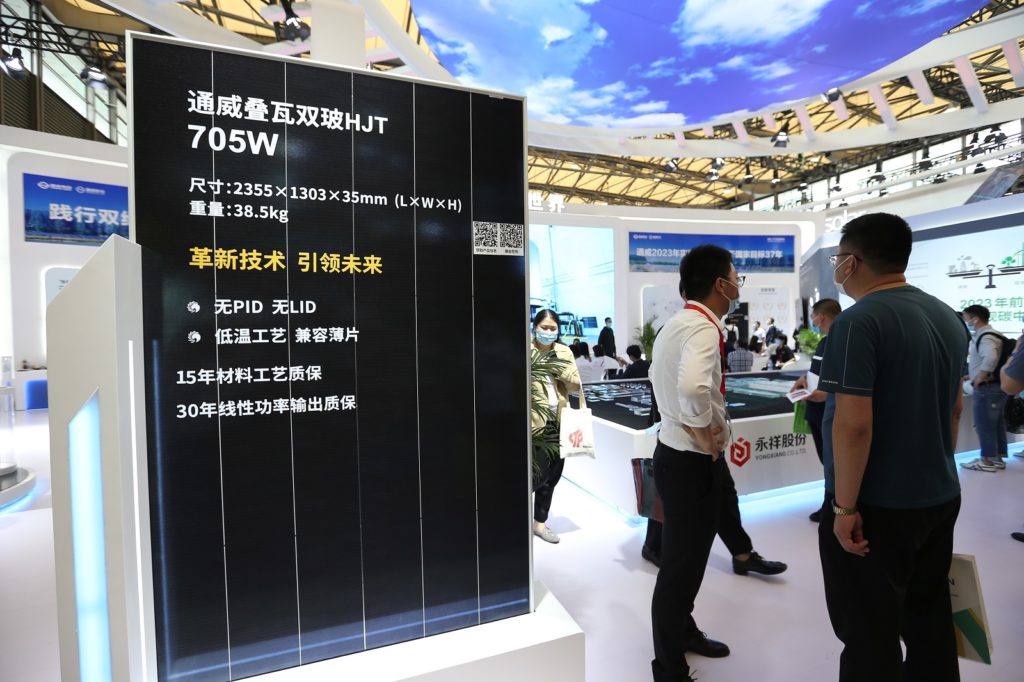

Tongwei Solar, EGing PV and LONGi have been shortlisted as candidates for the fifth module procurement round of Hong Kong energy company China Resources Power.

The state-owned energy company is seeking 3GW of PV modules, including 2.9GW of bi-facial 545W modules and 100MW of mono-facial 545W modules.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Tongwei submitted a bidding price of RMB5.827 billion (US$840 million), with a unit price of RMB1.942/W (US$0.28c/W), while EGing PV put forward a bidding price of RMB5,984 billion (RMB1.995/W) and LONGi a total bidding price of RMB6.061 billion (RMB2.020/W).

PV Tech understands that the bidding includes freight for 1,000km of transportation. The delivery time and construction period is 90 days after the procurement contract signed by the bidder and the module delivery time is from 10 September to 10 December 2022.

Tongwei lands top spot

The project will appoint one module supplier, meaning Tongwei will most likely get the module procurement order worth 3GW.

In a recent institutional survey, Tongwei said that it will expand its module business based on the industry’s development as well as making preparation in organisational structure and talent recruitment, but cannot disclose further information due to privacy considerations.

Tongwei has demonstrated production and maintenance capabilities in silicon material and cells, and even accumulated technical experience in the module sector. At present, the company has 6GW of module production capacity.

Considering Tongwei’s controlling capability in the cell and silicon sectors, it said it was well position to expand its module capabilities, supported by advantages in terms of infrastructure and industry knowledge.

Tongwei said in the survey that its modules arm was undertaking small-scale research and development activities. It also noted how the company did not initially intend to move into module manufacturing but is now targeting greater vertical integration.

Early stage fluctuation in prices in the PV supply chain are related to periodic shortages of capacity caused by insufficient participants in each sector, Tongwei said. As a result, the company has made a firm plan to target 30-50GW of module production.