Major polysilicon and merchant solar cell producer Tongwei has resumed production at its 20,000MT polysilicon plant in Leshan City, Sichuan province after damage, due to severe flooding in the region forced the plant to close in mid-August, contributing to a spike in polysilicon prices at the time.

The company said that workers at the subsidiary, Yongxiang Polysilicon had worked for 68 days, 24 hours a day to restore production. Tongwei has around 80,000MT of polysilicon production capacity.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Financial results

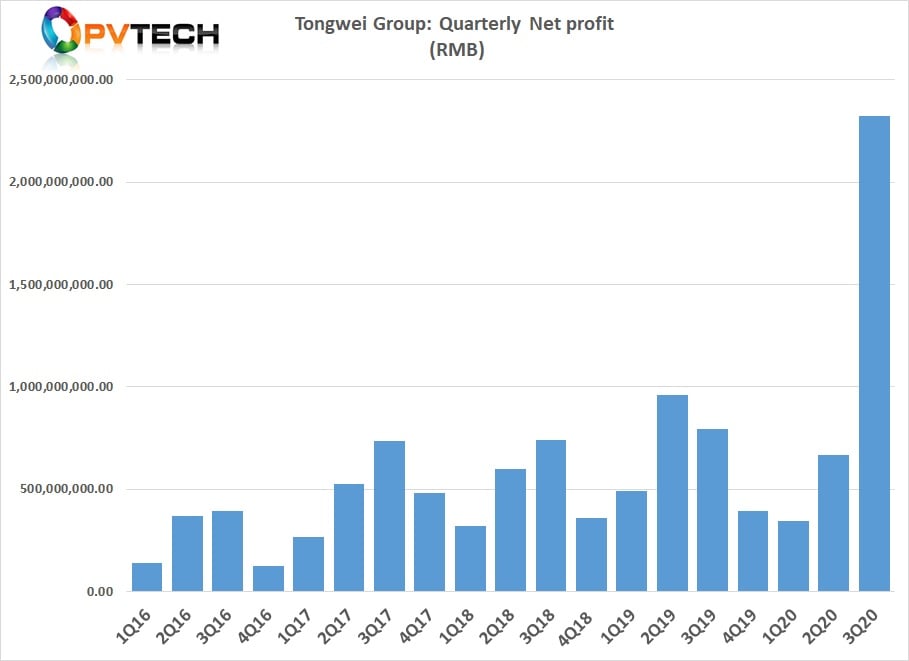

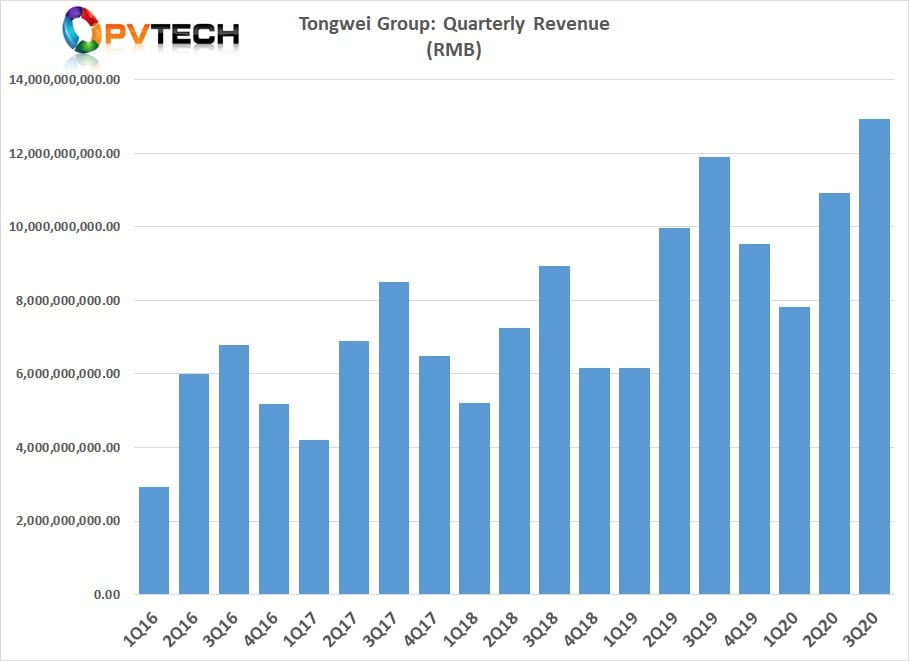

Tongwei has recently reported record third quarter financial results, driven by polysilicon ASP increases and higher capacity levels than the prior year period, supported by increased solar cell capacity and sales volume.

The company reported total group revenue of RMB12.93 billion (US$1.92 billion) for the third quarter of 2020, despite the forced closure of one of its polysilicon plants, up from US$1.62 billion in the previous quarter.

Revenue for the first nine months of 2020 topped RMB31.678 billion (US$4.72 billion), up 13.04% from the prior year period.

Net profit in the quarter was a significant RMB2.33 billion (US$345.8 million), compared to US$99.1 million in the previous quarter.

However, net profit after deductions for non-recurring gains and losses were US$286 million, still more than two times higher than its previous quarterly record and 48.57% higher than the net profits for the nine-month period, year-on-year.