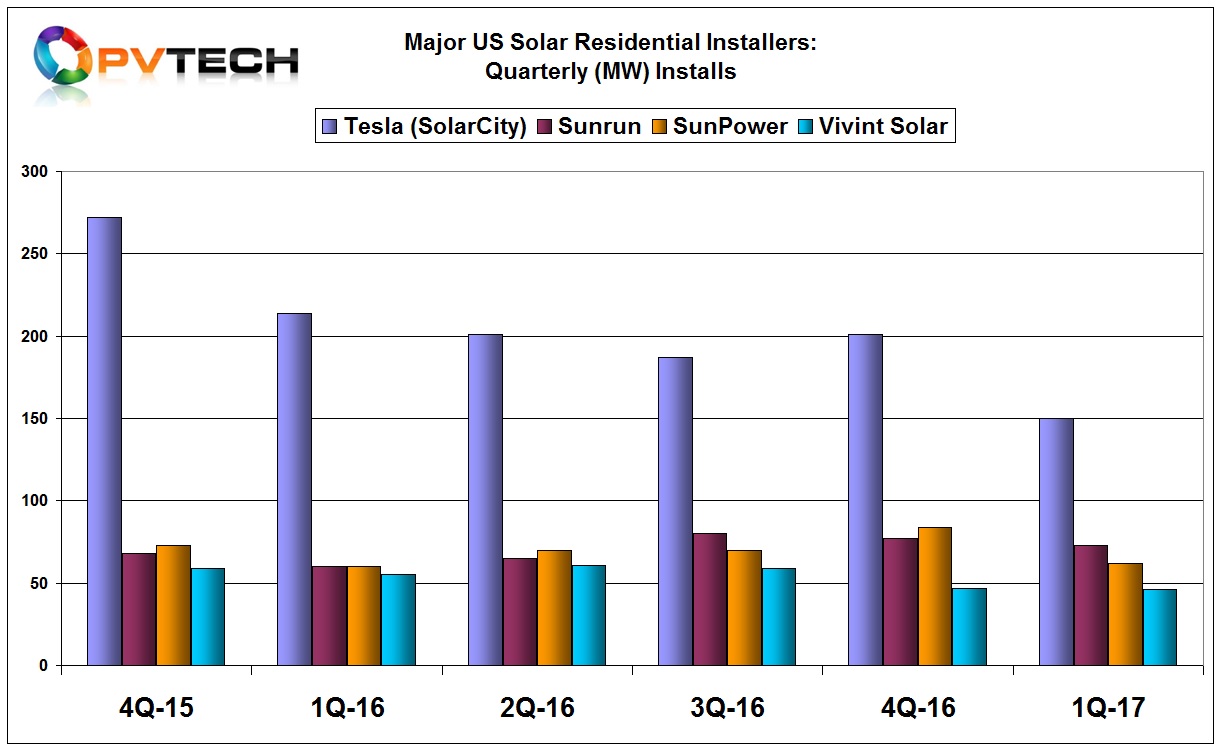

The seasonally soft first quarter of the year for the residential solar rooftop market in the US played out again in 2017, with the addition of much heavier rainfall, notably in California. A basket of primarily US residential installers that are publically listed have recently reported first quarter results.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Sunrun

Sunrun was the exception in the first quarter having maintained higher quarterly rooftop deployments since the third quarter of 2016. The company deployed a total of 73MW, up 21% from the prior year period and down only 4MW from the previous quarter.

New bookings in the quarter were 74MW, an increase of 19% from the first quarter of 2016.

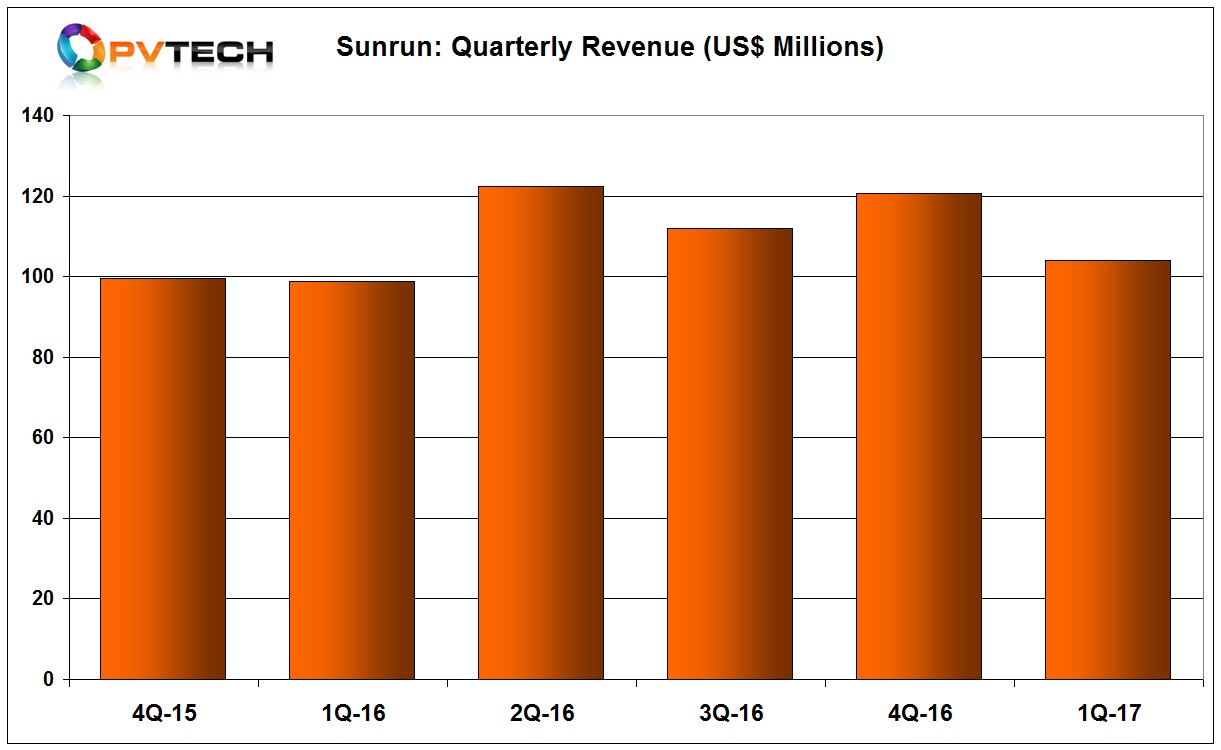

Revenue in the first quarter of 2017 was US$104.1 million, up US$5.4 million, or 5% from the first quarter of 2016. Operating leases and incentives revenue grew 39% year-over-year to US$48.1 million. Solar energy systems and product sales declined 13% year-over-year to US$56.0 million.

Creation cost per watt was US$3.38 in the first quarter of 2017 compared to US$4.07 in the first quarter of 2016, an improvement of 17% year-over-year.

“The positive momentum continues in Q1, with a 21% growth in volumes and improvements in our unit economics, a testament to the resiliency of our multi-channel business model and alignment of our product offerings with customer demand,” said Lynn Jurich, Sunrun’s chief executive officer.

Sunrun guided expected deployments in the second quarter to be approximately 72MW, reflecting approximately 15% growth in the first half of 2017 compared to the prior year but basically flat quarter-on-quarter. For the full year 2017, Sunrun said it expected to deploy 325MW, reflecting 15% year-over-year growth rate.

Vivint Solar

Vivint Solar reported first quarter deployments of approximately 46MW, down around 16% from the prior year period and down just 1MW from the previous quarter. Installations were 6,581 for the first quarter. New bookings were 52MW, down over 20% from 66MW booked in the first quarter of 2016.

Total revenue for the quarter was US$53.1 million, up 209% from US$17.2 million in the first quarter of the prior year. Operating Leases and Incentives Revenue was US$30.4 million, up 83% from US$16.6 million in the prior year quarter.

Vivint Solar reported a cost per watt of US$2.98 in the first quarter, a decrease from US$3.08 in the fourth quarter of 2016 and down from US$3.34 in the first quarter of 2016.

However, deployments guided for the second quarter indicate further weakness in demand with the company expecting deployments to be in the range of 44MW to 48 MW. Vivint Solar had installed 61MW in the second quarter of 2016.

Seperately, Vivint Solar announced that it was launching kiosks at retail locations in California, Massachusetts, New Jersey, New York and Utah by the end of June 2017 and expand into additional retail locations and states throughout the year. The company has been focused on door-to-door sales up to this time.

RGS Energy

RGS Energy reported first quarter revenue of US$3.65 million, down around 26% from the prior year period. The company reported a net loss of US$4 million.

RGS Energy had raised US$16.1 million of financial capital in the fourth quarter of 2016 and a further US$16.0 million during the first quarter of 2017.

In SEC filings, RGS Energy noted that it required approximately US$16 million in quarterly revenue to achieve profitability.

Sunworks

Sunworks reported revenue of US$14.4 million in the first quarter of 2017, compared to US$19.4 million in the prior period. Gross margin was down to 19.4%, compared to 28.7% in the first quarter of 2016. Sunworks reported a net loss of US$2.9 million compared to net loss of US$0.4 million in the prior year period.

The company reported new sales of US$25.7 million, compared to US$9.9 million in the year-ago quarter and its order backlog stood at US$59.8 million, compared to US$39.8 million in the prior year period.

“The first quarter marked an important transition for Sunworks,” said Chuck Cargile, Sunworks' Chief Executive Officer. “The unusually rainy weather limited the number of days our teams could spend installing, particularly in the ACI part of our business. As a result, our revenue was relatively low and we incurred a loss for the quarter. However, our new sales more than doubled and our backlog is at a record level. In addition, as drier weather returns to California, we expect our installation revenue to increase significantly in the second quarter.”

Previously, both Tesla (SolarCity) and SunPower had reported first quarter results.

Tesla is shifting its business model towards retail and away from direct sales as well to outright system sales and away from the leasing model, which is having a significant impact on quarter deployments at the moment. Tesla still remains the largest publically listed US residential installer with 150MW deployed in the first quarter of 2017, down from 201MW in the previous quarter, a 25% decrease and down from 214MW in the first quarter of 2016.

SunPower reported global residential deployments of 62MW in the first quarter of 2017, up slightly from 60MW in the prior year period.