A buoyant utility-scale ecosystem will allow US solar to sidestep the COVID-19 disruption and end 2020 with 33% more installs than in 2019, according to SEIA and Wood Mackenzie.

The latest update from the PV body and the consultancy predicts that nearly 18GWdc of new solar could be added US-wide in 2020, a sizeable jump on 2019 installs (13.3GWdc) despite the US’ rise this year to global pandemic hotspot.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The report underpinned the talk of growth on utility-scale players, expected to install 14.4GWdc of the total 18GWdc of solar alone. The figure would make 2020 “the biggest year on record” for the segment, ahead of its earlier all-time high of 10.7GWdc in 2016.

Having installed 2.3GWdc in Q1 2020, a first quarter record, utility-scale solar firms have found COVID-19’s impacts – project delays, hikes of financing costs – are so far “manageable”, the report said. Going forward, the segment is expected to overcome the headwinds it will face.

“The strength of the current pipeline and additional demand from utilities for new electricity generation or to meet renewable portfolio standards and carbon reduction pledges will drive significant capacity additions through [the 2021 to 2025] period,” the analysis predicted.

Top US solar states of recent times

| State | Installations in 2018 | Installations in 2019 | Installations in Q1 2020 |

|---|---|---|---|

| Florida | 865MWdc | 1,377MWdc | 958MWdc |

| California | 3,236MWdc | 3,125MWdc | 486MWdc |

| Tennessee | 32MWdc | 86MWdc | 282MWdc |

Source: SEIA’s and Wood Mackenzie’s U.S. Solar Market Insight Q2 2020 report

Despite the cautiously optimistic 2020 outlook, SEIA and Wood Mackenzie were unequivocal about COVID-19’s impacts. If US solar hit quarterly record installs (3.6GWdc) in Q1 2020, when the pandemic had barely kicked in, Q2 2020 will reflect the disruption more starkly.

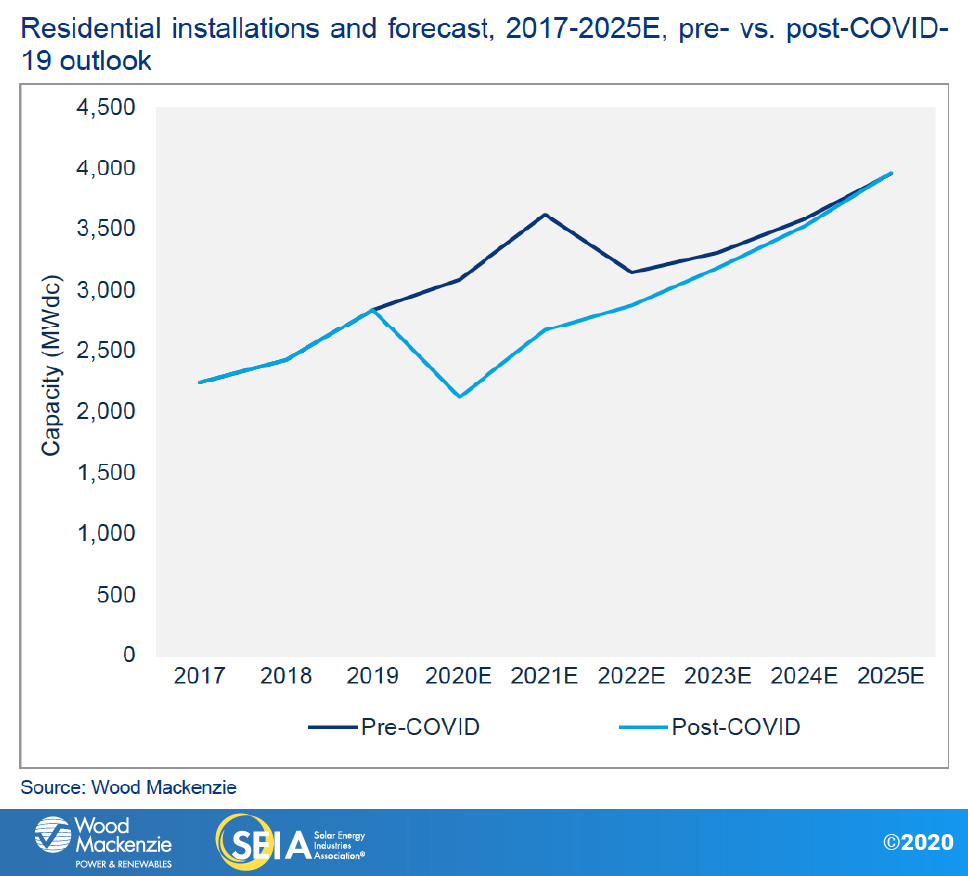

The shift will be apparent among residential solar operators, according to the report. At 810MW installed, the segment scored a quarterly record in Q1 but will witness a downturn in Q2, coinciding with the roll-out of stay-at-home orders in California and other key markets.

As the study noted, residential firms have softened the blow through a speedy shift to online sales, with bigger operators able to maintain pre-COVID volumes of leads and sales. How the digital push will translate into actual performance remains hard to predict at this point however, the study said.

For the residential market, the exposure to consumer sentiment will bring disruption in the form of economic recession – Wood Mackenzie expects US GDP to shrink by 5% this year – and “unprecedented” levels of joblessness among the demographics solar relies on for sales, the report warned.

According to the study, the result will be US residential solar installs dropping by 25% in 2020 compared to 2019, before they recover by 26% in 2021. By the mid-2020s, the segment could have returned to annual growth rates in the low-teen region, the analysis predicted.

Whether it is stronger utility-scale players or less-buoyant residential counterparts, all US solar operators will face in the coming years uncertainty from the same front: the gradual phase-down of investment tax credits (ITC).

The update from SEIA and Wood Mackenzie noted that the tapering of the federal incentives will “further complicate” the comeback of residential solar later this decade. For non-residential players, the expiry of ITC support in 2023 may cause a growth contraction, the report pointed out.

“Long-term growth in a post-ITC world will be contingent on continued geographic diversification outside of established state markets as well as regulatory, technological and business-model innovation to improve product offerings in the solar-plus-storage space,” the study advised.

Solar firms following the ITC’s phase-down timetable with concern were recently offered a short-term lifeline. In late May, the US Treasury agreed to extend the so-called safe harbor deadlines by one year, delivering a victory to a group of bipartisan senators who had urged for the reprieve.