A leading German solar distributor has predicted “crazy” ongoing pricing pressures in Europe as the PV industry continues to face huge product oversupply and competition prompted by the easing of the recent energy crisis in Europe.

Speaking on the first day of the Intersolar 2024 conference yesterday, Daniel Schmitt, CEO of Bavaria-based equipment supplier Memodo, said the current intense competition at all levels of the PV industry would persist with prices having not yet reached rock bottom.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Schmitt said the European industry had enjoyed the “biggest subsidy ever in PV industry” in the form of the huge spike in energy prices prompted by the war in Ukraine. This spike led to a procurement gold rush as distributors such as his had over-ordered inventory to keep up with demand that did not actually exist.

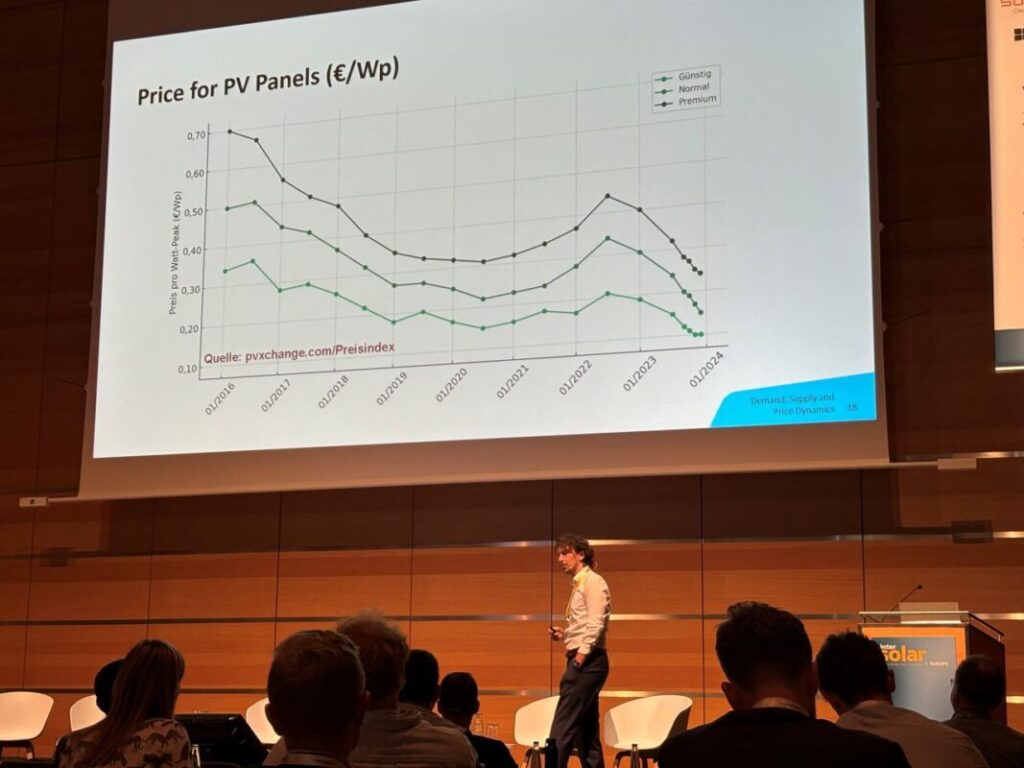

But with the energy crisis easing and that ‘subsidy’ effectively disappearing, the market had now gone from a seller’s to a buyer’s one, prompting a crash in prices. For companies such as his, with warehouses full of unsold inventory, competition on pricing is now “huge”, Schmitt said.

“This subsidy is gone and now we also need to understand that the storm is not yet over,” Schmitt said. “There is huge competition on all levels – installers, distributors, manufacturers; it’s crazy. Everybody’s doing crazy prices and end consumers are very lucky at the moment. So tell all of your friends. Now’s a good time to buy.”

Schmitt predicted the situation would continue, with prices falling even lower.

“Banks are not willing to give money anymore to PV companies. That probably leads to bankruptcies in the whole market and the whole industry chain, and then we will see it gets really nasty because then we will see sell-out prices. We see that already on some points, but we have not yet reached the lowest level.”

He said the problem was compounded by the level of “price transparency” in the industry, with online marketplaces such as eBay having become favoured outlets for PV equipment.

“One of the biggest resellers for PV stuff – inverters, modules, etcetera – I think is eBay at the moment. You can find everything on it and every price. It’s crazy. And it always happens in market phases like this.”

He concluded with a plea that in future booms, the industry collectively thinks more carefully about whether demand is real or imagined.

“So, I’m sorry, I don’t have an answer to it now. I just can ask everybody again to think about what demand is real, and then next time, hopefully, we can make better decisions.”