Home to some of the world’s highest solar irradiation levels and urgently in need of homegrown energy resources, Chile has established itself as a key PV market in Latin America. Jonathan Touriño Jacobo looks at that rise and asks what we can expect to see next for the country.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Even though nowadays the solar industry in Chile is the second most important in Latin America, only behind Brazil, the boom for solar PV projects only started less than a decade ago. In 2013 it had merely passed a megawatt of solar PV before reaching its first gigawatt of total installed capacity back in 2016 and as of this year, is at almost 7GW. Last year it managed to install more than 1GW of solar PV in a single year for the first time, according to a report from SolarPower Europe. For 2022, the European trade body expects Chile to install 2.9GW of solar PV, continuing the country’s expansion in renewables.

Chile is home to one of the highest irradiation regions in the world, the desert of Atacama, with “around 60 to 70% of solar PV” capacity so far installed in the regions of Atacama and Antofagasta, says Darío Morales, director of studies at Asociación Chilena de Energía Renovables y Almacenamiento (ACERA), the country’s renewables and storage trade association.

Aside from a large pipeline of utility-scale plants, Chile has also invested in its distributed generation, also known as “pequeños medios de generación distribuida” (PMGD), which are projects of up to 9MW. “Of the near 7GW of installed capacity, a little bit more than 1.3GW comes from distributed generation,” adds Morales. The difference with utility-scale is that the PMGD has expanded in the centre zones of the country, near the capital Santiago, as they are more practical as areas of large consumption of electricity.

It is safe to say that the solar industry in Chile is up and running, but it might need to further accelerate pace if President Gabriel Boric’s government is determined to push forward the closure of all of its coal plants from 2040 to 2030, with a first decommissioning phase in three years’ time.

A phase out by 2030 is achievable

Before winning his presidential bid, Boric’s programme had the goal to achieve the closure of all coal power plants before the end of his term in 2026. Even though it looks improbable that will happen, 2030 might sound a much easier goal to achieve, according to Morales. But it still implies a high demand for renewable energy by that time.

Last year, ACERA made a study in collaboration with consultancy firm SPEC and the universities of Instituto Sistemas Complejos de la Ingeniería from Santiago de Chile and Universidad Técnica Federico Santa María, looking at what was needed in order to have a “successful” closure of the remaining fossil fuel plants.

Given the different dates explored by the government for the closure of coal plants still active, the study looked at three dates: 2025, 2030 and 2040. Morales says there were three conditions to be filled, to make the phase out a success. The first was to avoid any power cuts due to a lack of electricity, which then required study into the stability of a renewables-powered grid, which “opens a new technological challenge to operate a 100% renewable electrical system”, says Morales. While the last condition is to make sure that costs don’t increase and stay reasonable.

To successfully retire the remaining coal plants in Chile, 18GW of additional renewables will need to be installed in the next three years, says Morales. There are around 8GW to 10GW of projects announced so far, which means the other half is in “no one’s mind.” Morales adds: “Last year we had four years, but now there’s only three remaining. It looks very complicated. If those conditions are not met, then we’ll have problems with the electricity.” For Morales, 2030 sounds already more reasonable and doable since instead of 18GW of new renewable energy needed it will be 22.5GW.

“It remains an important quantity, with an investment north of US$30 billion, which represents almost 10% of Chile’s GDP. It sounds more reasonable.” Concrete measures need to be taken if the country wants to achieve that goal, such as with regulation.

“We all want to decarbonise, but we need to do it well and for that we need to define the institutional operation, the market’s needs, the technical conditions and the legal bindings that allows and incentivise such developments,” says José Ignacio Escobar, chief executive at Colbún. As one of the Chilean utilities which has yet to close its remaining coal plants, the company’s roadmap for decarbonisation involves increased investment in renewables, propelling energy storage forwards, developing green hydrogen projects and searching for new growth opportunities in Chile and in other countries, says Escobar.

If in the past Colbún made agreements with third parties for the purchase of renewable energy, it is now focused on developing its own portfolio of renewables, with the goal to reach more than 4GW by the end of the decade.

The utility has three solar PV plants in operation in Chile with a total capacity of 250MW, of which one is located in the Atacama region with a power capacity of 230MW. Two solar plants with a capacity of more than 1GW have received environmental approval, with a further 820MW of wind and battery storage under construction.

Transmission lines: the next big hurdle

If the phasing out of all the remaining fossil fuel plants was not enough of a challenge, Chile has faced a loss of hydropower due to increasing droughts, with power generation 21% lower in 2021 than it was in 2020. Most of its production is currently coming from the centre-south zone of the country which has been forced to run on diesel. “This creates a two-fold issue, in one side we have the contamination and on the other hand there’s the problem of costs,” says ACERA director of studies, Darío Morales.

This loss of power brings with itself another challenge related to the transmission lines, as most of the new renewable power installed currently comes from areas that lacked such infrastructure and needs to be brought there, according to Morales.

“The structure of the existing transmission line will probably need to be reinforced to bring more energy from the north to the zone of highest energy consumption. The issue is that the development of renewable plants is much faster than the development of the transmission lines.”

Even though the north accumulates between 60 to 70% of new renewable energy projects, primarily solar PV, it is not the region with the highest consumption of electricity, even with the energy intensive mining industry’s presence in the region. For Morales, the two main connections that need to be solved rapidly are from Concepción (500km south of Santiago) to the south and from Santiago to the north, as the transmission line infrastructure has not been developed fast enough.

The northern and central systems were only interconnected in 2017, and Morales says that despite it being an important feature, is it not robust enough. A new line nicknamed Kimal-Lo Aguirre is expected to be completed by the end of the decade and would further alleviate the situation. For Morales this will not be enough to fully solve the problem. Overcoming transmission line hurdles will be a “cornerstone” in the energy transition to achieve a 100% clean energy grid, Morales says.

Co-located solar-storage is the future

What might help reduce congestion in the country’s grid is energy storage. Currently a law is being discussed that would answer questions on income from energy storage and reduce renewable energy curtailment contingencies.

Those curtailments contingencies that some companies are having could exceed up to 10 to 20% during the day, says Moisis Damianidis, general manager LATAM, renewables & storage development business unit at Mytilineos. Mytilineos has so far installed more than 500MW of renewable capacity for third parties and is developing its own portfolio with more than 600MW of solar set to be operational between 2023 and 2024. And one solution to avoid any loss and at the same time add the ability to offer energy during the night, would be co-located projects with battery storage.

“Recent talks we have been doing with a lot of companies, including of course our interest in this sector, is that all existing projects in the next three to five years are going to be covered by battery storage capacity,” says Damianidis. “We’re therefore speaking about a market, which according to our conservative calculations is going to exceed 10 to 12GWh over the next three to five years.”

So far battery energy storage system (BESS) technology is near non-existent in Chile, with just 64MW of installed capacity, according to ACERA’s data. The reason for such a low penetration so far is “a mix of various elements: price, uncertainty about revenue and lack of regulation”, says Morales. The issue of cost is primarily a question of time before prices drop and installing BESS with solar becomes affordable. This is why the proposed bill that is currently being discussed in the Chilean Congress could solve some of the existing uncertainties.

Without battery storage, it will be nearly impossible for developers to attract the “Holy Grail” which is the mining industry, as they do not want to discuss any power purchase agreement (PPA) unless it’s for 24/7 power, says Damianidis.

Antofagasta, land of solar opportunity and green hydrogen

As Chile ramps up its investment in green hydrogen, two regions have created hubs around that technology: Magallanes in the south and Antofagasta in the north. While the southern region will mostly see green hydrogen projects coupled with wind energy, in Antofagasta and around the desert of Atacama, solar will be favoured. “There are more than 60 investment projects, some that have been published, others that have not,” says Ricardo Rodríguez, director of studies at H2 Chile, the trade body for hydrogen in Chile. Of those projects, 10 are in Antofagasta. Both hubs will have a similar production capacity and an access to international markets.

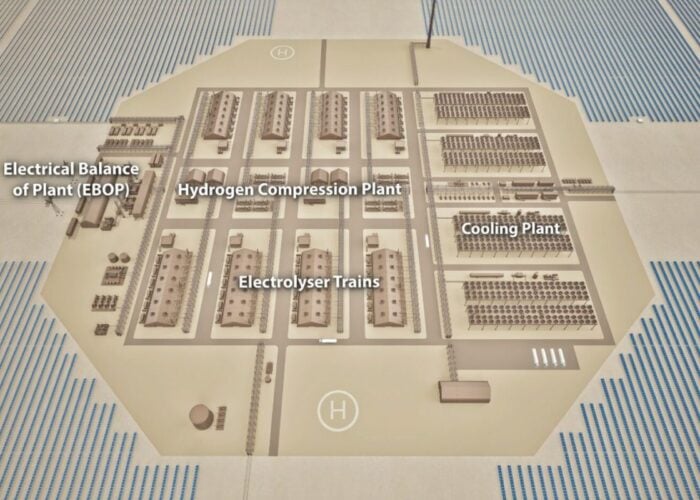

“In Antofagasta’s case, one of the advantages for green hydrogen investments is that the infrastructure has already been built, with excellent roads which are needed for the movement of the mining industry,” says Rodríguez. There is also a good amount of public land that could be used for green hydrogen investments in the region, such as the programme ‘Ventana al Futuro’ (‘Window to the Future’) that was launched last year to attract green hydrogen electrolyser projects of at least 20MW by 2025 that would be granted 40-year licences. Or the Chilean economic development agency (Corfo) that held a first financial call offering up to US$50 million to finance a capacity of 400MW of electrolysers by 2025.

The mining industry has an important role in Antofagasta and represented 52% of its GDP in 2020, according to a report from the mining trade body Consejo Minero. With the industry today so dependent on fossil fuels, the development of technologies using green hydrogen for lorries and other mining equipment will create a “sort of dependency, or virtuous circle” between both industries that could help in the development of both.

The country is increasing its investments in green hydrogen and with the projects currently in construction it is nearing 5GW of electrolyser capacity, says Rodríguez, adding the country is aiming for 25GW by 2030.

Developing in the desert of Atacama

Chile has two regions that are highly attractive for renewable energy. In the south, Magallanes is pivotal for onshore wind. Up north, the region of Antofagasta and particularly the Atacama Desert region is well known for its high levels of irradiation.

This brings certain constraints or necessities when developing a project there, such as using bifacial modules or using trackers, according to Moisis Damianidis at Mytilineos who says it’s a given that those technologies will be selected in an optimum design.

“Dealing with a project in a deserted area, it’s a one-way road that you go bifacial, it’s a one-way road that you go on with a tracker and it’s a one-way road that you have to select equipment with maximum isolation protection, so IP65 and IP66.”

In terms of operations and maintenance (O&M), the lack of nearby water resources in a desert area and thus its high cost to use for cleaning modules gives developers no other choice than to opt for dry cleaning. The advantage of the Atacama Desert, says Damianidis, is that given it is a very dry area, the dust will not get stuck onto modules, making dry cleaning much easier.

But an aspect that might be overlooked by developers, and that Mytilineos has faced with some of its previous projects, is the community. This has been an aspect the renewable division has been focusing on.

“All of the local community, where we are developing the projects, [are] being benefited from our development: whether it comes to employing personnel from the local community, or supporting the local community by building facilities, schools or something similar, in order for them to embrace the investment that we’re doing. To give the message that when it comes to investment, all of the involved stakeholders should receive the best.”

By getting the local community to feel involved in the project, either by hiring people for the projects during the different phases of it or simply getting something in return, will make them feel it is a part of them too, says Damianidis.

One other challenge Mytilineos was expecting to be a problem with energy storage was the dust, says Damianidis. This is because in many areas in Chile the dust is very fine and that ingress protection (IP) of the equipment would be a challenge, but that ended up not being the case after all. Instead, “…the big enemy of storage is high heat.” One advantage of doing projects at a high elevation, between 1,000 to 1,500 metres above sea level, is that even despite temperatures reaching up to 31C, nights are much cooler, an advantage for energy storage equipment.

The Atacama Desert is positioning itself as one of the key regions in the world for renewable projects. Thanks to its great level of irradiation, it will be able to attract both green hydrogen plants and will increase co-located solar PV with energy storage, as Chile tries to accelerate the decarbonisation of its electricity grid.