Chinese solar company Xinzi Optoelectronics Technology, has submitted an initial public offering (IPO) application to the US Securities and Exchange Commission (SEC), as it looks to appear on the NASDAQ market.

The IPO is expected to issue 1.5 million shares priced between US$4-6 per share, which would raise up to US$8 million. At the midpoint of the price range, the company’s market value is estimated to be US$83 million.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

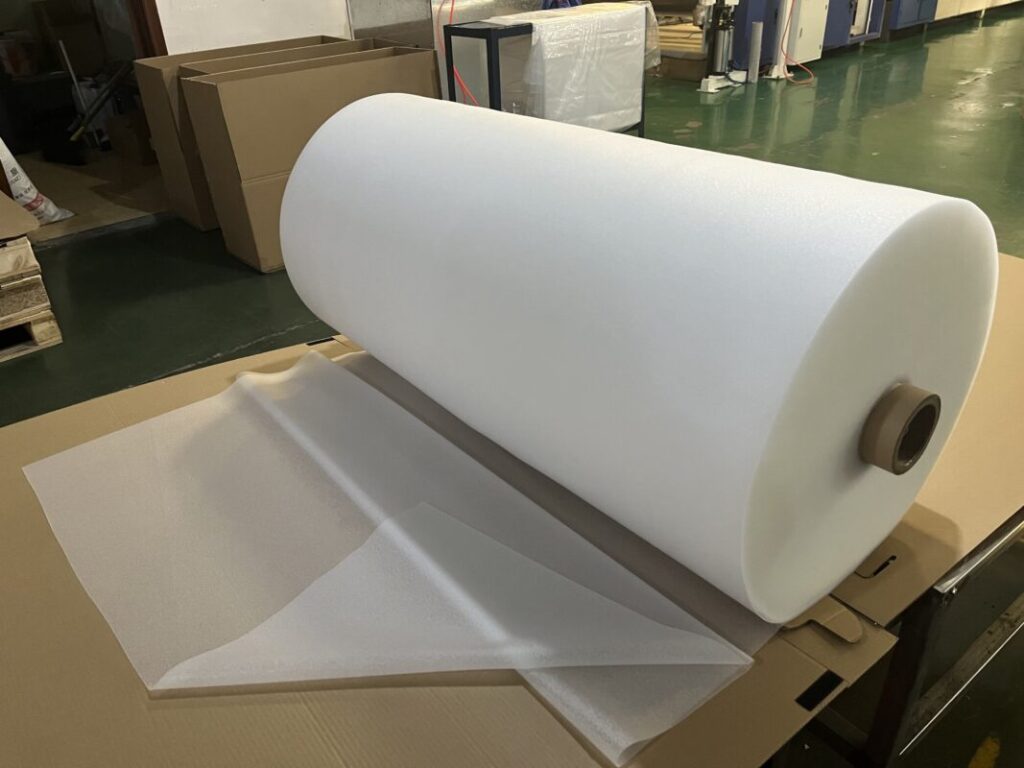

Headquartered in Hangzhou and established in 2016, Xinzi Optoelectronics Technology is a solar PV film manufacturer specialising in the research, development, production and sales of transparent PV module encapsulation films. Its main products include transparent ethylene-vinyl acetate (EVA), white EVA, polyolefin elastomer (POE) and a combination of EVA and POE layers known as EPE.

The company operates through its Chinese operating entity, Hangzhou Xinzi Optoelectronics Technology, with its products already integrated into China’s PV industry chain.

The prospectus reveals that in the past two and a half years, from 2022 to the first half of 2024, Xinzi Optoelectronics Technology’s revenues were US$38.4 million, US$32.9 million, and US$12.6million respectively. The company posted net profits of US$1.9 million and US$0.5 million in 2022 and 2023, respectively, and a net loss of US$0.5 million in the first half of 2024.

The exclusive bookrunner for Xinzi Optoelectronics Technology’s IPO is Revere Securities. The company plans to use the funds raised for research and development, capacity expansion and market expansion.

The global PV market has been growing steadily in recent years, and China, as the world’s largest producer of PV modules, has strong demand for encapsulation materials. Xinzi Optoelectronics Technology’s decision to go public in the US is likely aimed at leveraging the international capital market to accelerate technological advancements and responding to challenges from domestic and international competitors.

However, heightened US scrutiny of Chinese products, coupled with the company’s short-term profitability challenges, poses risks for investors.

Securities analyst Hua Ya pointed out that although Xinzi Optoelectronics Technology has built technical expertise in this niche market, its small scale and unstable profitability still require capital-driven improvements post-IPO. Moreover, the technological advancements in the global PV industry, such as the higher requirements of n-type cells for encapsulation materials, may present new challenges for the company. This also necessitates continuous investment in research and development to maintain competitiveness.

This is the second PV company from Zhejiang, China, to initiate an IPO plan in the US recently. Previously, Skycorp Solar Group Limited, headquartered in Ningbo, Zhejiang, had been listed on the NASDAQ exchange in the US.

Skycorp Solar began its work by manufacturing and selling solar cables and connectors. It has since evolved into into a comprehensive new energy firm that integrates the production of wire harnesses, distribution of storage inverters, deployment of supercharging stations and investment in PV power plants.