Almost 80% of new US energy generation projects awaiting grid connection withdraw their applications before coming online, according to a study from the Lawrence Berkeley National Laboratory in California.

The findings, published in the journal Joule, show that 78% of the energy generation capacity proposed between 2000 and 2018 have withdrawn from interconnection queues. Over that period, only 14% of proposed solar projects came online compared with 32% of natural gas plants.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

This could be a sign of a “healthy, competitive marketplace, as it suggests that resource developers are actively competing to find the best sites to develop new projects”, the report said.

However, it explained that “completion rates that are too low can be a drain on transmission provider resources, could be a sign of excessive speculation due to low queue entry costs, and may pose an obstacle to the timely processing of interconnection requests.”

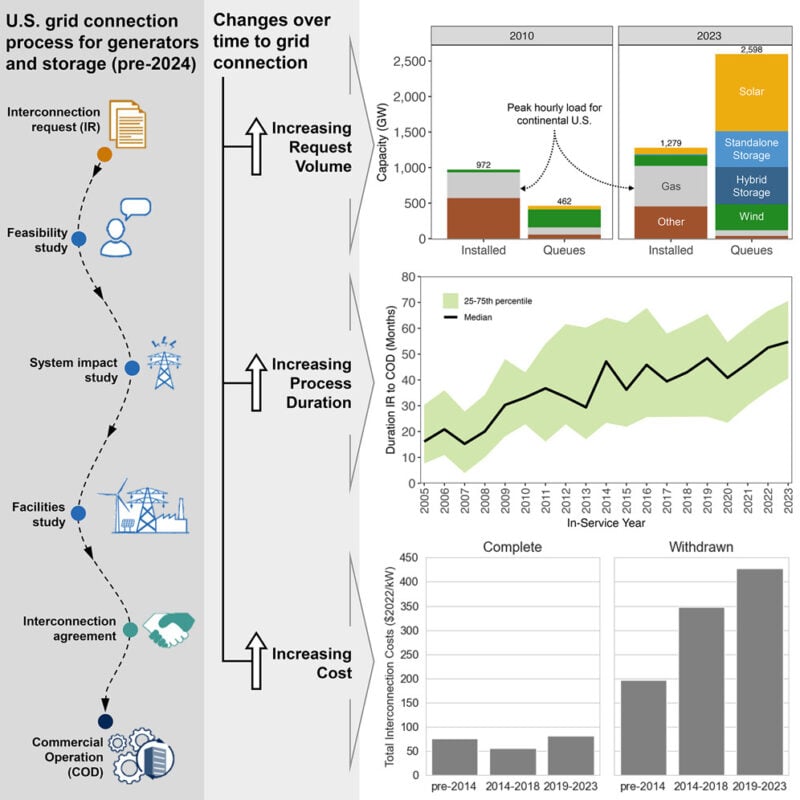

It also highlighted the increasing duration of interconnection studies and agreements, which have increased by 70% on average between 2010 and 2023, from 33 months to 56 months. This is a “key indicator of procedural and regulatory inefficiencies in the interconnection process”, the study claimed. The Electric Reliability Council Of Texas (ERCOT) grid has shorter interconnection timelines, the study said, partly because it is not subject to federal interconnection procedures.

The current interconnection queue is too long to come online in the near- to mid-term future, the Berkeley researchers said. At the end of 2023, there was over 1TW of solar PV capacity alone in the US interconnection queue (premium access).

However, the report said: “The surging volume of clean energy capacity in the queues points to a major and imminent transformation of the US power system, but the growing backlog is also evidence of a significant structural and regulatory bottleneck for plants seeking grid connection.”

This bottleneck and the scale of the interconnection queue could “significantly impact withdrawal rates and project delays”, the report said, “and even lead completion rates to decrease in the near term to medium term.

“Such results suggest that long-term US energy transition targets will be difficult to meet without reductions in current withdrawal rates or interconnection durations.”

In November, the Department of Energy announced US$30 million in funding to seek AI solutions to ease the country’s interconnection processes.

The increasing volume of requests and increasing duration of interconnection processes has pushed up interconnection prices, the report said, with the highest prices for renewable energy generation sources. While prices vary across different US transmission operators, they have all trended upwards over the last decade.

The interconnection costs for completed projects were 44% higher in 2019-2023 than in the previous five years; withdrawn projects were 23% more expensive than in 2014-2019.

The greatest average interconnection costs have been for solar (US$243/kW), battery storage (US$265/kW), solar-plus-storage hybrids (US$272/kW), and onshore wind ($218/kW) projects, the report said.