The Australian Energy Regulator (AER) has said that a delay in new renewable energy and energy storage capacity coming online on the National Electricity Market (NEM) in 2023-24 means the grid will reach 6.4GW at full capacity next year.

Detailed within the regulator’s ‘State of the Energy Market 2024’ report, the NEM is continuing the transition from a centralised system of large fossil-fuel generation, such as coal and gas, towards a variety of smaller-scale, dispersed wind and solar PV generation. These are complemented by hydroelectric generation, grid-scale battery energy storage systems (BESS), and demand response capabilities.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The AER also specified that much of the planned generation from 2023-24 had been delayed, with 2.1GW of large-scale generation and energy storage commissioned throughout that year. Much of the commissioned capacity set to enter the market during the year will now come online a year later in 2024-25, providing 6.4GW to the NEM at full output. For reference, the NEM often seeks peak demand spikes of around 34GW, supplied by 48GW of generating capacity.

Consumers have become an ‘integral part of the energy transition’

This grants an opportunity for rooftop solar PV, which is set to overtake coal-fired power by the end of this year and by the end of the decade and is forecast to reach 49.4GW. According to the AER’s report, consumers have become an “integral part of the energy transition” due to their investment in rooftop solar PV, home batteries, and electric vehicles (EVs).

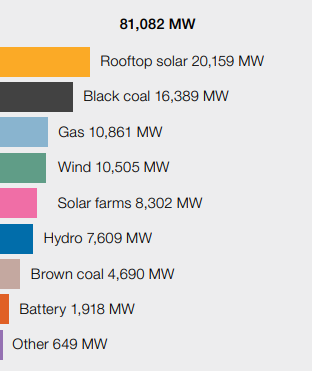

Consumer investment in rooftop solar PV has meant that it has become the highest registered capacity fuel source on the NEM, the AER has said, standing at over 20GW. This is the equivalent of 25% of the registered generation capacity on the NEM and is an increase of 2.9GW year-on-year.

This is a remarkable feat for clean technology and could lead to it playing a major role in the market under plans being explored by the Australian Energy Market Commission (AEMC). The organisation introduced a new draft determination proposing to enable virtual power plants (VPPs) to compete directly with large-scale generators in the energy market. This would be achieved by enabling aggregated consumer energy resources (CERs) to be scheduled and dispatchable in the NEM.

The AEMC cited that price-responsive small resources, such as backup generators and solar PV, could, therefore, respond to changes in spot prices. This would also contribute to a decentralised energy system. The amount of rooftops on the NEM could provide key services in the energy transition as coal-fired power is withdrawn from the grid.

It is worth noting that New South Wales and Queensland have the most installed capacity. However, South Australia has the highest relative rooftop solar capacity, making up 40% of its total capacity. Queensland, however, has the highest percentage installed on its rooftops with it standing at just over 50%.

The AER stated that the rapid uptake of rooftop solar PV has “dramatically changed the shape of daily spot price and grid demand” in the NEM. Before the mass adoption of the technology, the peak of both prices and demand in the summer typically occurred in the middle of the day. The ARE claims that the “opposite is now true”.

Grid-scale solar PV leads to negative price intervals

The AER’s report also highlights the importance of grid-scale solar PV power plants. The organisation states that Australia has the highest solar radiation per square metre of any continent, thus showcasing the opportunity the technology could play in Australia’s energy transition.

In 2017, around a year before investment levels started to rise with government incentives, commercial solar farms accounted for only 0.5% of total NEM generation capacity. They met only 0.3% of the NEM’s electricity requirements. In 2023–24, solar farms comprised 10% of registered capacity and 7% of generation output.

This has led to the technology breaking various records across the year. The AER states that solar generation was higher in all quarters relative to comparative quarters in the previous year, and the absolute quarterly output record was broken in the October to December quarter of 2023 and then again in the January to March quarter of 2024.

In 2023-24, the NEM saw record quarterly negative price intervals from July to September 2023 and subsequently from October to December 2023, impacted by the flood of cheap, green electricity produced from large-scale solar PV power plants.

The rapid rollout of large-scale solar PV should not come as a surprise. Australia boasts some of the best conditions for solar PV generation, and it has also been deemed the fastest renewable energy generation technology to build in the country.

The AER warns that the NEM needs sufficient large-scale energy storage capabilities to fully optimise the low-priced capacity that solar PV can bring, a message that can also be shared globally. As CERs grow, the role of energy storage in avoiding curtailment of rooftop solar PV and the resulting loss of income for consumers becomes even more significant.

Grid-scale energy storage deemed ‘essential’

As mentioned, energy storage will play a critical role in the energy transition by capturing green energy and avoiding energy curtailment.

As coal-fired power is withdrawn from the NEM, the AER said that the increased energy storage capacity will be essential to manage daily and seasonal variations in output. Because of this, the energy storage market in Australia is booming, accompanied by lower costs and expanding opportunities.

BESS operating in the NEM stands to earn significant revenue from operating in frequency control markets. However, this can come at the expense of their availability in the energy-only market. However, this attractiveness continues to entice wide global investment in the country’s energy storage market.

In 2023-24, BESS added 2GW of capacity to the NEM, with the total output from batteries increasing compared to the previous year. Despite this, it contributed less than 0.5% of total generation output.

But this capacity is rapidly increasing. In the next year, the AER forecasts an additional 2GW of capacity to be brought online and by 2037-28, it will peak at just under 22GW. One major development to keep an eye on is the 850MW/1,680MWh Waratah Super Battery, which will become the largest BESS on the NEM.

Renewable energy generation investment and expected plant closures

With the opportunities rife in the Australian energy market and with the aforementioned growth in energy storage, rooftop and utility-scale solar PV, it is no surprise that investment levels in renewable energy generation continue to increase, with 2024-25 expected to be the biggest year yet.

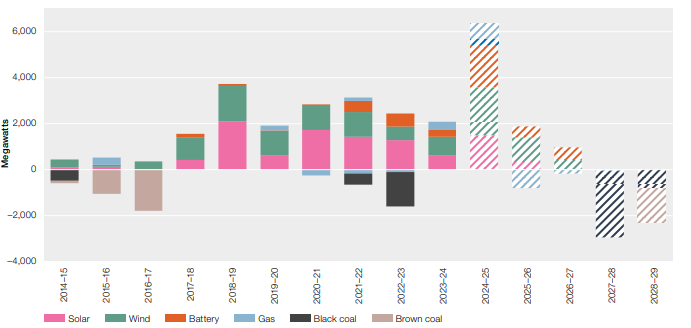

Since the beginning of 2017-18, over 15GW of new grid-scale solar PV, wind, and BESS have been added to the NEM. Over the same period, just over 2.5GW of coal and gas capacity was withdrawn, as can be seen in the image below.

Almost all of this withdrawn capacity was replaced between 2023 and 24, with 2.1GW entering the NEM. Of this, 600MW of solar PV capacity was added in New South Wales, Victoria, and South Australia, and 300MW of BESS capacity was added in New South Wales, Queensland, and South Australia.

Although no generator exits are expected in the next financial year, large volumes of historical fossil fuel generators are scheduled to close in the next 5 years. This includes 1,050MW of gas, 3,720MW of black coal and 1,480MW of brown coal. Large volumes of renewable energy and dispatchable generation will be required to meet the supply gap, the AER adds.