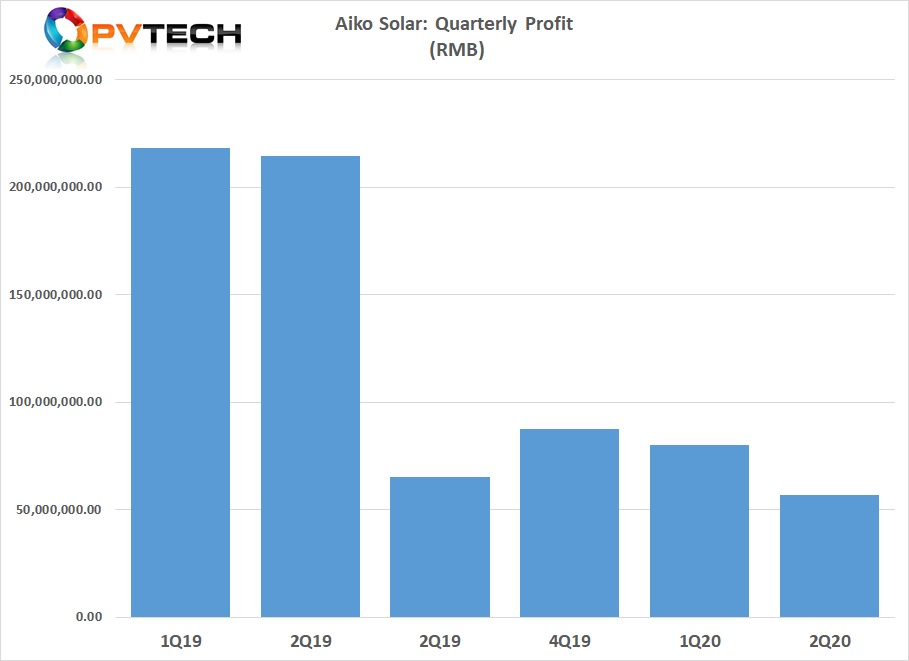

Major merchant solar cell producer Aiko Solar may have increased first half year revenue 30% compared to the prior year period, but COVID-19 and solar cell average price declines, triggered by weak demand, sent net profits falling by 68% year-on-year.

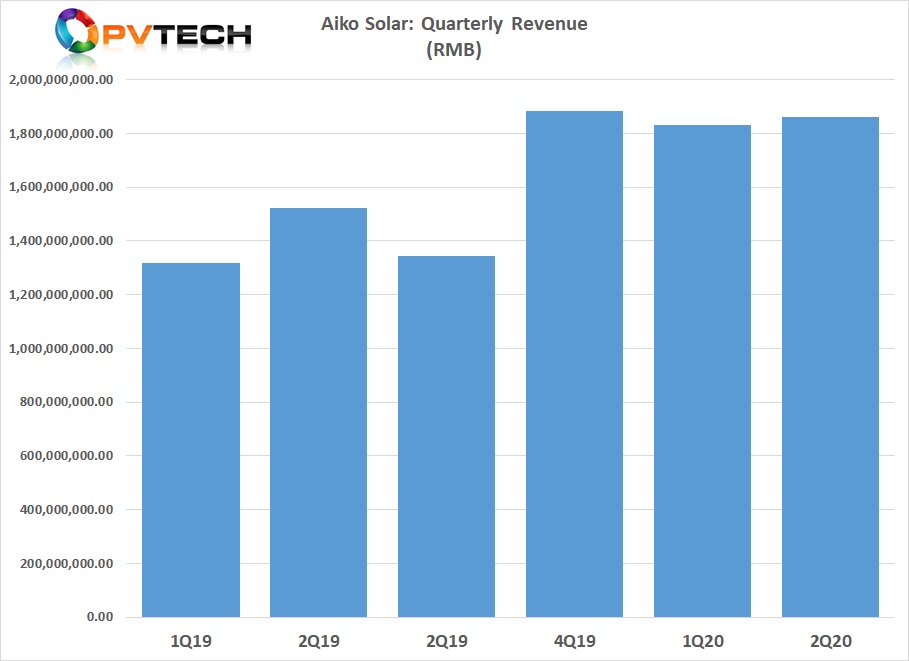

Aiko Solar’s quarterly revenue for the last nine-months flatlined, reaching around RMB1.8 billion (US$270 million), despite increased solar cell shipments and capacity expansions. The company reported H1 2020 revenue of RMB3,694 million (US$267.7 million), which was up 30% from the prior year period.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

However, COVID-19 impacted the company in the first quarter. Higher manufacturing costs caused by efforts to limit the effects of the pandemic on manufacturing operations came on top of a lull in demand as solar cell ASPs within the sector were said to have fallen 20% in February through to April 2020.

Net profits had already declined in the second half of 2019 and were down 68% in H1 2020, compared to the prior year period. Profits only declined slightly in Q1 2020 but reached a new low in Q2 2020, slumping to RMB56.67 million (US$8.28 million), compared to around US$31.35 million in Q2 2019.

Aiko Solar noted that in the May-June 2020 period, the impact of COVID-19 had eased and the company was able to increase production and sales with orders recovering quickly as both domestic and overseas demand improved.

Official Chinese figures put PV installations in H1 2020 at 11.52GW, on par with figures in the prior year period, despite the pandemic.

Manufacturing update

Aiko Solar had previously published plans to reach 22GW of high-efficiency solar cell capacity by the end of 2020. The company said that it had reached 15GW of nameplate capacity in the reporting period, up from 9.2GW at the end of 2019.

Aiko Solar expects to benefit from the new era of larger wafers and cells in two key new sizes (182mm and 210mm). Demand is gradually increasing and is expected to be a hot market in the third quarter of this year before becoming the mainstream of the market next year.

To respond to the rapid wafer size market shift, Aiko Solar highlighted that it had around 5GW of cell capacity capable of producing 180-210mm cells with around a further 8GW producing 166mm cells. The company said that it had around 2GW of capacity that was backwards compatible for cell sizes below 166mm, which included 163mm, 161mm and 158.75mm sizes. The 156.75mm cell size was withdrawn from the market, according to the company.

The demand for larger cell sizes and higher cell conversion efficiencies enabled Aiko Solar to ship approximately 5.24GW in H1 2020, an increase of 82% year-on-year.

During the reporting period, the company’s R&D spending reached RMB140 million (US$20.45 million), an increase of 30% over the same period last year and further increased its investment in next-generation technologies such as HJT, TOPCON, IBC and HBC. Aiko Solar’s annual R&D expenditure in 2019 reached US$31.3 million, putting the company in the Top 15 rankings of R&D spenders from PV Tech’s analysis of 25 PV manufacturers that are listed on stock exhanges.