Amtech Systems has acted to divest its solar business to a special-purpose Dutch entity after a year of failed talks with potential buyers, replacing its group-wide CEO in the process.

On Tuesday, the manufacturer said shares of its solar-focused unit Tempress Group Holding have been transferred to Stichting Continuiteit Tempress (SCT), an independent foundation regulated under Dutch law that will hold the assets with a view to a future sale to another buyer. SCT has recently registered and has the same address as Tempress in the Netherlands.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Amtech’s exit caps off a solar review it had launched in late 2018. Before that year, financial updates had recorded profitability issues for the firm’s solar divisions – specialised in manufacturing equipment – amid claims 531 New Deal policies were crippling orders from China.

At the time, Amtech set a plan to quit the solar market by 31 March 2020. SoLayTec, Amtech's unit for Atomic Layer Deposition (ALD) equipment, was sold to an undisclosed buyer in July 2019. At the time, the firm said talks were underway with “both private equity and strategic buyers” for Tempress.

The statement by Amtech CFO Lisa Gibbs this week, six months later, shows such talks yielded no success. “We were disappointed with the offers that emerged, as the terms were not favourable to us and most required a significant cash infusion from Amtech,” Gibbs said.

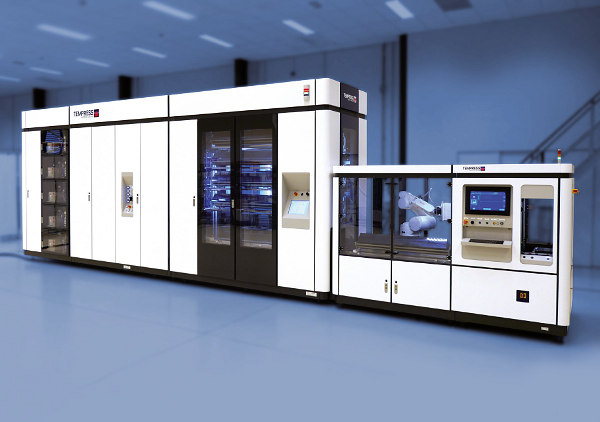

The choice of a new Dutch foundation as buyer will give Tempress – which sells diffusion furnace equipment – time to restructure and prepare for a further sale, the CFO said. In the meantime, Amtech will provide the subsidiary with a US$2.25 million term loan to ease the transition.

According to Amtech, the loan package contains “repayment provisions specifying amounts due and payable upon certain future events, including the sale of the equity or a material portion of the assets of Tempress in a future transaction.”

As anticipated by Amtech throughout the years-long review of its solar business, the plan after the solar exit is for the group to refocus on the semiconductor segment, spanning business lines such as silicon carbide (SiC) and light-emitting diodes (LEDs).

The realignment will come as a new name takes over at Amtech’s helm. Also this week, the group announced it has appointed its until-now COO and US lead Michael Whang as CEO, effective immediately. In parallel, executive vice president Robert Hass will retire after 27 years at the firm.

“With solar fully behind us, we are making changes to our executive team that will take us into the next phase of Amtech's future with a highly focused effort,” J. S. Whang, who will remain as Amtech’s executive chairman going forward, said in this week’s statement.

The so-called Stichting Continuiteit (Dutch for ‘continuity foundation’) is a legal entity the country’s companies use to safekeep shares for purposes including deflecting hostile takeover attempts. Firms setting up the structure include PostNL, a listed Dutch delivery and e-commerce unit.