With the bipartisan infrastructure investment bill now on its way to the House of Representatives, the attention of the US Senate moved swiftly to the budget resolution bill this week. The budget bill, which will pave the way for up to US$3.5 trillion of spending, includes vast swathes of US president Joe Biden’s agenda and, of particular pertinence to the US solar industry, an extension of the investment tax credit (ITC).

A top line summary of the FY2022 budget resolution published by senate Democrats this week details the immediate priorities of the budget bill, with a significant section establishing the Biden Administration’s aims for climate action. Within that area Democrats intend to:

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

- Create a new clean electricity payment programme;

- Establish clean energy and manufacturing tax incentives and grants;

- Impose new polluter fees, and;

- Create new consumer rebates for home electrification measures, amongst other measures.

It’s the leading two items in that list which will be of most interest to the solar community, both from a developer/installer perspective and manufacturers with at least one eye on Senator Jon Ossoff’s proposals earlier this year to create a solar manufacturing tax credit.

A ten-year extension of both the investment and production tax credits at a 30% rate has long been towards the top of President Biden’s agenda. A standalone ITC for energy storage – rather than the status quo which supports energy storage, but only if it is co-located with solar and installed simultaneously – as well as a direct pay option have also been supported at the top level.

But while Biden can indeed claim a majority in the senate – with 50 senators each, vice president Kamala Harris casts the deciding vote in the event of a tie – the president falls far short of the 60 votes needed to gain an absolute majority and the power to pass through bills containing such measures unimpeded. As a result, the budget resolution framework is Biden’s only real political route to passing his agenda.

It does, however, come with limitations.

Firstly, the budget resolution mechanism prohibits the passage of bills which would create a deficit on the US budget after a decade. This would somewhat restrict the direct pay option given how it is structured, meaning that it’s likely developers would only be able to claim up to 80% of credits available via direct pay.

Of far greater significance however is the way in which amendments to the bill, from both sides of the aisle, are entertained and voted on, as was seen in the late hours of Tuesday evening and early hours of Wednesday morning.

Shortly after the US Senate passed the bipartisan infrastructure investment bill on Tuesday a vote was held to begin the budget reconciliation process. Democrats won the vote 50-49, triggering the start of an hours-long session, dubbed ‘vote-o-rama’, wherein senators from across the aisle lodged amendments to the bill to be voted on an individual basis. The session went long into the night of 10 August, only concluding shortly before 06:00 on 11 August.

One of the amendments lodged by Alaskan senator Dan Sullivan – amendment 3627 – could prove particularly troublesome, seeking to establish “a deficit-neutral reserve fund relating to prohibiting renewable energy projects receiving Federal funds and subsidies from purchasing materials, technology, and critical minerals produced in China”. In short, the amendment intends to stop any renewable project built in the US that uses technology from, or indeed technology made using materials from, China from claiming federal funds and subsidies, including tax credits.

The amendment was passed with an overwhelming majority, securing 90 votes for to nine votes against.

Speaking before the vote, Senator Sullivan said the US was “dangerously reliant” on China for around 80% of the materials and minerals vital to the country’s renewables sector. “We have these resources right here in the US, and by developing our national supply chains we can create thousands of good paying jobs, protect our national interests and deny support to the Chinese Communist Party,” he said.

The amendment was supported by Democrat senator for Oregon Ron Wyden, who added that once the amendment had passed he would be seeking a “more targeted approach” to restrict the purchase of products with federal funds of any product bearing connections to forced labour.

The amendment’s passing follows heightened tensions between the US and China and the introduction of trade sanctions over alleged forced labour practices within polysilicon supply chains. A withhold release order (WRO) implemented in late June essentially blocked the import of silicon metal products from Hoshine and its subsidiaries.

The move could cause disruption to the US utility-scale solar sector, effectively limiting the number of large-scale solar projects capable of receiving federal supports or subsidies to those only using components, or components using materials, made outside of China. While the amendment would seemingly not apply to modules made in other manufacturing hotspots such as Malaysia or Taiwan, the inclusion of materials in the amendment’s text could feasibly include Chinese-made polysilicon used in wafers and cells that are then incorporated into modules elsewhere.

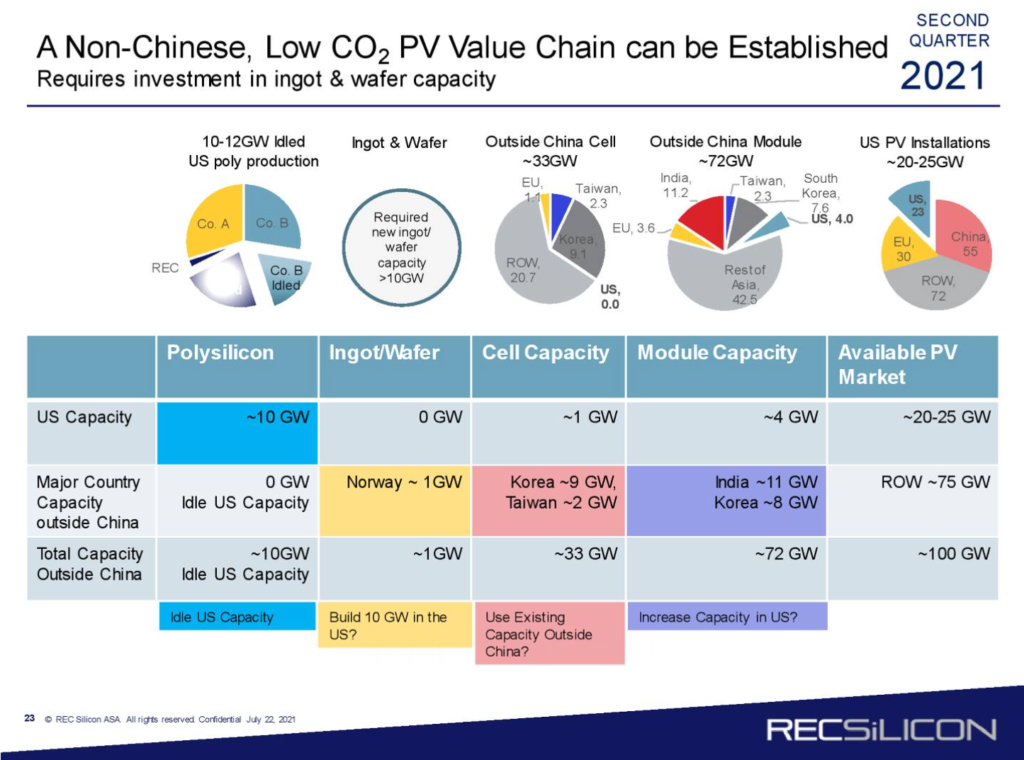

With little polysilicon manufacturing and next to no solar ingoting and wafering capacity outside of China, the bill could place an indirect cap on the number of renewables projects coming forward to claim ITCs. The below graph, produced by US-based polysilicon provider REC Silicon, highlights how little domestic solar manufacturing takes place in the US and perhaps highlights the issue at hand.

As the graph illustrates, while roughly 72GW of solar module manufacturing/assembly capacity exists outside of China, Just 33GW of cell manufacturing takes place outside of the country. Extrapolated further, the market size shrinks to just 10GW if discussing polysilicon production, but the real bottleneck would occur in the ingoting and wafering requirement, with just 1GW of ingot and wafer production taking place outside of China.

First Solar’s manufacturing capacity must, of course, also be factored in here – indeed, First Solar’s share price is up more than 4% this week, and up nearly 40% since the US government began its clampdown on Chinese imports. But with US module demand set to soar in the coming years, it is without doubt that the amendment could prove to be severely limiting if included within the budget resolution bill with its current language intact.

While the amendment was indeed passed by the floor, it is not yet guaranteed to feature in the final text of the bill. It could still be omitted or even amended further through secondary amendments. More discussions – and amendments – are expected to be made before the bill proceeds to a vote, which is in turn expected in the coming weeks. The timetable for it to pass through the House of Representatives and onto the desk of President Biden is longer still, perhaps reaching into November.

All eyes will therefore be on future hearings within the senate which will shape the bill as it progresses.