The Asia Pacific (APAC) region is expected to invest US$3.3 trillion in power generation over the next decade, with around a quarter of that sum spent on solar, according to energy research company Wood Mackenzie.

Deployment of new capacity is forecast to reach nearly 2TW (1,840GW) in the next five years, with India and China leading the ever-growing power demand and investing in coal and renewables primarily.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Across the APAC region, renewables will get the most of the US$3.3 trillion capital expenditure in power generation, with solar PV at the front and a share of 25% – 15% for distributed solar and 10% for utility-scale -, followed by offshore and onshore wind with 24% and 12% for energy storage (pumped hydro storage and battery storage combined).

Floating solar (FPV) projects will play a key role in the deployment of solar PV in the APAC region as it is expected to deploy the most FPV capacity globally, as the market will surpass 6GW per year globally by 2031.

“The Asia Pacific region is critical to the power sector’s energy transition as it grows to over half of global electricity demand this year. The two largest markets in the region, India and China, are at the forefront of renewables growth, but are also leading the world in coal power deployments,” says Alex Whitworth, Head of Asia Pacific Power & Renewables Research at Wood Mackenzie.

Among the markets leading this investment in new power generation is India, as the second largest regional market after China and with the potential to see its power demand double in the next 12 years, as it already did in the past 12.

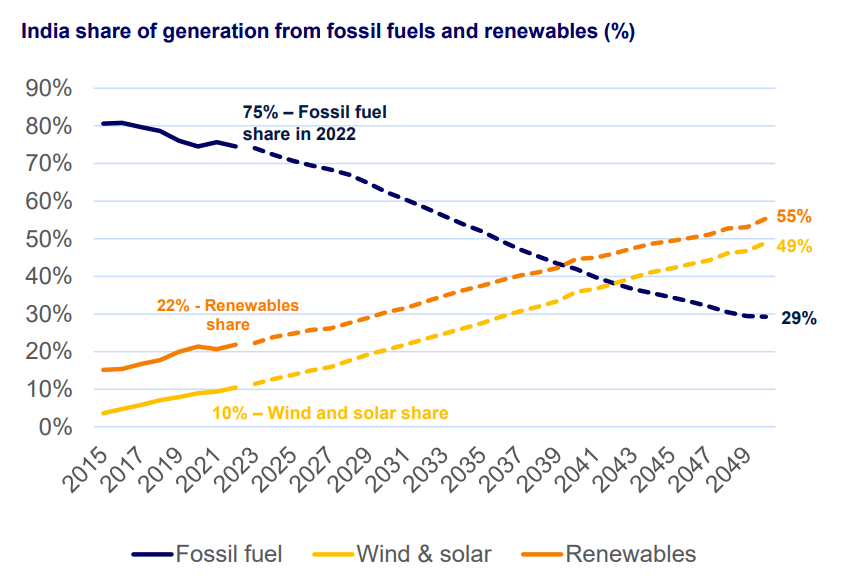

Having one of the lowest cost renewables globally, this helped India accelerate the intake of solar and wind capacity. In 2022 the share of renewables in India’s power generation rose to 22%, of which 10% from solar and wind, with Wood Mackenzie expecting renewables to pass fossil fuels by 2039, while solar and wind would do so around 2042, as shown in the chart below.

However, Whitworth added: “While cheap renewables and technology advances support continued expansion of renewables in India, the speed of growth of wind and solar is not a given. There are key uncertainties around grid investments and reform of pricing mechanisms to support such investment, growth of energy storage, as well as policy support for all of the above. Despite such uncertainties, India’s key role in the overall global energy transition is certain.”

Solar’s installed capacity growth is so far behind the targets set by the Indian government, which expected to reach 100GW in 2022 and only reached 70GW of installed solar PV earlier this year. For a fourth quarter in a row, solar installations decreased during Q2 2023 to 1.7GW, down 58% from the same period the previous year.

Moreover, in the next decade, India will require a US$350 billion investment in power generation to meet the growing power demand, with a similar amount of investment for grid investments to support the buildout of renewable capacity and other technologies.