US solar tracker supplier Array Technologies is to acquire Spanish tracker manufacturer Soluciones Técnicas Integrales Norland (STI Norland) in an acquisition that Array said will create “the largest tracker company in the world”.

Under the deal, Array will buy STI Norland for roughly €570 million (US$652 million) in cash (€351 million/US$401 million) and stock, with the transaction expected to close in Q1 2022.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

It comes at the same time as Array reported a larger than expected Q3 loss in its most recent financial results.

“This transaction is an important first step in the expansion strategy that we articulated when we announced our preferred equity investment from Blackstone in August,” said Brad Forth, chairman of Array.

Javier Reclusa, CEO of STI Norland, as well as the rest of the company’s senior management team, will remain with Array following the closing of the transaction and continue to lead STI Norland, the company has said.

The acquisition is particularly beneficial to Array’s Brazilian prospects as STI Norland is a major provider of solar trackers in Brazil, with is increasingly seen as a favourable environment for solar.

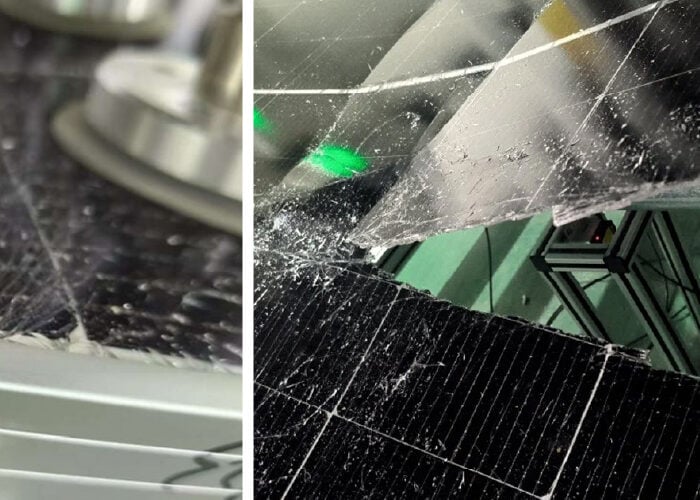

STI Norland sales team will now be able to sell Array’s DuraTrack products, which “have the lowest lifetime cost of any tracker system and exceptional wind and snow load performance,” according to Array.

It also puts Array in a “leading position” in North America, Latin America and Europe, accelerates the company’s expansion plans (the combined company is expected to generate 30% of its revenues from international projects in 2022) and creates opportunities for significant cost reductions through economies of scale, according to a company media release.

“The combination of Array and STI Norland creates the global leader in trackers with leading positions in every major market for solar outside of China and India,” said Forth.

Array also expects STI Norland to be “significantly accretive” to Array’s margins and earnings per share in 2022 “before any synergies”. Based on current market conditions, the backlog, awarded orders and pipelines for both companies, “Array expects that the combined business can generate in excess of US$200 million of Adjusted EBITDA in 2022 before synergies,” it said in media release.

While Array’s shares jumped from US$20.5 to US$22.11 upon the news of the acquisition, they are still down 52% year-to-date and 48% so far this year.