UPDATE 16:30 BST / 11:30 ET – Shares in Array Technologies have continued to fall in early morning trading, slumping more than 33% to US$16.50 at the time of writing.

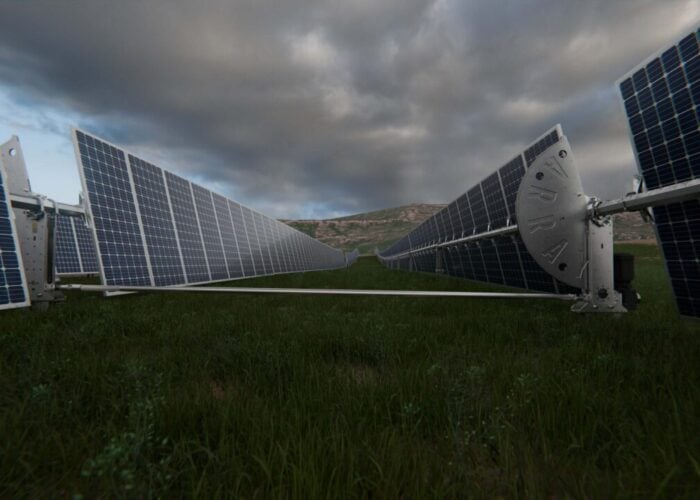

Array Technologies has withdrawn its guidance for 2021 after experiencing “unprecedented” increases in material and logistics costs which severely impacted earnings in the first quarter.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Reporting its Q1 2021 results yesterday, Array revealed lower than expected adjusted earnings of US$34.5 million for the reporting period, a 69% drop year-on-year, on the back of headwinds caused by spiralling costs of steel and logistics constraints.

Revenue fell by around 44% year-on-year to US$245.9 million, attributed by Array to unseasonably high revenues recorded in Q1 2020 as developers procured components for safe harboring ahead of the step-down in investment tax credit levels.

Speaking yesterday, Array Technologies chief executive Jim Fusaro said that higher than anticipated logistics costs weighed heavily on its Q1 2021 earnings, contributing to the missed guidance for the period, but also warned of increases in steel and shipping costs that are “unprecedented both in their magnitude and rate of change”.

Fusaro noted that between the first quarters of 2020 and 2021, spot prices of hot rolled coil steel used in Array’s tracker products more than doubled, and have continued to increase since, rising a further 10% since 1 April 2021. Array does not hold large inventories of steel, meaning the company is more exposed to price fluctuations. “…A significant increase in the price of steel over a short period of time can negatively impact our results,” Fusaro added.

Gross margin as a result fell from 27% recorded in Q1 2020 to around 18% in the reporting period, exacerbated by less revenue available to absorb the higher fixed costs.

This volatility is anticipated to continue. Fusaro said that increases in steel and freight costs will impact Array’s margins at least in the second quarter and potentially later in the year if prices do not normalise. The company is taking “several actions to mitigate” on the potential impact of these on 2021’s full-year results, including passing some of these costs onto its customers and negotiating long-term contracts with freight providers, and other initiatives.

Full guidance for the year will be reinstated once the company has completed a review of open purchase orders and prices have stabilised, allowing it to develop a more stable forecast.

Fusaro was also, however, keen to stress the potential upside of price pressures from a competitive point of view.

“Importantly, we believe our competitors are being impacted by the same cost increases that we are experiencing and, in certain cases, much more significantly because their smaller size gives them less buying power with suppliers.

“We believe the near-term pressure that is being created by the current environment may enable us to accelerate our market share gains because some of our competitors may not be able to deliver on customer commitments given their inability to procure raw materials at a competitive price or at all,” he said.

Array also noted that its quoting activity had risen to the highest levels seen in the company’s history, with Fusaro specifically mentioning the up to 4GW contract sealed with leading US-based EPC Primoris Services late last month.

Nevertheless, shares in Array Technologies have fallen steeply in pre-market trading today, falling by around 25% to US$18.73.