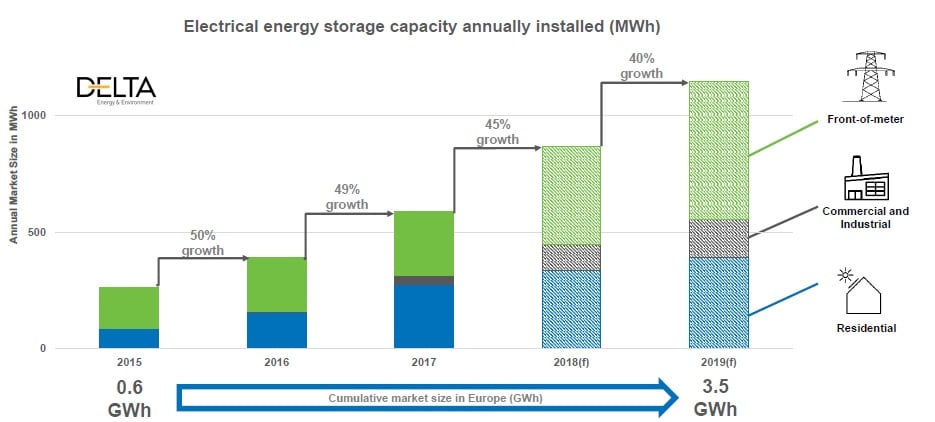

Europe’s installed base of electrical energy storage leaped by almost 50% during 2017 but perhaps the bigger takeaway is the growing share of battery systems installed behind-the-meter, an analyst has said.

The overall European market, encompassing behind-the-meter residential and commercial and industrial (C&I), as well as front-of-meter grid-scale installations, compared with 2016 (around 400MWh), grew by 49% to close to 600MWh. That was the headline finding from ‘European Market Monitor on Energy Storage’ (EMMES), a six monthly-report produced by research firm Delta-EE, with the European Association for Storage of Energy (EASE).

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Valts Grintals, senior analyst in energy storage research at Delta-EE, told Energy-Storage.news that this big growth was largely in line with expectations. However, perhaps the most telling finding was that residential markets in Italy and Germany have grown more than anticipated, while the C&I market is “beginning to take off”, Grintals said.

The front-of-meter market underperformed a little due to some of the UK’s enhanced frequency response (EFR) projects, scheduled to come online in late 2017, being pushed back to early 2018. This reduced total completed installations by 90MWh compared to the forecasted pipeline. The key dynamics dictating market size when looking at expected overall deployments of front-of-meter systems, the Delta-EE analyst said, is that they are contingent on top-down planning processes.

“The front-of-meter market tends to fluctuate, just like the values they tend to tap into. So frequency response becomes saturated as an opportunity in one market, it starts going down.”

Front-of-meter still up for grabs as operators assess grid requirements

Grid operators throughout Europe are still unclear on how they will allow batteries to participate in their various markets, if at all. Grintals gave the examples of Italy and Spain which are “putting together their framework for ancillary services, which usually tends to include frequency response”.

“Looking [historically] at markets like Australia the UK and Germany, the number of batteries, installing significant numbers of lithium batteries usually follows [these sorts of] schemes and we’ll see more information on those schemes [as they develop].”

“The base case tends to be that the scheme initially favours larger front-of-meter (FTM) batteries, or it could be a framework in which batteries are not considered at all. That’s the big unknown and it’s hard to predict – and you have to look at other markets in the past. Currently, the [best examples are] the UK and Germany and how network services have been procured there.”

Grintals said that those two early adopter markets are also beginning to see front-of-meter projects move from relying on one value stream via frequency response contracts or Capacity Market (in the UK) to adding, or ‘stacking’ more values. This includes a growth in projects being considered, if not yet delivered, that can compete with gas peaker plants or in co-location with renewable energy generation.

“The value is moving from one side to another, focusing on ancillary services, then when [that opportunity is] oversaturated, figuring out what else you can do. There’s a lot you can do if you co-locate batteries with PV and wind, there’s a lot of potential to get value from. It’s [about] being flexible enough to adjust to a market that changes quickly.”

‘Natural growth factors’ driving behind-the-meter segment forwards

Meanwhile, Grintals said, there is something more of a ‘natural growth factor’ associated with both main types of behind-the-meter (BTM) energy storage, residential and C&I, with the latter in particular expected to fuel a further 45% expansion of the market in 2018.

Italy installed about twice of what was expected in homes in 2017, about 8,000 units, while Germany was forecast for 31,000 units and instead deployed 37,000. Meanwhile C&I customers in Germany are increasingly using batteries to reduce their demand charges levied on their use of energy at peak times. Germany and the UK will remain C&I’s two biggest European markets in the near future, Grintals predicted.

“There’s more natural growth in Residential and C&I [compared to FTM], as more and more customers adopt and learn more about the technology and take it on and the costs go down – making a kind of ‘natural growth factor’.”

Conversely in the FTM space, 2017 was “relatively small” while 2018 will be “bigger”, Grintals said.

“There’s a few projects in the pipeline for Germany, Italy and the UK [in particular] so I would expect: ancillary services schemes to be defined by the network operator in Italy, which would drive the pipeline there while the UK is kind of settled down. So all of that adds up to a fluctuating [front-of-meter] market while BTM are more on a steady increase, when looking at the annual market.”

This article was originally published on Energy-Storage.news. Visit the site to read the first part of a full Q&A with EMMES lead author Valts Grintals at Delta-ee, looking behind the statistics at prevailing and emerging trends here.