For years California, Texas and Florida have dominated the US solar market, but backed by the investment tax credit, strong state-specific renewables standards and falling costs, new states are coming to the fore. Molly Lempriere takes a look at what is driving them, and the challenges they face if they are to challenge the ‘Big Three’.

The solar market is booming in the US, thanks to renewed confidence in the policy landscape, cost reductions and renewables targets. In June 2021, the Solar Energy Industries Association (SEIA) announced that the market had surpassed 100GW, doubling the size of the industry in just three and a half years.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

“It’s really just a bounty of opportunities across the US,” says Kevin Smith, Americas CEO at Lightsource bp. “And largely, it’s because of the price of solar power has just come down so dramatically over the last number of years, that utilities and corporates really can’t resist the drop from solar; it’s very, very cost effective.”

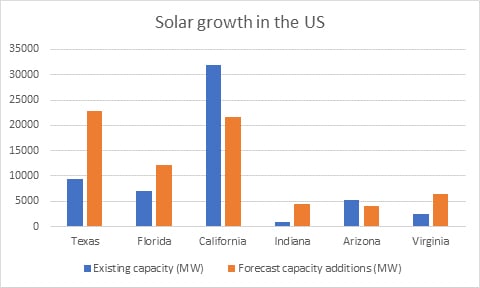

5GW of new capacity was installed in the US in Q1 2021 alone, with a record 3.6GW of this from utility scale. Figures provided by SEIA show how Texas has led the way, installing 1.52GW of new solar capacity – three times more than any other state. The Lone Star State forms one of the ‘Big Three’ together with California and Florida, as the states whose solar markets have buoyed the industry for years.

But new states are now coming to the fore and developing significant pipelines. SEIA has ranked the states in terms of their growth potential, with the Big Three followed by Virginia, New York, Indiana, Nevada, Arizona, Colorado and North Carolina. But what is driving solar in these up-and-coming markets? And what do they look like for developers?

Tax credits as a driving force

There are a number of factors aiding the rollout of solar throughout the US, most notably the ivestment tax credit (ITC). Originally introduced in 2006, the solar industry has grown by more than 10,000% since then, according to the SEIA.

“As you can imagine, the ITC is a massive, massive driver of making projects happen, helping developers to get their actual return on investment and it encourages a lot of the offtakers, the people signing the PPAs to think about actually building the projects before the ITC goes away, and maximising the incentive,” says Michelle Davis, principal analyst for solar at Wood Mackenzie.

Currently, the ITC provides a 26% federal tax credit that can be claimed against the tax liability of residential, commercial and utility investors in solar energy under Section 25D and Section 48. The level of credit is set to step down to 22% for projects beginning construction in 2023, before the residential credit drops to zero and the commercial and utility credit drops down to 10%. This phasedown was set in December 2020, when the ITC was extended. “Before the ITC extension at the end of 2020, it was supposed to just phase down every single year for the next several years,” says Davis.

“So you could actually see that utility-scale deployments from 2019 to 2020 literally doubled in the United States; that is the ITC at play. And so you can imagine the expected impacts that we are building into our forecast over the next three years given that that environment will be the same for at least a few years before the current law has the ITC expiring or starting to phase down at the end of 2023.”

There are calls now to further extend out the ITC, to ensure solar can grow to help meet the US’s decarbonisation targets – currently set at a 50-52% reduction from 2005 levels by 2030. In March, President Joe Biden included plans to extend the ITC for both clean power generation and energy storage by 10 years, as part of a US$2 trillion infrastructure investment plan.

“As we’ve looked at new markets opening up, and opportunities to expand the ITC within a new infrastructure package, that is something that we’re supportive of,” says George Hershman, president and general manager at renewables engineering, procurement and construction firm Swinerton. “We believe that it is a great opportunity to maximise private investment in solar, which is so key to being able to bring in outside financial interests into these large projects.”

State level standards

Beyond federal support from the ITC, one of the biggest drivers of utility-scale solar at a state level has been Renewable Portfolio Standards (RPS). These require a certain percentage of electricity sold by utilities to come from renewable energy sources such as solar.

The first state to establish an RPS was Iowa back in 1983, when legislators required its two investor-owned electric utilities to use a combined 105MW of renewable energy capacity. Since then 30 states, Washington D.C. and three territories have adopted an RPS, while seven states and one territory have set renewable energy goals. These vary from state to state in a number of ways, including the target level, the resources eligible and cost caps, but the majority mandate for between 10 – 45% of renewable energy to be obtained through renewable energy credits or certificates (RECs).

“When the utilities do their analysis, the lowest cost resource is utility-scale solar,” says Wood Mackenzie’s Davis. “And that continues to be the case. We’re having massive growth in utility-scale [solar] over the next three years, it’s really going to break records. We’re having plus 10% growth for the next three years in utilityscale deployments.”

According to the National Conference of State Legislatures, since the beginning of the 2000s roughly half of the growth of US renewable energy can be attributed to these RPSs. In recent years, a number of states have increased their targets further, pushing utilities to expand their solar and wind portfolios and the RECs they acquire.

While RPSs are a key driver of solar growth, and particularly in states which are seeing major growth, Lightsource bp’s Smith noted that over the past three or four years corporate buyers have started to catch up with utilities. “I would probably estimate that probably 50% or more of our power sales discussions and contracts are now with corporate buyers, which is a pretty substantial change than say five, six, seven years ago where probably it was 90% utilities. Now it’s certainly at least 50/50 between utilities and corporates,” Smith says. “And I would wager that the corporates are extending past 50% of the power buyers for renewables.”

Indiana’s ‘remarkable resources’

The Midwest is set to see substantial growth in the coming years, and in particular Indiana. Currently the state has 939.1MW of installed solar capacity, making it just 20th in SEIA’s national ranking. But this is already a jump from 32rd in 2020, and the Hoosier State is widely backed to leap further up that table. Over the next five years it is expected to see more than 4.5GW of new solar installations, the sixth-most in the US, according to SEIA figures.

“We’re having massive growth in utility-scale [solar] over the next three years, it’s really going to break records.”

Michelle Davis, WoodMackenzie

Indiana has benefitted from largely supportive policy, helping to drive forwards this growth. The state brought in its first piece of solar legislature back in 2002 with the Solar Easement Laws, and has since introduced compensation schemes and tax exemptions to help drive the growth of solar at a number of levels. In 2011 it passed its first RPS, which called for 10% of electricity to be supplied by renewable energy by 2025.

But challenges remain in the state, in particular around land use with 34 of its counties having ordinances that restrict wind and solar projects or prohibit their construction entirely. Despite state lawmakers working to change this, there has been significant push back, with the Indiana House Bill 1381 for example being quashed in April 2021 due to opposition from local governments.

Despite these obstacles large-scale solar projects are popping up throughout the state, such as Indiana-based solar developer Hoosier announcing 1.6GW worth of solar and storage projects in April 2021. Carl Weatherley-White, Hoosier Solar’s chief executive officer, said that Indiana has “remarkable resources for solar power” due to its agricultural sector. He said residents “want to preserve productive land for multiple generations” therefore solar projects provide farmers with “long-term, steady income that is neither seasonal nor dependent on weather or crop pricing”.

Arizona RPS precipitating a market boom

Another market set to boom is Arizona, building on an already strong position in SEIA’s national ranking. In 2021, the state moved from 9th to 5th as installed solar grew to 5.247GW. Over the next five years this is set to grow still further with 4.161GW expected to be installed in the state, putting it eighth in SEIA’s growth projection rankings.

Arizona is one of the states that has benefited from particularly strong RPSs, which were established as a result of regulatory action adopted by the Arizona Corporate Commission in 2006, and then reaffirmed by the state’s attorney general in 2007. This gave the state a goal of originating 15% of its power from renewables by 2025, a target that is supported by credit multipliers for in-state solar installations and other renewable sources installed before 2006. Utilities in Arizona must source 15% of their energy from RECs, of which 30% much come from distributed energy sources. The impact of the strong RPS on driving solar development has already been seen, with Swinerton’s Hershman suggesting the industry has seen it “drip drive the market significantly” in recent years.

In 2020, the Arizona Corporation Commission voted to approve a suite of amendments that would require the state’s investor-owned utilities to phase out fossil fuels completely by 2050. Additionally, utilities would have to increase energy efficiency savings by an average of 1.3% starting in 2021, and increase energy storage capacity by 5%.

The vote followed Arizona Public Service (APS), the state’s largest utility, announcing in January 2020 that it was targeting 100% clean energy by the middle of the century. Despite the challenges for utilities created by the COVID-19 pandemic, commented Jeff Guldner, APS chairman and CEO, the company has not “taken our eyes off the ball” and is continuing to work with stakeholders to reach a “carbon-free energy future”.

With this increasing push from utilities in the state to decarbonise their offerings, combined with the reduced cost of solar, Arizona is set for significant growth in the utility-scale sector in coming years.

Moving beyond land-use challenges in Virginia

Virginia has been another state that has established strong RPSs, helping to drive the build-out of solar with the pace picking up. The Virginia Clean Economy Act was brought in in 2020, replacing the voluntary RPS with a mandatory renewable policy.

This requires Dominion Energy Virginia and American Electric Power – the two incumbent utilities in the state – to produce 100% of their electricity from renewables by 2045 and 2050 respectively. Despite this positive step however, there are still challenges to developing large-scale solar in Virginia, predominantly around land use, as Hershman says. “They’ve got significant land use requirements around their stormwater site control, site stabilisation requirements that on a much smaller development make sense, but when you’re talking about the size of projects that need to be built to supply the demand, it makes it really difficult.”

Each portion of the site needs to be stabilised, moving from one to the next across thousands of acres. Therefore some sites become unworkable, as the land use requirements drive up the cost of the projects dramatically.

In recent years, there have been efforts to bring in legislation that would ease these land use concerns, such as siting agreements for solar facilities in opportunity zones. Introduced in July 2020, these agreements allow developers and localities to negotiate assistance beneficial to the low-income areas as defined under the 2017 Tax Cuts and Job Act. This was brought in to ensure communities benefit from solar developments, easing the concern of local governments.

Revenue share legislation was also introduced, which give localities the option to create an energy revenue share ordinance. If this is adopted, projects larger than 5MW are entitled to 100% machinery and tool tax exemption.

Both these pieces of legislation, along with other mechanisms, will hopefully help ease the challenges of developing in Virginia. Solar in the state is predicted to grow by 6.454GW over the next four years, the forth biggest level in America, according to the SEIA. This is well over double the state’s current installed solar capacity of 2.546GW as the state eyes its decarbonisation goals.

Going further requires easing grid connections

Solar is set to grow rapidly in coming years across the US, but states can still go further to push development by easing grid connection processes. A study from the Lawrence Berkeley National Laboratory in May 2021 found that over 755GW of generator capacity was sat in connection queues across the US at end of 2020, along with an additional 200GW of energy storage projects. Of this total solar represented the largest chunk, with 462GW laying wait in queues that continue to grow larger each year.

Wood Mackenzie’s Davis says the states that provide some certainty for developers through a streamlined, effective interconnection process as opposed to an arduous one are some of the most attractive. “And honestly, that’s a big reason that Texas has a lot of build out because they have these massive transmission lines that they built out for renewable energy deployments, specifically,” she adds.

But the average wait time for generation projects in queues is increasing, with the time projects spend in queues before being built having grown from ~1.9 years for projects built in 2000-2009 to ~3.5 years for those built in 2010-2020. Additionally, being within a connection queue does not guarantee construction, with only around 24% of projects reaching commercial operation, a figure that’s even lower for solar projects at 16%.

“I think probably the most critical thing that states, and probably in conjunction with their state utility commissions, can do is ensure a smooth interconnection process,” says Davis. “So if grid investments need to be made, if interconnection queues are building up with lots of project delays, states and utility commissions can work on those kinds of issues.”

Despite challenges like grid connection, the solar sector is looking forward to a busy few years with Swinerton’s Hershman describing the current US solar industry experience as an exciting time. “We’re seeing a lot of movement and interest into the phase two infrastructure package that I think will do amazing things for renewables because I think it will extend the ITC, it will likely give an ITC bump for the use of prevailing wage and some positive labour type of movements. And so, I think that only will drive more deployment,” he says.

PV Tech publisher Solar Media is hosting the Solar & Storage Finance USA event this October. Held virtually, the event will bring together leading figures from the US solar market’s finance, investment and development communities. For more information, click here.