Martin Pochtaruk, President of Heliene, Inc. on the challenges and opportunities of building out the domestic PV supply chain in the US.

The recently passed Inflation Reduction Act (IRA) contains the most ambitious climate investment policy in US history. This legislation, which includes billions of dollars in tax credits and other incentives for growing the manufacture and deployment of solar and other renewable energy technologies in the US, will help supercharge expansion of the domestic solar PV market.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

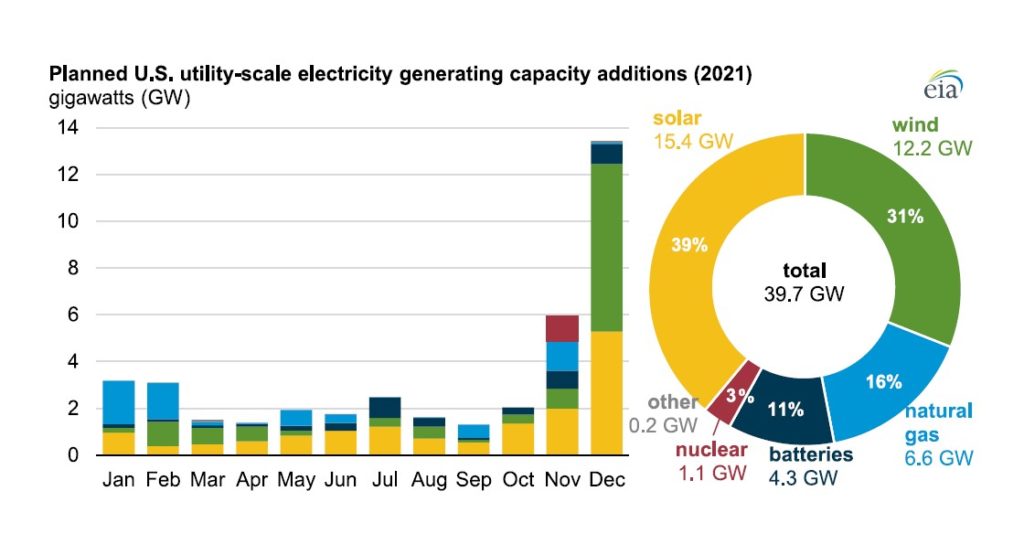

However, this market was growing at a robust pace even before the passage of the IRA. According to the US Energy Information Administration, total annual solar power installations in the US tripled between 2015 (5.7GWac) and 2022 (17GWac). Thanks to this growth, in 2021 the US was able to add twice as much new solar electricity generation capacity (15.4GW) as new natural gas electricity generation capacity (6.6GW).

This growth occurred despite a period from 2016-2020 in which the US president and his administration actively worked against e‑orts to encourage renewable energy development. Yet the US solar PV power market was still able to grow during this period because such investment made good business sense. Solar PV’s environmental and energy reliability benefits – it generates electricity without releasing greenhouse gas emissions and can provide customers with power even when there is a grid outage – were two of the reasons for this growth. But in the end, the primary reason companies and households continued to invest in solar PV even as its pre-IRA government incentives were being phased out was an economic one – solar PV provided them with a strong return on their investment.

Now, with the new, long-term solar incentives contained in the IRA further increasing the returns (and lowering the risk) of US solar PV investments, research firm Wood Mackenzie forecasts that this market will grow rapidly over the next five years, with total installed US solar capacity rising from 142GW today to 378GW by 2028.

Obstacles That Might Slow Growth of the US Solar PV Market

While the IRA provides fertile soil for the rapid growth of the US solar market over the next decade, several obstacles that have hindered this growth over the last ten years remain. If solar PV manufacturers, developers and installers, government policymakers, utilities, and other key industry stakeholders hope to not just continue to grow the US solar PV market, but fully leverage the IRA’s new incentives, they need to address these obstacles.

Specifically, these stakeholders need to build the solar PV market back better by addressing three obstacles that threaten to hinder its growth over the next decade:

- Supply chain issues that could limit the ability of solar developers and installers to receive in a timely manner the solar PV panels they need to meet growing customer demand.

- Labour issues that might prevent solar manufacturers, developers, and installers from being able to recruit and retain the skilled talent they need to manufacture and deploy hundreds of gigawatts of new solar PV capacity.

- Transmission issues that will make it difficult for solar PV systems to reliably and affordably transmit the energy they generate to consumers.

Obstacle: Overdependence on Asian Solar PV Equipment Manufacturers

One of the biggest risks faced by the US solar market over the next decade is that the global solar PV manufacturing supply chain will not be able to deliver enough solar PV panels to reliably meet domestic demand. One major reason for this risk is that one country – China – today claims an 80% share of all stages of the global solar panel manufacturing market.

If US access to Chinese or other Asian solar PV manufacturers were hindered or cut off – due to geopolitical tensions, a new pandemic, a natural disaster, or other events – the growth of the US solar PV downstream market could grind to a halt. Europe’s recent energy crisis, caused by cuts of Russian natural gas and oil imports due to the invasion of Ukraine, provides a vivid illustration of how overreliance on a single country or region for an essential commodity can disrupt not just markets, but entire economies.

Solution: A Diversified, ‘Friend-shored’ Solar PV Supply Chain

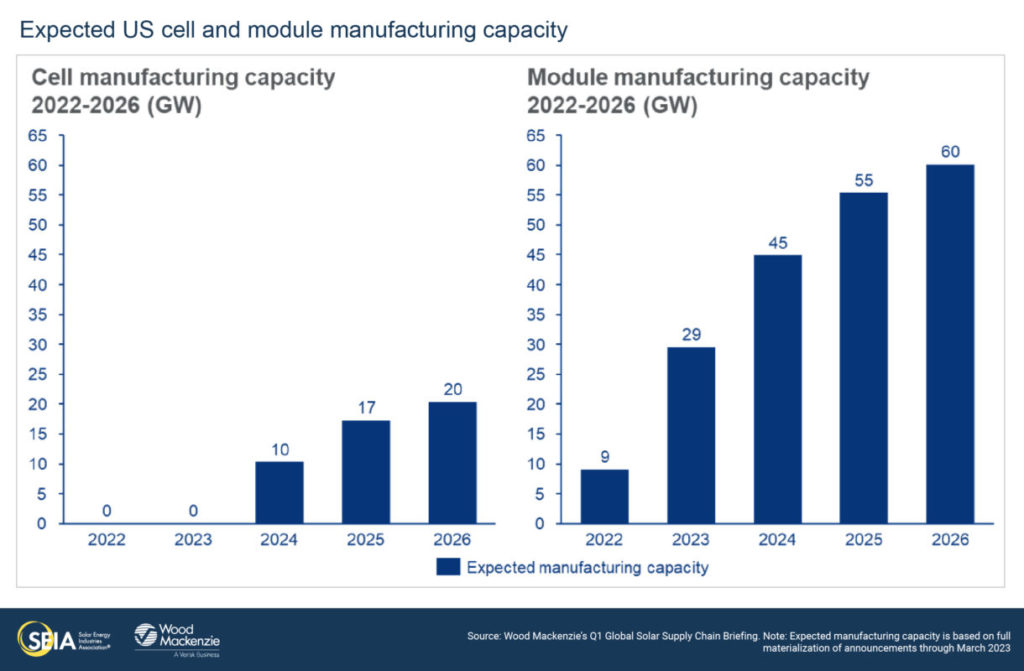

The US has already made some headway in mitigating its overreliance on Asian solar PV equipment supplies by increasing its domestic solar PV equipment manufacturing capacity over the past few years. For example, according to the NREL, US c-Si solar module manufacturing capacity grew from less than 0.5GW in 2018 to almost 2.5GW in 2022.

In addition, the IRA contains an industrial policy with robust incentives to encourage further growth of the US solar PV manufacturing sector. Research indicates these clean energy manufacturing incentives will boost US solar PV manufacturing over the next decade. For instance, a February 2022 report from the DOE forecast that domestic US solar module production capacity could reach 10GW in two years, 15GW in three years, and 25GW in five years with the right federal investments (like those found in the IRA) in place. These forecasts are being borne out – since the IRA’s passage, companies have announced plans to build manufacturing capacity across the entire solar PV supply chain, including 26 separate new manufacturing plants.

However, such new manufacturing capacity would likely not be enough to meet future US domestic PV module demand. In addition, investment is particularly needed in the upstream sector of the solar PV supply chain to support the reshoring of the industry. For example, according to Wood Mackenzie, solar cells domestically manufactured in the US will meet just 33% of announced domestic module manufacturing capacity by 2026. US solar PV module manufacturers will need reliable access to solar cells as well as the other components and materials used in their products – including wafers, polysilicon ingots, and raw polysilicon itself – if they want their solar PV supply chain to be secure.

Such a secure supply chain will require existing US companies to expand their operations into the solar market, as well as the launch of new companies in the US to manufacture components for solar modules. This is already happening – until recently no companies in the US produced the two types of polymers used for solar module encapsulants and backsheets. However, today two companies – Endurans and HB Fuller – are producing these polymers in the US for solar PV module manufacturers.

It will also require working with companies in Canada, Mexico and other friendly nations and US allies to manufacture key solar PV module components. For example, the vast majority of solar glass used in solar PV modules is sourced from companies that manufacture it in China, Malaysia, and India. However, a Canada-based company, CPS, in May announced that it is building a plant in Manitoba to manufacture this type of solar glass in Canada – the first plant of its kind and size in North America.

Such a diversified, friend-shored solar PV supply chain strategy – in which we can source all the components and materials needed to manufacture solar modules from companies operating in the US or our close allies – lowers the risk that geopolitical tensions, natural disasters, or similar events might disrupt the US downstream PV market. In addition, a diversified, friend-shored supply chain strategy also reduces shipping costs, simplifies supply chain logistics, and lowers solar PV manufacturing’s carbon footprint.

Obstacle: Lack of a Large, Skilled Solar PV Workforce

Developing a diversified solar PV manufacturing supply chain that spans across the US and its close allies will help provide the US solar PV downstream market with the reliable supply of the modules it needs to maximise its growth.

However, this supply chain might not be able to operate at its full capacity if the US does not have a large, skilled workforce able to manufacture solar PV equipment or deploy solar PV systems.

This is why it is important for the US solar PV industry and its key stakeholders to foster expansion and training of the US solar PV workforce. Even before the passage of the IRA, the US solar workforce was growing, with the Interstate Renewable Energy Council reporting that, as of December 2021, the industry supported 255,000 jobs, a 9.2% increase from 2020. But with the passage of the IRA, the growth of this workforce will need to accelerate – according to a recent SEIA study, the solar and storage industry will need to double its workforce over the next decade.

Solution: Improve Solar Worker Compensation, Expand Recruiting, and Increase Training

One way in which US solar PV manufacturers, developers, and installers can recruit and retain the skilled talent they need to support rapid growth is simple – better pay.

In a world where many jobs now offer workers flexible schedules and the ability to work from home, solar companies need to offer their workers competitive salaries and comprehensive benefits if they want to attract workers that are willing to commute to a solar PV manufacturing facility for an early morning or late-night shift or to climb on roofs to install solar panels.

They also need to expand their recruiting efforts to groups – particularly women – that are currently underrepresented in the solar PV workforce. For example, according to the IREC, just under 30% of solar employees in 2021 were women, while women represent 47% of the overall US workforce. Women and other underrepresented groups could provide the solar PV industry with many of the skilled workers it will need to support its rapid growth. But first companies in the solar industry need to demonstrate to people in these groups that they are actively working to make their cultures more inclusive and their workforces more diverse.

Finally, the US solar PV industry needs to ramp up its efforts to partner with high schools, vocational schools, community colleges, and other educational institutions on apprenticeship and other training programs. Without such partnerships, the industry will find it difficult to recruit the large number of skilled entry-level workers it will need to grow both rapidly and efficiently.

Providing solar PV workers with good wages and benefits, expanding solar PV industry recruitment e‑orts to women and other underrepresented groups, and launching new mechatronics and electrical apprenticeships and other training programmes will require significant investment by the solar PV industry. However, over the long term, these investments will build the large, well-trained workforce that the US solar PV market needs to reach its potential.

Obstacle: Fragmented Electricity Transmission System

A diverse friend-shored solar PV supply chain and large, skilled solar workforce will both help the US solar industry fully leverage the incentives contained in the IRA. However, there remains an issue that could throw sand in the gears of this growing market.

This is the patchwork, non-optimised state of the US long-distance electricity transmission system. Currently, its operations are fragmented, with separate Western, Eastern, and Texas grids that share few connections with each other. These grids are subdivided as well, with a large number of different operators managing different parts of these grids.

This fragmentation makes it difficult to use the existing US grid infrastructure to transmit power from areas where it is being generated to where it is needed. It also complicates efforts to build new grid infrastructure that would enable clean, low-cost solar power to be transmitted to areas where power is expensive or capacity is constrained.

Solution: A National Long-Distance Electricity Transmission System

There are signs that transmission operators are waking up to the fact that a clean energy economy needs a national long-distance electricity transmission system optimised to support clean energy generation. For example, the recently approved Champlain Hudson Power Express transmission line (CHPE) will help deliver 1,250MW of clean energy from hydropower facilities in Québec to energy consumers in New York City. But there is still a lot of work to be done before the US long-distance electricity transmission system is updated to support an economy powered by solar and other forms of clean energy.

It will be difficult to get regional transmission authorities, state and local governments, and utilities to work together to develop and implement a comprehensive national transmission system that enables solar and other types of clean energy to be efficiently transmitted from many of the rural locations where it can be best generated to the more populous locations where energy demand is high. But the stakes couldn’t be higher. According to a recent study by the Princeton-led REPEAT project, 80% of the potential emissions reductions delivered by the IRA in 2030 could be lost if we only expand transmission at a rate of 1% per year, and approximately 25% might be lost if transmission growth is limited to 1.5% per year.

With the passage of the IRA, solar and other types of renewable energy won an important battle in the war against fossil fuels. But unless the solar industry and its stakeholders ensure clean energy can be affordably and reliably transmitted from where it is produced to where it is needed, it will delay the arrival of the day when solar, wind, and other renewables Finally win the war to replace fossil fuels.

Faster US Solar PV Market Growth Will Speed Our Transition to a Clean Energy Economy

The supply chain, labour, and transmission issues described above are not the only obstacles that could slow the growth of the US solar PV market over the next ten years. However, if the solar PV industry and its key stakeholders address these supply chain, labour, and transmission obstacles they can build this market back better. In doing so, they will not just maximise the growth of the solar PV market enabled by the IRA, but also accelerate the development of a US economy fully powered by clean, renewable energy.

Author

Martin Pochtaruk has 35 years of experience managing manufacturing and innovation businesses across Europe and the Americas. He founded Heliene, a technology-leading high quality solar PV manufacturer in 2010. Heliene is challenging the solar industry status quo by putting customers first and manufacturing high quality, competitively priced solar PV modules made to order in North America. To learn more, visit www.heliene.com.