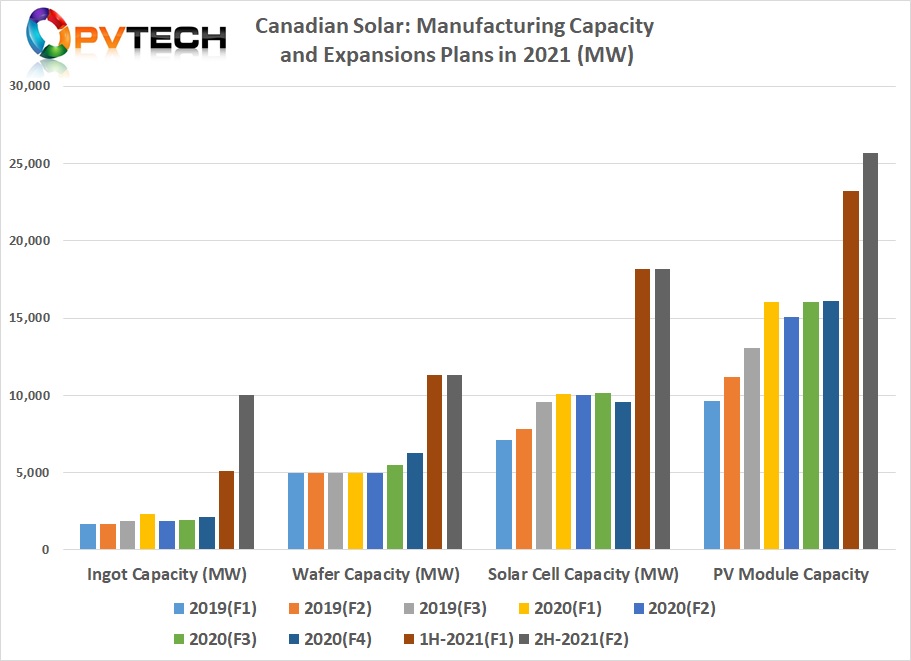

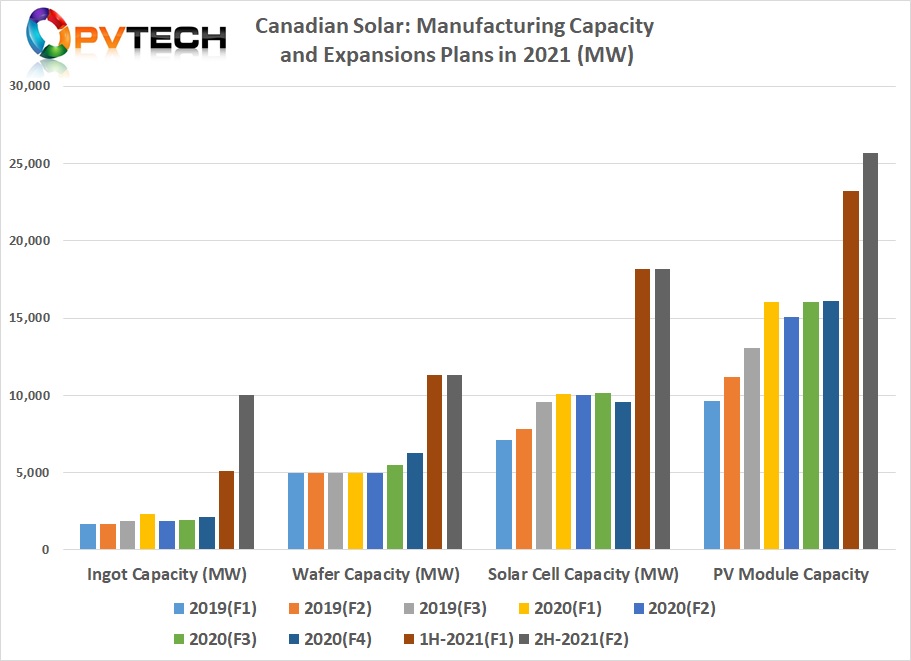

‘Solar Module Super League’ (SMSL) member Canadian Solar has stopped tweaking manufacturing capacity expansion plans and guided major plans for 2021 that encompass ingot, wafer, solar cell and module assembly.

The SMSL member said in releasing third quarter financial results that it would expand in-house silicon ingot production by 7,900MW in 2021, its first major expansion since 2016. The company will increase nameplate capacity to 5,100MW in the first half of 2021, up from 2,100MW at the end of 2020.

In the second half of 2021, Canadian Solar will expand annual nameplate ingot nameplate capacity to 10,000MW.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Canadian Solar’s in-house nameplate wafer capacity has been static at 5,000MW since the end of 2017. New plans announced would add a total of 5,800MW of wafer production in 2021, taking nameplate capacity to 11,300MW by the end of 2021.

The company did not disclose wafer sizes for the new expansion plans, but these would be expected to be either 182mm x 182mm, 210mm x 210mm, or a combination of both.

Although Canadian Solar would seem to have scrapped previous solar cell capacity expansions in 2020, these were actually very small at only 400MW, and plans for 2021 are much more ambitious.

With solar cell nameplate capacity static since the end of 2019 at 9,600MW, the company plans to add an additional 8,600MW of capacity in the first half of 2021. No further solar cell expansion plans were announced for the second half of the year.

In total, Canadian Solar expects to have total nameplate capacity of 18,200MW by the end of 2021. The company provided no information on the locations for these large solar cell capacity expansions.

In recent years, Canadian Solar has primarily added new module assembly capacity, keeping an asset-lite capex model. However, the company plans to increase module assembly capacity by 9,600MW in 2021 to reach total nameplate capacity of 25,700MW.

In 2020, Canadian Solar has only added around 1GW of module assembly capacity, taking annual nameplate capacity to 16,100MW. In the first half of 2021, the company expects to add a further 7,100MW of module assembly capacity, followed by a further 2,500MW in the second half of 2021.

By the end of next year, Canadian Solar is planning to have an annual module assembly nameplate capacity of 25,700MW. As with the other expansion plans, Canadian Solar did provide further details on where this expansion would take place in China or in what regions of the world were included in the figures.

However, recent (September 2020) Chinese media reports noted that Canadian Solar subsidiaries in Jiaxing City in northern Zhejiang province, China had signed a Phase II 5GW high-efficiency module assembly plant expansion that would start production in the first quarter of 2021. There has been no update or confirmation on these reports from Canadian Solar.

Almost all of Canadian Solar’s rival SMSL members (JinkoSolar, Trina Solar, JA Solar, First Solar, LONGi Group and Risen Energy) have already announced a string of major capacity expansions in 2020 and projected further expansions through 2021.