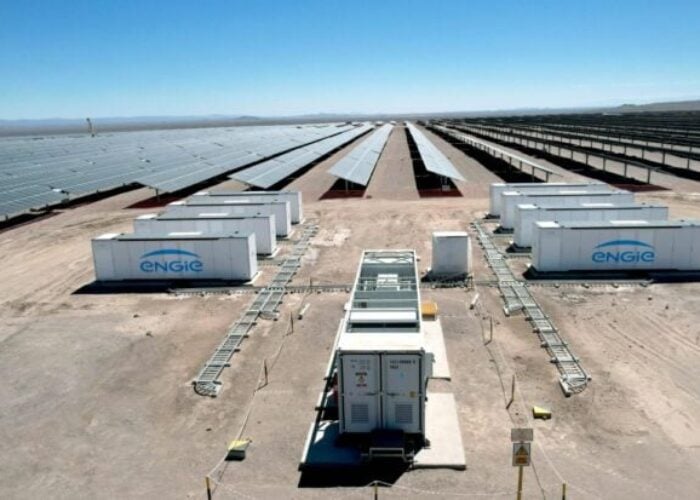

While most projects built in Chile are utility-scale and mainly located in the Atacama desert, the country has slowly grown its distributed generation sector through its Pequeños Medios de Generación Distribuido (PMGD) programme, with this trend expected to continue as it seeks to diversify its generation portfolio.

Projects within the PMGD programme have an installed capacity of up to 9MW, get automatic grid access with a no curtailment guarantee, transmission toll reductions and access to a stabilised pricing scheme. But they have more difficulty receiving financing.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“We found the market very interesting, because we felt it was an unserved base of clients that really wanted to do more deals, but were lacking some sort of international lender support,” says Aitor Alava managing director and head of infrastructure and energy finance for Latin America at Natixis CIB, adding that it had been looking closely at Chile’s PMGD market for about three years now.

In those three years, Natixis CIB has supported 12 PMGD projects in Chile, investing close to US$1.5 billion, with the latest one representing its highest ever portfolio financing with US$360 million.

Its first deal, however, required a lot of work as the company was not familiar with the market. But it took the risk as it saw a potential way to scale distributed generation in Chile and become a first mover in the nascent segment.

“We could structure things to make sure they were robust,” says Alava, adding that unlike utility-scale projects, there was not much competition.

Chile’s particular geography and the concentration of the demand in Santiago will inevitably increase the need to bring energy generation closer to where demand is. And this is where PMGD enters the scene as it would help reduce bottlenecks in the country’s transmission system.

“If you’re able to pull the generation closer to the consumption, it might be a little bit more expensive on the generation side because you will lose the synergies of scale […] but you cannot forget that you might be saving a lot of money in terms of transmission costs,” says Alava.

He sees the potential for other countries in Latin America to adapt Chile’s distributed generation framework to solve their own grid constraints. “I think distributed generation is a smart way [to solve grid constraints] in countries in which you do not have a very strong grid.”

Chile’s PMGD market is set to be transformed, however, by incoming regulation that will see projects remunerated according to the hours of the day the system generates power. Given all solar power is generated during the day, this will drive down the price generators can sell their excess electricity for. Existing projects, registered before the April deadline, on the other hand will still benefit from the previous regulation’s terms for the next 14 years.

“Right now there’s a little bit of a pause while the market rebalances and finds an effective way to continue financing non-grandfathered deals,” says Alava, adding that it might be premature to finance 100% non-grandfathered deals – the one’s made after the regulation change – as more visibility needs to be given on the regulation.

New projects since the regulation change in April could, however, benefit from co-locating energy storage to their existing solar systems, says Alava.

Depending on the wording of the new regulations for co-located storage, projects might be entitled to dispatch power generated during the day at periods of higher demand, with the plants no longer be considered as producing energy intermittently. This would enable projects to capture higher market prices during periods of high demand later in the day, which in turn would boost revenues.

“What I don’t know and what sponsors are doing right now is to see if that additional revenue is sufficient to cover the additional investment of putting batteries. But it definitely at least makes sense to consider it,” says Alava.

PV Tech has taken a closer look at the future of solar PV in Chile in the latest edition of PV Tech Power (Number 32). You can download your digital copy of PV Tech Power 32 via our subscription service here.