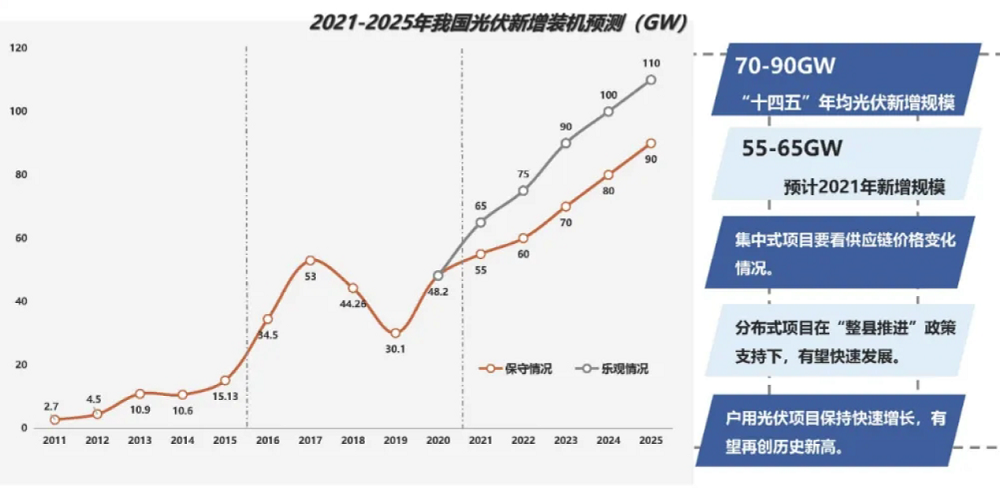

China could install up to 65GW of solar this year, driven largely by a surge in demand for distributed solar installations, while average solar deployment could reach 90GW per year in the years leading up to 2025.

Those deployment projections were provided by the China Photovoltaic Industry Association (CPIA) at a conference in China this week, during which the trade body said solar installations this year would be between 55 – 65GW.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

China installed 48.2GW of solar last year, according to figures published by the country’s National Energy Association, meaning the CPIA is forecasting growth of between 14.1% and 34.8% for 2021.

But those figures are slightly below other industry estimates issued earlier this year, with some forecasters expecting China to install as much as 70GW in 2021 as it accelerates renewables deployment to help the country progress towards a target of reaching net zero status by 2060.

Those estimates were, however, issued prior to an unprecedented spike in polysilicon prices, triggering price volatility throughout solar’s value chain. Polysilicon prices have more than doubled since the start of the year, with module prices rising by as much as 25% in the process.

This has led to widespread claims of utility-scale projects in China being pushed back towards the end of 2021 and into early 2022, with developers waiting for prices to stabilise before bringing projects in the country forward.

In a presentation discussing the solar development situation in China in 2021, which also noted the expected prominence of n-type technologies such as TOPCon and interdigitated back contact (IBC) cells this year, the CPIA said residential and distributed solar installations were expected to surge in the second half of the year, helping installs climb to what would constitute a record year for PV installs in China. The last time China installed close to 55GW was in 2017, when the country recorded 53GW of new solar development.

The CPIA expects solar installations to continue to grow each year out to 2025, with the range between its central and optimistic estimates also rising. Between 2021 and 2025, the CPIA expects China to install an average of between 70 – 90GW.

Earlier this year Chinese president Xi Jinping established the country’s 14th Five-Year Plan, which included the stated aim of eliminating emissions from its economy by 2060. Central to this is a rapid acceleration of both renewables manufacturing and deployment, with China aiming to have 11% of its power demand supplied by solar PV and wind this year.

Additional reporting by Carrie Xiao.