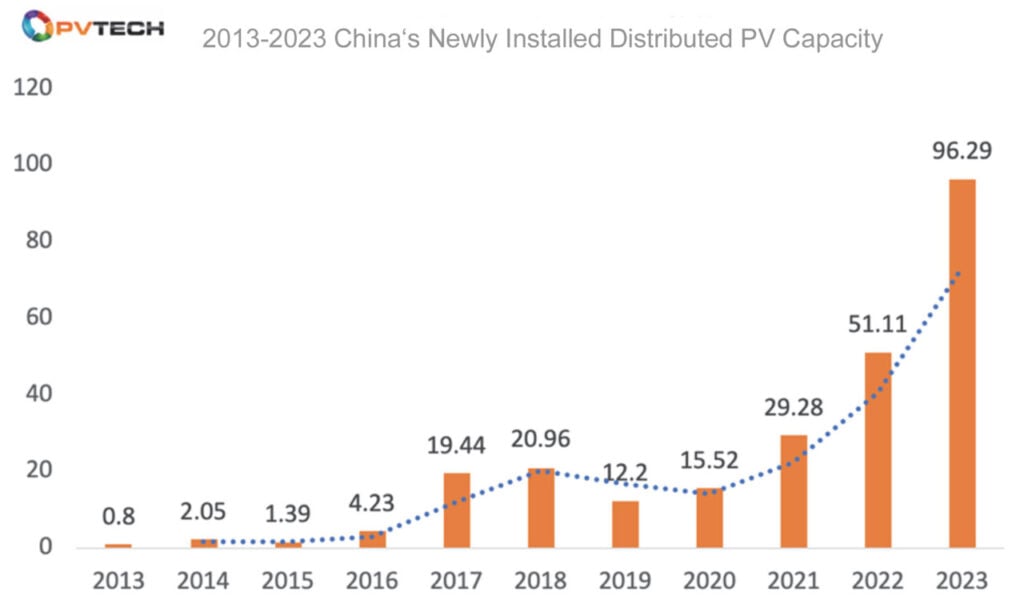

Last year saw 96GW of distributed PV installed in China, an all-time record. But as Carrie Xiao reports, even as the distributed market segment begins to surge, problems associated with its rapid development are beginning to emerge.

In 2023, the Chinese photovoltaic industry delivered results that far exceeded expectations.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

According to official figures, China saw the annual addition of approximately 216.88GW of PV capacity in 2023. But perhaps even more striking was the addition of over 96GW in distributed PV installations, which became a highlight and set a new historical record.

Over the last three years, China has witnessed explosive growth in added PV capacity, particularly in the distributed PV sector.

Data from the National Energy Administration shows that in 2021, China’s distributed PV installations for the first time surpassed centralised PV installations, with new installations reaching 29.28GW, making up about 55% of all new PV installations for the year.

In 2022, distributed PV installations saw significant growth, reaching 51.11GW; and in 2023, new distributed PV installations soared to 96.29GW, an 88% increase year-over-year.

The data on installations shows that the annual growth in capacity has consistently exceeded 70%, with the 2023 increase nearing 90%. By the end of 2023, China’s cumulative distributed PV installations hit 254GW, accounting for 42% of total PV capacity, marking an impressive achievement.

Market boom spurs competition and innovation

The recent surge in distributed PV in China not only brought about a vast market and substantial performance but also opened up a lot of room for imagination for 2024 and beyond, attracting an increasing number of PV companies to compete in what has become a highly competitive space.

Leading PV companies are increasingly focusing on the distributed market, rolling out new products, technologies and innovative service solutions tailored for this market.

Trina Solar led the way with its 210R rectangular silicon wafer combined with n-type TOPCon technology modules, adopting a strategy under the slogan, “700W+ on the roof, integrating PV and storage for new scenarios”, which has been well-received in the commercial and industrial PV market.

In October 2023, LONGi Green Energy introduced a distributed product, the Hi-MO X6 high-efficiency anti-dust PV module, targeting the industry pain point of dust affecting power generation performance. Notably, LONGi wasn’t the only one to launch anti-dust modules; GCL had previously introduced similar products.

Meanwhile, JA Solar launched its DeepBlue 4.0 Pro series for the distributed PV market, incorporating multiple quality and efficiency-enhancing technologies.

The distributed PV market has hit a development sweet spot, and string inverters have greatly benefited. Inverter companies such as Sungrow, Huawei, Ginlong, GoodWe and APsystems are active in this field, with each company seeing rapid growth in performance.

Additionally, PV brand merchants are not only focusing on product innovation but also increasingly emphasising their service capabilities for distributed customers, gradually shifting from a manufacturing mindset to a service-oriented approach.

On the operational and maintenance challenges of distributed power stations, CHINT Anneng’s household PV maintenance brand “Xiao’an to Home” has integrated big data and PV maintenance through a smart cloud platform, managing the entire process from roof survey and installation, to post-installation monitoring and maintenance online. Users can access power generation and fault troubleshooting information through the app.

Another notable brand, Skyworth PV, introduced the innovative BIPV product “Xiao Yang Lou” for household PV, integrating PV panels with rooftop architecture, suitable for self-built villas and cast-in-place flat roofs, effectively adding a free layer to buildings, enhancing their value and generating income for users through electricity production.

Challenges in grid connection and consumption

While the distributed PV sector is booming, problems associated with rapid development are beginning to emerge, especially as this market’s installations become a significant part of China’s new PV installations. The difficulties of grid connection and consumption have become pressing issues.

By the end of 2023, several provinces and cities announced that there was no additional capacity for new distributed PV connections. Provinces such as Shandong, Heilongjiang, Henan, Guangdong, Fujian, Hebei, Inner Mongolia, Hubei, Liaoning, Guangxi and Jiangxi faced issues with distribution grid capacity reaching saturation or warning levels.

Interestingly, these regions were among the top contributors to China’s distributed PV installations in recent years. According to Energy Administration data, in 2023, Henan province led the distributed PV addition rankings with 13.89GW, followed by Jiangsu with 12.17GW and Shandong with 10.13GW in distributed PV additions.

Faced with grid capacity crises, these provinces had no choice but to temporarily halt the filing of distributed PV projects, making grid-connected power generation one of the major complaint areas in the new energy and renewable energy sector in 2023.

Gao Jifan, chairman of Trina Solar, points out: “Alongside rapid development, issues such as power consumption, and the temporal and spatial mismatch between new energy and electricity demand are becoming increasingly prominent.”

Gao believes that power consumption challenges could limit the large-scale sustainable development of domestic new energy. “Large centralised PV plants are constrained by ultra-high voltage transmission limits, leading to insufficient room for further development. In the case of distributed PV, provinces such as Henan and Shandong have sequentially issued consumption warning risks, significantly dampening the growth expectations and enthusiasm for the distributed PV market.”

Xiaobin Zhang, vice president and secretary-general of the Shandong Solar Energy Industry Association, notes: “From the perspective of distributed PV generation and grid connection, the rapid pace of PV installations is outstripping the capacity for grid expansion and line construction. When investments and costs in PV plants have not yet returned to a rational range, it can be detrimental to the healthy development of the industry.”

Zhong Baoshen, chairman of LONGi Green Energy, also highlights in an interview that both rural household distributed PV and urban commercial and industrial distributed PV are developing rapidly but are facing consumption challenges.

“For example, some logistics and storage companies in cities have large rooftop spaces but minimal electricity needs, making it difficult to feed surplus electricity back to the grid, and thus preventing full utilisation of rooftops for PV installations.”

Zhong suggests that considering the temporal and geographical distribution of electric loads in rural areas, after the rural grids are upgraded, local PV electricity consumption should be transmitted to higher-level grids, at least up to the county or city level.

Multiple measures to enhance grid capacity

It’s noted that in addressing the challenges of new energy consumption, governments, businesses and consumers have been collaboratively strategising solutions.

According to the “Guidelines for High-Quality Development of the Distribution Network under New Circumstances” (hereinafter referred to as “the guidelines”) issued in early February 2024 by China’s National Development and Reform Commission and the National Energy Administration, by 2025, the distribution network’s carrying capacity and flexibility are expected to significantly improve, with about 500 million kilowatts of distributed new energy and approximately 12 million charging piles capable of being connected.

The digital transformation of the distribution network will be comprehensively advanced and the smart control and operation system will be rapidly upgraded. By 2030, the transformation towards a flexible, intelligent and digital distribution network should be fundamentally completed, effectively promoting the integrated development of distributed smart grids with the larger grid.

“The guidelines focus on addressing the new energy consumption issue, with enhancing the grid’s carrying capacity being one of the key points. With the application of appropriate energy storage and long-duration energy storage in the future, the construction and operation of distributed PV are expected to break through development bottlenecks,” a March 2024 report from China Development Bank Securities stated.

The guidelines propose that, in line with the development goals of distributed new energy, targeted strengthening of the distribution network’s construction is necessary, along with improving the means to ensure stable grid operation and energy quality. It’s important to coordinate the capacity of the distribution network, load growth, and regulation resources, systematically conduct new energy grid connection impact analyses, assess the carrying capacity of the distribution network, establish mechanisms for announcing and warning of new energy capacity that can be accommodated, and guide the scientific layout, orderly development, nearby connection, and local consumption of distributed new energy.

Gao Jifan believes that promoting a new energy installation model that synergises PV and storage can effectively solve grid absorption pressures and break through PV installation bottlenecks, opening up the market’s potential and becoming a key to the next phase of new energy development.

In this regard, a research report from CITIC Securities predicts that if domestic PV consumption bottlenecks are addressed, it could significantly expand the space for new PV installations in China, coupled with a bottoming out of module prices, potentially boosting the willingness to install downstream. The demand for PV installations in China in 2024 is expected to exceed expectations, with the annual growth rate revised upwards to 20-30%; the total new PV installations for the year are expected to reach 260GW to 280GW (previously projected at 230GW for 2024).