On July 25, the “2025 H1 Development Review and H2 Outlook” seminar for the PV industry, hosted by the China PV Industry Association, was held in Datong, Shanxi.

At the meeting, representatives from industry regulatory departments, research institutions, consulting agencies, and PV enterprises analysed the development of various segments of the domestic PV industry chain in the first half of 2025 and discussed the industry’s trends for H2 of the year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

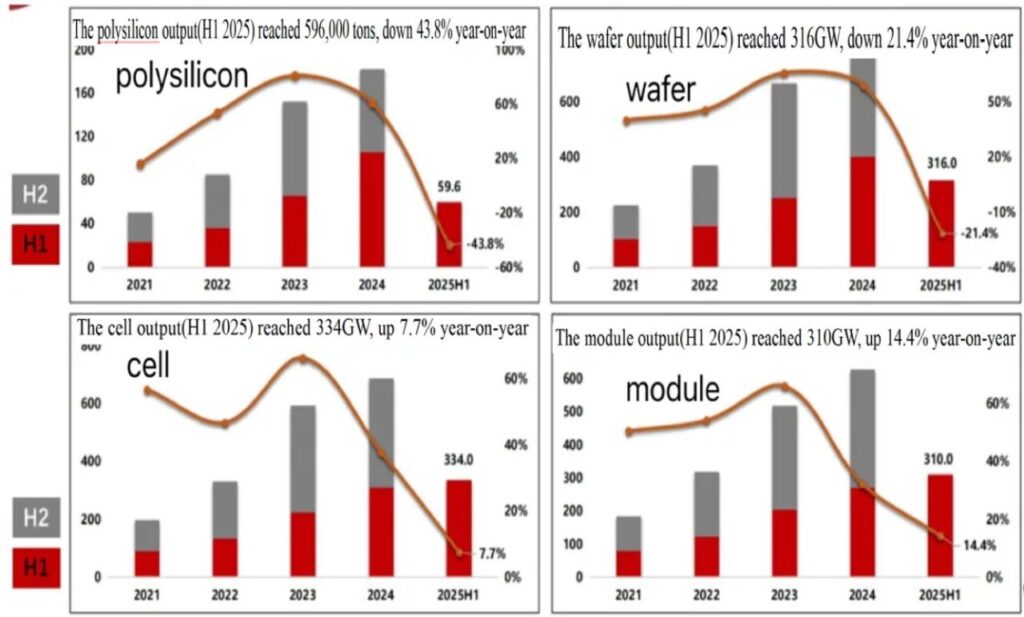

Wang Bohua, honorary chairman of the China PV Industry Association, delivered a keynote report. He pointed out that in H1 2025, China’s PV industry faced significant challenges, with production across the manufacturing chain growing at a slow pace. Specifically, polysilicon and wafer production saw negative growth.

The detailed figures are as follows: polysilicon production in H1 reached 596,000 tons, down 43.8% year-on-year; wafer production stood at 316GW, down 21.4% year-on-year; cell production reached 334GW, up 7.7% year-on-year; and module production reached 310GW, up 14.4% year-on-year.

Meanwhile, in H1 of this year, PV product prices also fell significantly. The average prices of polysilicon, wafers, cells, and modules have fallen below historical lows, having dropped by 88.3%, 89.6%, 80.8%, and 66.4% respectively, compared to their peak levels since 2020.

According to customs data, China’s exports of PV products declined in H1 2025. From January to June 2025, wafer and module exports decreased by 7.5% and 2.82% year-on-year, respectively.

“Export revenue has also seen a decline year-on-year for two consecutive years. In the module sector, the trend has shifted from ‘volume growth amid price declines’ to ‘declines in both volume and price,’ reflecting slowing demand in overseas markets. Against this backdrop, companies are facing significant survival challenges, with several PV firms announcing delistings or bankruptcies in H1 of this year,” Wang Bohua analysed.

In terms of export markets, traditional markets such as Europe, India, and Brazil have seen some degree of contraction, while emerging markets like Colombia, Iraq, Cuba, and Algeria have maintained steady growth. Moreover, export fluctuations in these emerging markets are smaller than those in Europe, highlighting a gradual trend toward diversification.

Despite challenges along the manufacturing chain, the outlook for the global PV market remains promising. According to CPIA, the global PV market will continue to operate at a high level in 2025. The association has revised its global market projections upward, raising the forecast for new global PV installations from 531-583GW to 570-630GW, and that for China’s new PV installations from 215-255GW to 270-300GW. Solar PV installations in China reached more than 212GW in H1 2025, according to recent data from the Chinese National Energy Administration.

However, Wang Bohua pointed out that the growth rate of the global PV market is not as optimistic as expected and is projected to decline significantly. This is the case with the European Union, where its growth is forecast to decrease in 2025 for the first time in over a decade, according to trade association SolarPower Europe.

Looking ahead, CPIA predicts that by 2027, solar power will account for half of the growth in global electricity demand, indicating substantial room for further increases in PV penetration.