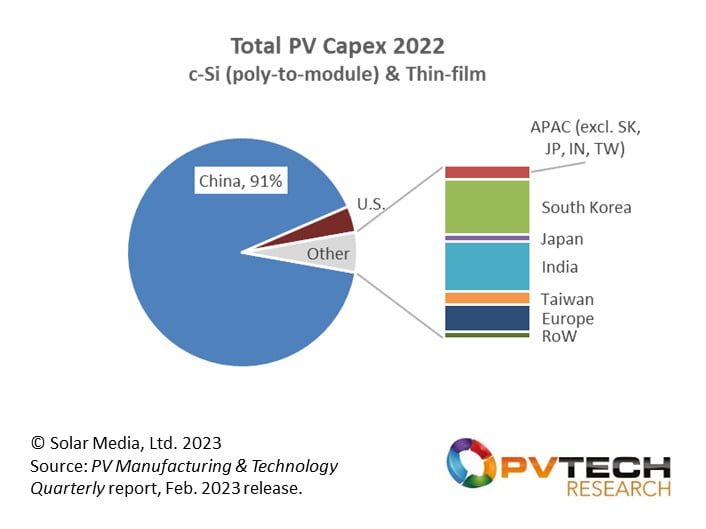

During 2022, capex for solar PV manufacturing fabs reached a record high – at more than US$27 billion – with spending dominated by Chinese companies building out new fabs in China and across Southeast Asia.

Chinese companies accounted for more than 90% of total PV capex in 2022, including new capacity for polysilicon and across the full c-Si ingot-to-module value chain. The only area where Chinese companies did not participate was new thin-film capacity that was 100% dominated by US owned First Solar.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

This article explains why 2022 capex trends are vital to understand the global PV community; non-Chinese companies trying to compete as manufacturers, anyone buying a solar module outside China, and policy-makers seeking to create domestic manufacturing ecosystems.

In the text below, I define first what PV capex actually means. Then I go through the numbers for 2022. And finally, I look at how PV capex has cycled over the past 16 years, as fortune called on the Chinese PV industry. I also discuss the implications of 2022 spending levels at the country level; especially for manufacturing competition to China, but also valid for module buyers and government policy-makers.

Defining capex

Capex is short for capital expenditure. It includes actual spending (investments) by manufacturers in new fabs, upgrades and expansions within existing fabs, and maintenance of production lines in operation. It includes related investments into the buildings and infrastructure, and the production equipment that makes up the full production lines.

In the PV industry, capex is dominated by production equipment in new fabs. And with many of the fabs in China having minimal costs for the buildings in which the equipment is set up, capex is in fact dominated by the production equipment itself.

Capex for PV manufacturing can be segmented into six different value-chain categories (or manufacturing technologies). Five of these are c-Si specific: polysilicon, ingot, wafer, cell and module. The other technology category comes from thin-film, for which there is only one supplier of note in the sector today (First Solar).

Prior to the PV industry having a meaningful contribution to overall silicon production levels, polysilicon capex was committed by companies serving semiconductor wafer demand. Very quickly, PV started to be the main driver and virtually all the capex in the past couple of decades for new polysilicon plants has been for PV applications. Therefore, today, it is fair to say that almost all polysilicon capex is for the PV industry.

All other value-chain categories are PV specific, as there is no other application for a PV c-Si wafer or cell. These fabs would not exist without the PV industry.

For clarity, then, I break out polysilicon capex from the few producers that serve both semi and PV, to include only the PV part. This is really in the noise however; it would not dent the percentage levels that China spends on polysilicon capex for PV, as will become apparent shortly.

But now, let’s look at the data for PV capex in 2022.

China spending like there is no tomorrow

Capex data is accumulated by analysing the 100-plus PV manufacturers that make up about 99% of everything made in the PV industry today, while also factoring in the capex from many of the new entrants (today largely coming from players in the heterojunction space).

Capex for each of the 100-plus manufacturers is segmented into contributions from the various parts of the value chain they participate in. For example, cell and module, pure-play polysilicon, module-only, etc. All underlying data is contained within our PV Manufacturing & Technology Quarterly report.

For additional colour on the capex – for the first time – I have split out this segmentation further to assign company-specific spending to the location of the company’s headquarters (country). In the PV industry today, this is rather prescriptive. Chinese companies are owned by Chinese entities. Ditto for those in South Korea and Taiwan. Almost all the PV manufacturers in India are Indian owned.

Of the notable contributions from the US, this is almost exclusively First Solar, a company that is of course US owned.

Southeast Asian manufacturing has a slightly more cosmopolitan feel, but is mostly comprised of cell and module capacity that is owned by Chinese companies. First Solar has fabs in Malaysia and Vietnam. REC Solar has all its (mostly module) manufacturing capacity in Singapore and is now Indian owned (Reliance), having previously been Chinese owned. Maxeon has part of its capacity (mostly its back-contact cells now) in Southeast Asia: Maxeon is the former manufacturing arm of SunPower, and does have a significant shareholding contribution from a leading Chinese PV wafer manufacturer (Zhonghuan Semiconductor), but this is not a controlling share and as such Maxeon’s capex is assigned to US capex contributions. Hanwha Solutions has Q CELLS capacity still in Malaysia, a legacy feature of the bygone overseas expansion strategy of the first Q CELLS incarnation owned out of Germany.

In total, during 2022, over US$27 billion was committed to PV capex, covering all the value-chain technology segments outlined above. The contribution by company-ownership location is now shown below.

The pie chart above shows a picture that is worth a thousand words. Chinese companies accounted for 91% of total sector spending in 2022, with only First Solar’s thin-film contribution offering any meaningful non-China hope for the outside world.

Very little was spent in 2022 by PV manufacturers in any other part of the world, with Hanwha Solutions (for its Q CELLS operations) and OCI (for its Malaysian-based former Tokuyama plant) being worthy of note. Spending in India was almost all for new module-only capacity, in a country still working out how to get its domestic cell production off the ground meaningfully.

This picture has been the same for most of the past decade within the PV industry.

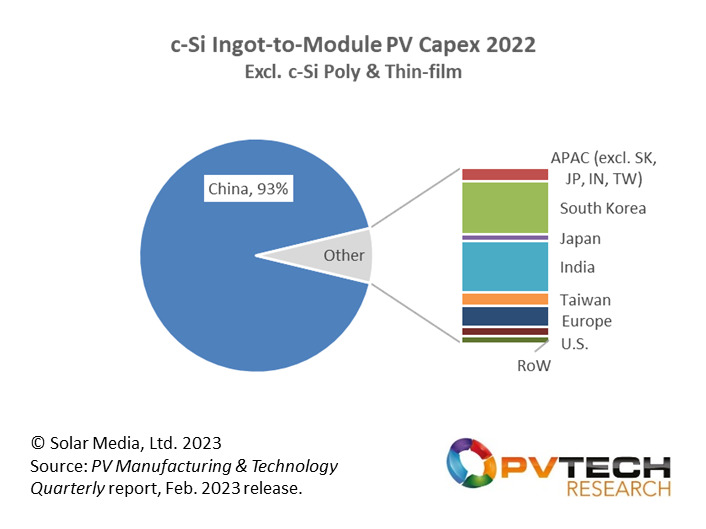

Going more deeply into the analysis, it is useful to remove c-Si polysilicon and thin-film capex. The main reason here is that capex for these technologies is less correlated to future production than all the other c-Si value-chain stages: ingot, wafer, cell and module. In short, it takes about 18 months to two years to get a new polysilicon plant up to full utilisation.

It also takes First Solar about 18 months to build a new thin-film fab.

By contrast, a new ingot, wafer, cell or module fab (in particular in China) can be at full operational capacity in a matter of months. And today, these are being done in 5-20GW increments.

Given also that c-Si modules represent about 97% of the market today (with more than 90% of supply coming from Chinese companies), it is useful to isolate c-Si ingot-to-module capex because the phasing of capex from spend-to-build is much quicker; and, in theory, is the best leading indicator of what will happen from a production standpoint over the next 12-18 months.

The following pie chart shows PV capex for 2022, specific to c-Si ingot, wafer, cell and module.

By now, there is really nothing new to say when discussing the pie chart above (for c-SI cell capex in 2022). All the key drivers have been outlined above. For Western equipment and material suppliers looking for green shoots in PV cell capex outside China in 2022, it was a depressing existence.

However, 2023 is the first year of hope for quite some time; with India, Europe, the US and some other countries (most notably Turkey) now in the process of placing purchase orders (PO’s) for new c-Si cell lines. But PO’s just make up the ‘book’ part of any ‘book-to-bill’ ratio. Capex is only real at the billing stage (payment), so let’s not get too carried away about PO’s (or indeed the dearth of vague expansion announcements for new capacity doing the rounds once again today). PO’s are an essential first part: fab build and productivity are the steps that ultimately matter.

16 years and the changing of the guard

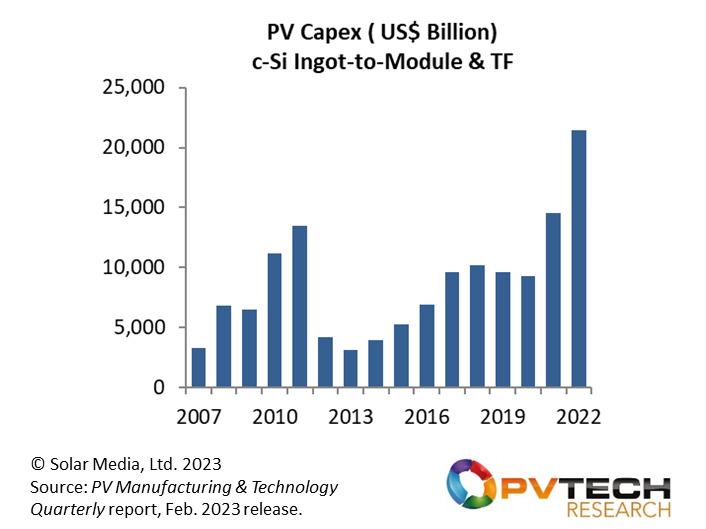

The last graphic I show – and discuss – is one that I traditionally shared with the PV industry when talking about PV capex over the past two decades. It includes everything except polysilicon capex. So, c-Si ingot-to-module and thin-film.

This is probably the graph of most interest to equipment suppliers outside China today, with many tool makers there serving both c-Si and thin-film segments (or being capable of doing) from within any PV (or PV dominated) business unit. It is also the one graphic that could perk the interest of a whole equipment supply community that for years has debated whether to get into PV or re-enter it. Tool makers like to go after attractive PV capex opportunities in adjacent technology segments, if tool-spec differentiation is the key to growth. This is something I will return to in the next phase of my 2023 manufacturing and technology article series on PV-Tech: how to get some of the major equipment suppliers serving other sectors to join PV, and why it is critical if the current China-domination is to be broken.

To explain this PV capex part (c-Si ingot-to-module and thin-film), I have chosen to look at historical trends: in total, a 16 year period of PV capex (excluding poly) from 2007 to the end of 2022.

To understand fully the graph above, you need to remember that capex by nature (for any industry in the history of time) exhibits cyclical trends.

Upturns and downturns in capex are unavoidable. They can be caused by oversupply, extended softening in end-market demand, or during a period of technology change. So, let’s talk through the main factors that have influenced PV capex levels in the past 16 years.

It might be hard for some to imagine today. But until 2010, PV capex was almost the sole domain of non-Chinese equipment suppliers (as was the case for many of the key materials used, such as silver paste and backsheets). Equipment suppliers then were from the Western World and Japan. They had been integrated within the fabric of early-day PV R&D and had created the blueprint of what the first production lines looked like.

Back in the day, Japan’s investments largely used Japanese tool suppliers (which were in abundance at the time during Japan’s early role in the semiconductor industry, when semiconductor companies were integrated). Europe and the US did the same, although there was cross pollination going on also between the two regions then. First Solar had a China-free equipment supply chain (and today is the only major PV manufacturer on the planet that can lay claim to this). India relied on European suppliers to get started. So too for Taiwan that was pretty much the birth of the c-Si turn-key line in decent numbers. South Korea also relied on European turn-key suppliers to get established. And China’s first foray into cell and module production used mostly stand-alone parts from European and Japanese tool makers – before ‘reverse engineering’ was even a phrase in the PV industry.

Then in 2010, things got a bit weird in terms of PV capex, as shown above in the graphic.

Billions were spent on new thin-film fabs, mostly across Europe and the US, although Japan sunk its fair share into failed thin-film fabs. At this time, “c-Si or thin-film” was a genuine question in terms of which one would win going forward. Much of the thin-film capex (mostly from turn-key lines by the likes then of Applied Materials, Oerlikon and ULVAC that had developed related technologies for display applications) got spent in the two-year period 2010-2011, and much of this was on triple-junction a-Si based tooling. None of this is in operation today for thin-film production, nor are the vast majority of the companies (or private investors) that lived the thin-film dream at the time.

This accounts largely for the artificial spike in PV capex during 2010-2011 as shown above. 15 years ago, it was a pastime of many to generate lists of new starters across a-Si, CIGS and CdTe: numbers could easily get as high as 100 or more. Today, the PV industry has only one thin-film winner (First Solar); and how this company has needed to be better-than-best to stay competitive over the years.

Following the weird 2010-2011 period, PV capex then went into its first (and as yet only real) downturn phase around about 2013. This had nothing to do with the fact that a large part of the thin-film capex did not lead to fab productivity. It was because of two factors that came together at the same time, outlined below now.

Feed-in-tariffs were abruptly ended (or scaled back significantly) in European countries. At this point, Europe had been the driver of end-market demand for the PV industry for a number of years. This caused a softening in demand from Europe (not a radical decline in any manner), but there were no other countries that could pick up the slack. PV then only existed with attractive government subsidies, and much of that was going to residential rooftops.

But the real reason for the downturn was that China had started – without caution – to build new fabs as a hobby, with new entrants focused on GW-scale additions to ship into Europe. This simply created a self-fulfilled chronic over-capacity situation for the industry, all through the value-chain. As a result, module average selling prices (ASPs) collapsed, margins for most went into the red, and China went largely into cost-reduction mode (as opposed to capacity addition fervour).

By the time things restarted meaningfully for PV capex (2015-2016), China had brought its domestic equipment and material suppliers up-to-speed and basically had the ecosystem it needed to take over the world in terms of PV manufacturing and module supply. To help China even more, the majority of PV companies in the Western World (including Japan) had shut down loss-making PV operations. And during 2013-2015, new PV capex levels were reset based on tooling being supplied by domestic Chinese equipment suppliers.

The door was open for China. Then, PV went subsidy-free, net-zero drivers added to the mix, and now there is an energy security crisis.

Is it any wonder why there is panic today across Europe and the U.S.? How to change the outcome in the future when solar PV is a leading global energy source? How not to be in a situation where 99% of global solar energy by 2050 is produced by Chinese equipment?

Some final thoughts on PV capex

It is incredible how many people come up to me and say: “The PV manufacturing game is over. China has won. There is no point in the rest of the world trying to change this”.

Indeed, anyone looking at the production shares across the value-chain (see the recent blog hyperlinked above) and 2022 capex trends in this article (as the main leading indicator for production in 2023 and 2024) might actually be inclined to agree with these people.

But possibly today, we are all simply living through Solar Manufacturing 1.0; namely, we are at the start of the game, not even close to half-time.

It is inconceivable to think the PV industry will look like this in 10 years. 2023 may just be part of the swansong of Solar 1.0: and in the future, people will talk about what the industry looked ‘back-then’ and what factors caused it to change and move to Solar 2.0 and then 3.0, and so on.

In this context, my next article will look at what Solar 2.0 could be: how this could totally change PV manufacturing compared to today; and how Western IP and know-how could become something that cannot be replicated anywhere else in the world. But for this, you will have to wait a few weeks. In part, the formulation has yet to be firmed up! But there is another reason for the short delay.

Right now, my focus moves to the PV CellTech Europe conference in Berlin, Germany on 14-15 March 2023. This promises to be something special, with PV cell capex now seeing its first major investments in Europe for more than 20 years. Two cell/module companies are driving this today: Meyer Burger and ENEL. Both are giving presentations at PV CellTech. I hope to see as many of you as possible in Berlin – there are still some tickets left to attend (follow the link here). And I will be giving a 30 minute talk to kick-start the two-day event, maybe with some Solar Manufacturing 2.0 talk from a European perspective!