During 2023, Chinese-owned PV companies supplied just over half of all PV modules shipped into the US market during the year, with more than 98% of these Chinese-owned modules manufactured in Southeast Asian countries such as Vietnam, Thailand and Malaysia.

This supply-channel dominance is not new. It was kick-started back in 2012 when the US first applied anti-dumping (AD) and countervailing duties (CVD) on c-Si cells and modules produced in China and Taiwan being imported into the US These AD/CVD duties propelled Southeast Asia into the PV manufacturing spotlight.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

However, it is especially pertinent at a time when the US is seeking to develop a domestic PV manufacturing footprint and decouple its reliance on PV imports from global regions that are not aligned to the country’s long-term geopolitical trade relationships.

This article provides a full segmentation of the 50GW-plus volumes of PV modules that were consumed by US channels in 2023, including the regions of module assembly, the breakdown of module ownership globally and what this means for module buyers in the US when addressing traceability.

The source data for the graphics and analysis is taken from the March 2024 release of the PV Manufacturing & Technology Quarterly report. Commentary on the companies is supplemented by the analysis contained within the PV ModuleTech Bankability Ratings Quarterly report.

Indian export bonanza

Knowing where products have been made and the source of upstream components back to polysilicon and beyond has never been more critical. I’ve gone on record many times about why this ought to be important in terms of product quality, but the current demand here is coming from supply-chain traceability and issues around environmental, social and governance (ESG) buying practices.

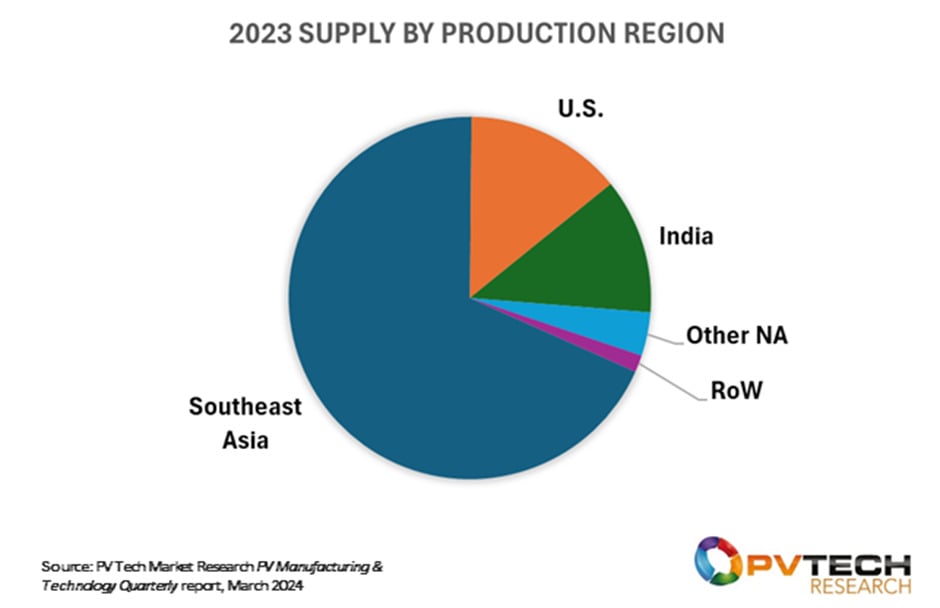

It is not realistic for a PV module-buying community to become experts overnight about the full value-chain supplier tendencies of some 50-60 companies potentially bidding for volume request for quotations (RFQs). However, at a bare minimum, such buyers really should know at least where the modules were assembled (from cells). This is shown in Figure 1 below.

During 2023, US-manufactured modules accounted for about 15%, with some two-thirds of these made domestically by First Solar. In this regard, there were no major surprises here.

What seems to have caught many by surprise, however, was the massive uptick in modules made in India being imported into the US; in reality, the success of the Indian PV companies is not by chance, as many have been patiently waiting for export opportunities to emerge for almost two decades.

India has a heritage in PV module manufacturing that goes back several decades, with many companies in this space having navigated industry cycles on multiple occasions. At the height of the European PV boom of 2010-2013, companies such as Vikram and Tata benefited from export business for almost the first time but subsequently withdrew from this market once it became dominated by Chinese imports. Having fallen back on a growing domestic sector for module supply thereafter, the desire to have a meaningful export business never vanished.

The massive uptick in Indian module imports to the US in the past few years – and in particular 2023 as shown in Figure 1 – has come about in part from excess product availability by Indian module suppliers but also from the desire of US module buyers to have non-China and non-Southeast Asia module supplier options.

India’s political relationship with the US – not to forget India’s frosty relationship with China – is also likely to have played a key part in the somewhat rapid customs compliance status for imported products to the US, despite most of the modules coming from India having to buy in solar cells made by Chinese companies in Asia.

It is therefore not entirely unsurprising that increased scrutiny is now being placed on the upstream components used in these imported modules to the US. However, India is finally moving on large-scale cell manufacturing additions for the first time, with only Adani already having made investments here on a large scale.

During 2023, Waaree catapulted well into top-10 module supplier status to the US, with a host of other Indian module suppliers – such as the aforementioned Vikram and Adani, Emmvee, Goldi, Rayzon and Jakson – rounding out a story that has continued momentum so far in 2024.

Aside from module supply from India and Southeast Asia (that also includes imports from non-Chinese entities producing in this region, such as First Solar, Qcells, REC, and VSun), smaller volumes of imports came from various module suppliers (either as self-branded products or OEM-supplied) located in Europe, the Middle East and the category shown above as Other North America (or Other NA) covering Canada and Mexico mostly.

All eyes are now on how many of the new module fabs in the US will come to fruition in 2024 from a meaningful supply-level standpoint. Not to forget of course, the source of the solar cells (likely to be dominated by supply from Chinese-owned companies in Southeast Asia today), where these cells source their wafers from, whether the ingots are made in China or nearby in the new Southeast Asia wafer fabs, and of course the origin of the polysilicon.

This year may end up a transition year for domestic module production growth in the US. The reality may be that the real uptick in domestic US module supply comes from First Solar’s projected year-on-year US module production growth in 2024 of about 40% as the new US fabs are further ramped up. Within a few months, it will be clearer how much additional domestic module supply will come from the multi-GW build out of Hanwha Solutions’ US entity, Qcells North America, with its new capacity in Georgia poised to come online.

Module supply ownership & the challenge for IRA allocations

Until recently, almost all the focus on restricting US module imports has fallen on the origin of regional cell and module production, not on tracing back the origin of company ownership. This explains to a large extent how the Southeast Asia ‘issue’ was allowed to evolve over the past ten years; namely Chinese module suppliers retaining such a high market share of modules bought by US downstream channels.

While the Inflation Reduction Act (IRA) is principally tasked with providing a funding model that allows incentives to be claimed by almost any domestic manufacturer (independent of whether the company is US owned, headquartered in China or a subsidiary of an overseas entity anywhere globally), it has nonetheless brought to the fore the question of module supplier ownership location.

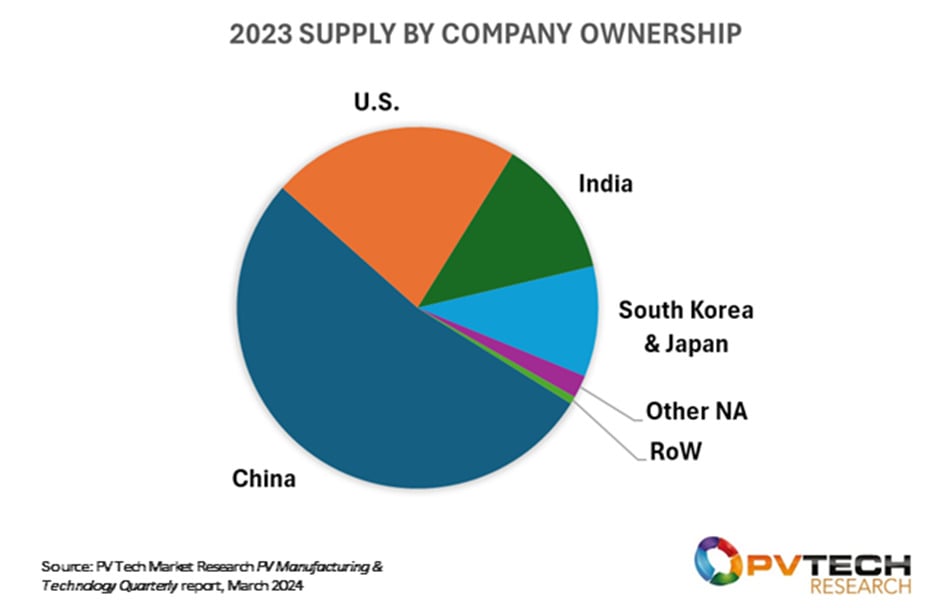

Figure 2 shows a segmentation of 2023 US module supply by the country of module supplier ownership. In this case, I have broken down the categories into China, the US, South Korea and Japan, Other North America (Other NA) and the Rest of the World (RoW), now including module suppliers owned in any other region here.

With Southeast Asia module manufacturing (excluding that of First Solar, Maxeon, REC and Qcells) existing only because of US import restrictions placed on shipments directly out of China, it is therefore not a surprise that China dominates the ownership-supply pie chart in Figure 2.

The big question, of course, is whether new domestic US module manufacturing (or subsequent cell production if, or when, this happens) mirrors the overall supply trends shown above. This is where justifying IRA fund allocations may get ‘challenging’, the reasons for which should be blindingly obvious to anyone tracking US/China relations in recent years, only amplified in the public domain during an election year.

In this regard, it is also easy to see why there is so much module import activity from three of the countries tied closest to the US from a geopolitical standpoint: South Korea, Japan and India. The only notable exception here is Europe, but the limited play here is more a consequence of there being very little module production in Europe today, far less any European entities having overseas capacity located anywhere other than mainland China for European rooftop supply.

De-risking module supply options still the key focus in 2024

While the phasing of new domestic PV capacity – excluding First Solar’s domestic fab build-outs – is still a work in progress during 2024 (and may well be during 2025 and 2026 also), the debate of IRA fund allocation appropriateness will continue to evolve. Moreover, the likelihood of new and amended trade/customs-based tariffs will always be in the background. With all these distractions, it is no small wonder that US module buyers simply want to have supplier options for the next few years with minimal risk and smooth deliveries on time.

Within the solar world, there is nothing remotely as complex as buying PV modules in the US today. Even when all seems fine (from a traceability standpoint), buyers are often left to face the harsh reality of buying from companies that have been technically bankrupt for years and are unlikely to honour a warranty claim in five months, far less five years. The prudent module buyer in the US has not only a Plan B, but a Plan C, D and E these days, and ought to think about spreading supplier options across various segments of the two pie charts shown in the figures above.

From a thematic standpoint, knowing which topics to cover at the forthcoming PV ModuleTech USA 2024 event – in Napa, California on 21-22 May 2024 – has been somewhat driven by many of the issues covered in this article. This event is all about buying modules in the US today, and for pipelines two to three years out, regardless of where these modules come from or who owns the company that makes the module.

The event is all about understanding what the landscape for US module buying looks like today and how to de-risk module supply selection. The event has been sold out the past couple of years. You can view the latest agenda here.

I will be on stage talking and moderating much of the content over the two days. The event should hopefully allow a much-needed perspective on any changes to module buying in the US over the past few months, new suppliers that were not options 12 months ago, and how people are testing and qualifying the various n-type technologies being deployed in scale on ground-mount applications now in the US for the first time.