Solar power firms and some wind developers are experiencing curtailment of their energy production in the north central regions of Chile, but this will have been accounted for in their business plans, according to a major industry representative.

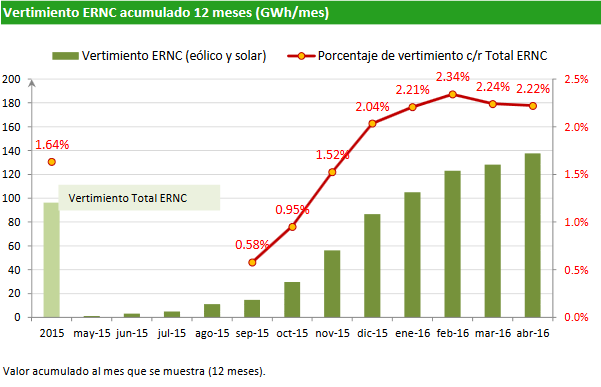

PV plants located in the northern part of the country’s main grid, the Central Interconnected System (SIC), which provides power for the majority of the country, have been experiencing significant levels of curtailment since October 2015, with rates reaching above 2% in December. This is partly due to a high concentration of solar plants in the area, taking advantage of the strong solar resources of the Atacama desert.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The following performance report on the SIC, published by the Centres for Economic Load Dispatch (CDEC) shows the rising trend.

Carlos Finat, executive director of the Chilean Renewable Energy Association (ACERA), told PV Tech that there are two major reasons for the curtailments.

Firstly, the Chilean power system is weak and attempts to resolve the requirements of the transmission system have experienced major delays. The need to expand the network was identified in 2014, but the tendering, permitting and construction processes take several years.

The main solution would be the Cardones-Polpaico transmission line being constructed by Columbian utility Interconexión Eléctrica (ISA), which has been awarded and is under construction although there has been some oppostion from various communities. The secondary solution is the major connection between the SIC and the northernmost SING grid, which is mostly run on more expensive coal power and could alleviate some of the PV overcapacity on the SIC, said Finat. Both lines are now expected to come online by the end of 2018.

The second major reason for curtailment is that for security and flexibility reasons, CDEC has to constantly run at least three units (around 75MW) from the 152MW Guacolda coal-fired power station operated by Chilean power firm AES. However, Finat said that a recent audit found that the minimum technical level of those units could be as low as 20-25MW.

Finat said: “The firm is not willing to take any action in favour of renewable generation, so some part of the curtailment could be avoided if the CDEC decides to use the results of this audit.”

He added: “This broad discussion about the flexibility of the 4-5 plants is the same that is happening in all countries where the operators of conventional generation don’t want to release the actual real flexibility capacity that they have.”

Effects of curtailment

While the curtailment of solar power is clearly a difficult situation for both PV developers and investors, Finat claims that developers must have accounted for this in their business plans. Thus, while some developers such as SunEdison have started to position solar plants further south in the metropolitan regions where transmission is more robust, it is telling that other developers have decided to carry on building solar plants in regions that are already experiencing curtailment.

Finat said that they are effectively betting on the successful completion of the major transmission overhauls.

He added: “At this moment a new transmission law is being discussed in the Chilean congress and is in the latest stages of discussion and should be approved in the next 30 days.

“This law includes a whole new process of expansion of the system that should solve totally the problems of a transmission system that has acted as a major barrier to both renewable energy and non-renewable sources. It is affecting everybody.”

Ultimately, Finat claimed that the possibility of curtailment was very clear and public to companies looking to invest in Chile at an early stage.

He added: “They were able to foresee that this would occur. The capacities are already known with the studies that they must have run. It will probably take a bit longer, but my feeling is that many companies have already considered this effect in their business plan. This is not a surprise.

“Of course it is not a good situation. Of course probably it will take longer than expected, but it is a manageable situation.”