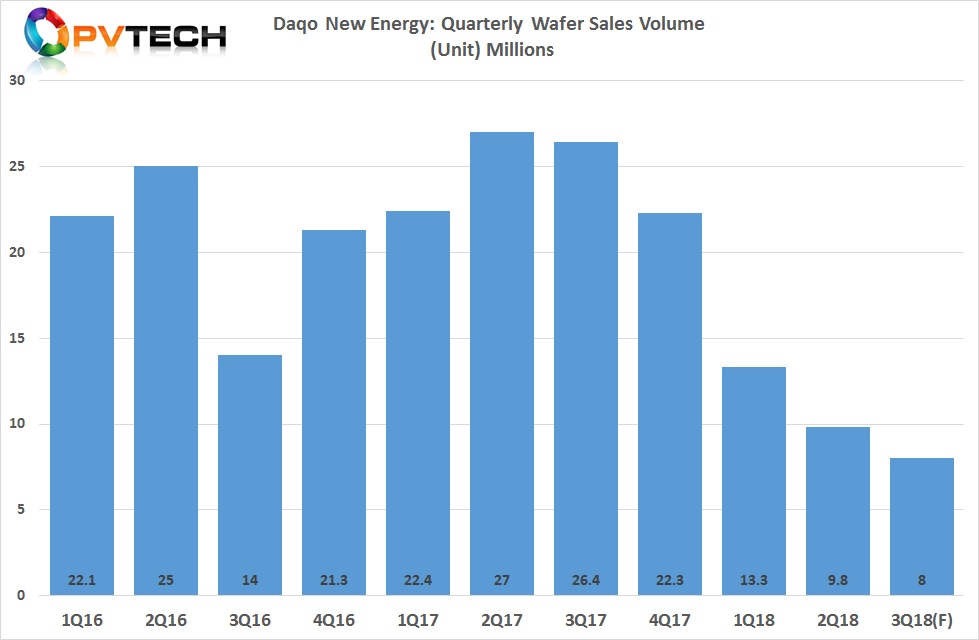

China-based polysilicon and wafer producer Daqo New Energy has guided wafer sales volume down 70%, year-on-year as the caps on utility-scale and Distributed Generation (DG) solar projects in China at the end of May start impacting quarterly business results for many companies dependent on the China solar market.

PV Tech had previously highlighted that Daqo’s multicrystalline wafer sales volume had been slashed by as much as 50% for the second quarter of 2018, due to the impact on the caps in the last month of the second quarter.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Daqo had revised its wafer sales volume guidance to approximately 9.5 million to 10.0 million pieces, down from previous guidance of 15.0 million to 20.0 million pieces. In releasing second quarter financial results, wafer sales volume was reported to be 9.8 million pieces, near the high-end of revised guidance.

However, Daqo guided third quarter 2018 multicrystalline wafers sales volume to only reach between 7 million pieces to 8 million pieces, a 70% decline, year-on-year.