Pressures on PV plant performance have led the solar industry to be more demanding and forensic of the data operational projects generate, as well as the power. Jules Scully explores the growing role software is playing in the utility-scale solar arena and how it must evolve further still to meet expectations.

Data spanning areas such as equipment performance, system monitoring and price forecasts have presented an opportunity for software providers to help solar asset owners maximise output from operational PV plants and optimise revenue streams.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

PV project data can be collected from a supervisory control and data acquisition system (SCADA) and grouped into asset management platforms to improve operators’ understanding of plant performance.

But while data offers invaluable inputs to the design and operation of solar assets, a recent report from DNV revealed that “an incredible volume of data remains largely under-utilised”, specifically the detailed performance and operation of plants and components. Insights into the performance of modules, inverters and trackers often remain buried under the uncertainties of weather, system availability, module soiling, shading, clipping and curtailment losses present in operating systems, the quality assurance consultancy said.

One software provider that aims to distil and interpret operating PV plant data to improve performance is Clear Sky Analytics, a US-based company that has offered insight for more than 150 solar projects since its inception in 2017. Acquired by testing, inspection and certification firm UL in May of this year, Clear Sky offers software that integrates data quality management, performance modelling and analysis algorithms.

The automation of codified PV subject matter expertise and data curation methods allowed for the development of algorithms designed to attribute observed losses to specific categories, says Ajay Saproo, global lead, solar asset advisory at UL, and founder of Clear Sky Analytics. The resulting accounting of lost and generated energy is said to enable actionable analytics to assess and optimise solar plant performance.

Saproo says a wealth of operational data on available solar resource, weather, energy generation and operating parameters from inverters and other components is being collected from a rapidly growing installed base of operating solar plants, with software evolving in response.

“With subsidy-free business models and overall improvement in capital efficiencies with new technologies, there is a greater focus on improving return on deployed capital. This drives demand for software that allows the PV power generation industry to optimise technical and business operations,” he adds.

The acquisition of Clear Sky came two months after UL launched software called HOMER Front & UL Analysis with the intent of helping project developers evaluate the profitability of utility-scale solar, wind and storage systems, and follows a recent trend of consolidation in the solar software space.

A consolidating market

California-headquartered Power Factors has grown to support 110GW of renewables assets following its purchase of Europe-based software providers Greenbyte and 3megawatt. Bringing together Power Factors’ presence in the US and knowledge of solar with Greenbyte’s strength in Europe’s wind market means that investors who have assets in multiple regions can benefit from the combined companies’ experience in both regions, according to 3megawatt CEO Edmée Kelsey.

“We see increasingly that investors invest in multi-technology portfolios, so they not only do solar, but they may do solar, wind and hydro. So they will need the software that will be able to support all these different renewable energy resources,” she says.

While Power Factors and Greenbyte are focused on the asset performance monitoring space, 3megawatt is said to be stronger in commercial asset management, in areas such as invoicing, reporting, and contract and complaints management. Alongside automating repetitive tasks such as invoicing, 3megawatt’s BluePoint software centralises power plant information, creating workflows for day-to-day activities.

Questioned on the challenges of providing solar software solutions, Kelsey says hurdles can arise when engineering, procurement and construction (EPC) contractors use obscure or cheap equipment, potentially leading to higher running costs for asset owners that may need to fund the installation of improved telecoms equipment, for example, in the future.

“Luckily, I think for the industry, there are now more experienced operators who will know what questions to ask when they buy assets, and they know what they’re getting themselves into. But there are plenty of people still out there that will just say, well, I’ll take the cheapest, and then they get problems down the road,” she adds.

Consolidation in the solar software sector in 2021

This year has seen an uptick in merger and acquisition activity in the solar software space as companies combine to bolster their offering and access new markers. Here are some of the M&A highlights of 2021 so far.

January: Enphase Energy snaps up Sofdesk

In a deal that Enphase said would “supercharge” its digital transformation efforts, the microinverter supplier bought Montreal-based Sofdesk, the developer behind Solargraf, a platform that enables solar installers to design PV systems and produce quotes for customers. The transaction also included Sofdesk’s Roofgraf tool, which is used by roofing contractors to generate proposals.

February: BayWa r.e. buys Kaiserwetter platforms

Complementing its 2019 acquisition of Canadian software house PowerHub, BayWa r.e. purchased two platforms from German firm Kaiserwetter. The ARISTOTELES software included in the deal is designed to maximise the performance of renewables portfolios, while the IRIS tool provides insights for areas such as due diligence.

April/May: Power Factors acquires Greenbyte, 3megawatt

US-based Power Factors secured two European deals in as many months, buying asset management platform Greenbyte as well as 3megawatt.

May: UL purchases Clear Sky Analytics

Having launched software for renewables hybrid projects in March, certification firm UL went on to acquire Clear Sky Analytics to boost its capabilities in assessing and optimising solar plant performance.

August: Aurora Solar acquires Folsom Labs

Building on a US$250 million funding round earlier in the year, solar sales and design software provider Aurora Solar bought Folsom Labs, the developer of HelioScope, a software solution for designing commercial PV systems.

Data on the rise

The falling cost of internet of things sensors and communications networks has helped expand the use of advanced analytics such as asset performance management and also the use of in-field digital tools such as augmented reality, according to BloombergNEF (BNEF). The research organisation last year predicted that the global power sector would spend US$3.2 billion on software in 2020 to optimise the performance, costs and revenues of generation and grid assets.

BNEF projected that utility-scale solar and battery plants will be the fastest growing sectors for software adoption, considering the large amount of capacity to be built over the coming years.

This forecasted increase in software investment follows recent technological advancements allowing data to be communicated to solar project owners. “I think the difference between now and say five or ten years ago is the amount of data that is bubbling up through the ranks,” says Liam Smith, a director at sustainable infrastructure investor Actis.

While investors might have historically been limited to analysing plant output, the availability of data at cloud level means they can now explore the performance ratios of plants adjusted for heat and climate as well as key performance indicators (KPIs) such as inverter level availabilities, soiling losses, irradiance and temperature.

“I don’t think it’s more data, it’s just data that’s now finally being communicated,” Smith says. “Previously, it was all just being lost in a data lake never to be reviewed again; now, it’s actually being accessed.”

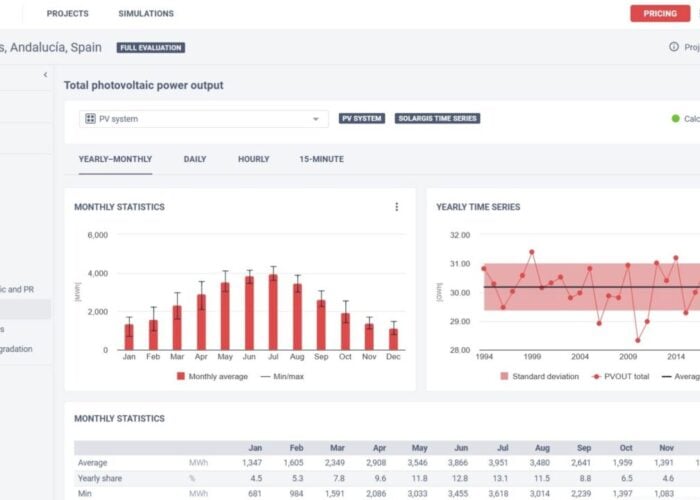

With this increase in available data, Smith says there are now three pillars of different software that help solar asset owners optimise project performance, the first of which is an off-the-shelf platform such as PVsyst. The second category relates to what Smith describes as more bespoke asset monitoring software, such as WinJi or Bazefield, that enable the first round of synthesising the data into something that is understandable and actionable. The final pillar consists of bespoke machine learning algorithms that allow asset owners to be proactive rather than reactive and is centred on areas such as improving availabilities and minimising grid penalties for unpredictability.

In a rapidly changing technological environment, Smith says some software providers have been able to keep up with the “incredibly quick turnaround time” between when bifacial modules were in the lab to when they were commercialised. Actis consequently monitored bifacial performance at lab scale and then used bespoke algorithms and machine learning approaches to develop its own bankable predictive modelling.

Other solar asset owners and managers contacted by PV Tech Power that have created their own software or platforms include German independent power producer Enerparc and WiseEnergy, which is part of the NextEnergy Capital Group and has managed more than 1,500 PV projects globally.

“There are a lot of different solar software products for different purposes, some just for monitoring, others just for performance analysis, others that include financial figures related to the PPAs,” says Jose Francisco Correia Pascoal, WiseEnergy head of technical operations. Despite recognising that software providers are quick to adapt to changes in the solar market, Pascoal says WiseEnergy couldn’t find one platform to meet all the company’s requirements.

The company has consequently developed its own asset management platform that allows it to both improve the efficiency of its teams and improve the performance of assets by increasing availability and reducing underperformances.

‘There’s no magic software’

Nearly all PV systems have monitoring capabilities enabled by SCADA systems, while asset management platforms provide a constant stream of data from sensors and inverters on site. Advanced analytics can replace Excel-based models and automate them in software to bring efficiency and additional resolution on the performance and losses of PV plants, allowing asset managers to evaluate specific losses at each site.

With a wealth of information available, asset owners face challenges when consolidating data from different SCADA providers used within a portfolio of projects. While new projects are well prepared in terms of SCADA connection, hurdles can arise when accessing data from older installations.

In a move to organise and collect SCADA data, renewables asset manager Quintas Energy set up a project called Parklife that involves creating a digital replication (digital twins) of all components within a solar project.

As part of a one-off process for each site, the company carries an onboarding phase involving the registration and mapping of all components to the economic and SCADA variables before the standardised data is included in a database, allowing the firm to benefit from a KPIs calculation layer. It uses Power BI, a business intelligence and data visualisation tool from Microsoft.

“It’s not really software that we use to create these visualisations or to visualise data and calculate KPIs. The most relevant thing is how data is being ordered, how data is being governed from the very beginning from the collection side through these digital twins,” says Antonio Dominguez, head of analytics at Quintas Energy.

Quintas has come under increasing pressure in recent years from clients looking to collect more data from assets and get the most from existing data, and the firm acts as a hub to provide information for offtakers, operators, technical advisors and clients. “So we need to be very open in that sense,” Dominguez says. “And we also need that all these stakeholders become more open.”

The need for additional data sharing has also been noted by Enerparc, which is required to provide more live data to the grid operator, while power purchase agreement offtakers are demanding more information related to areas such as CO2 certificates from the asset owner.

“The most common answer that we get is that the raw data quality is not sufficient for the software to do what it is supposed to do.”

Robin Hirschl

For the sector to further improve plant performance, affordable instruments to get the right input data need to be provided, according to Robin Hirschl, CTO at Danish solar investment and management company Obton.

The firm, which has solar PV systems under management across Europe with a combined capacity of more than 1GWp, is currently carrying out a programme to evaluate software solutions. “The most common answer that we get is that the raw data quality is not sufficient for the software to do what it is supposed to do. And if we get any results, they are telling us what we know anyway,” says Hirschl.

As software providers or asset owners themselves work to develop tools to assist in the operation of ever-expanding solar project portfolios, yields can be increased and profits maximised. And as more renewables connect to the grid, software can also be expected to play a growing role in areas such as load balancing.

While there is software spanning the solar sector, from site design, accounting, predictive maintenance, site monitoring, Dominguez says “there is no magic software to manage everything”. Therefore, the industry needs to make the most of existing software and business intelligence tools to ensure that everything is well governed. Dominguez says: “We can collect all data in the world, but it will never be helpful if we are not able to govern it and transform it into relevant information.”

PV design software adapting for new variables

Whether used to automate time-consuming tasks or to assess site feasibility by estimating capex, software can be invaluable for developers and EPCs looking to simplify the solar project design process.

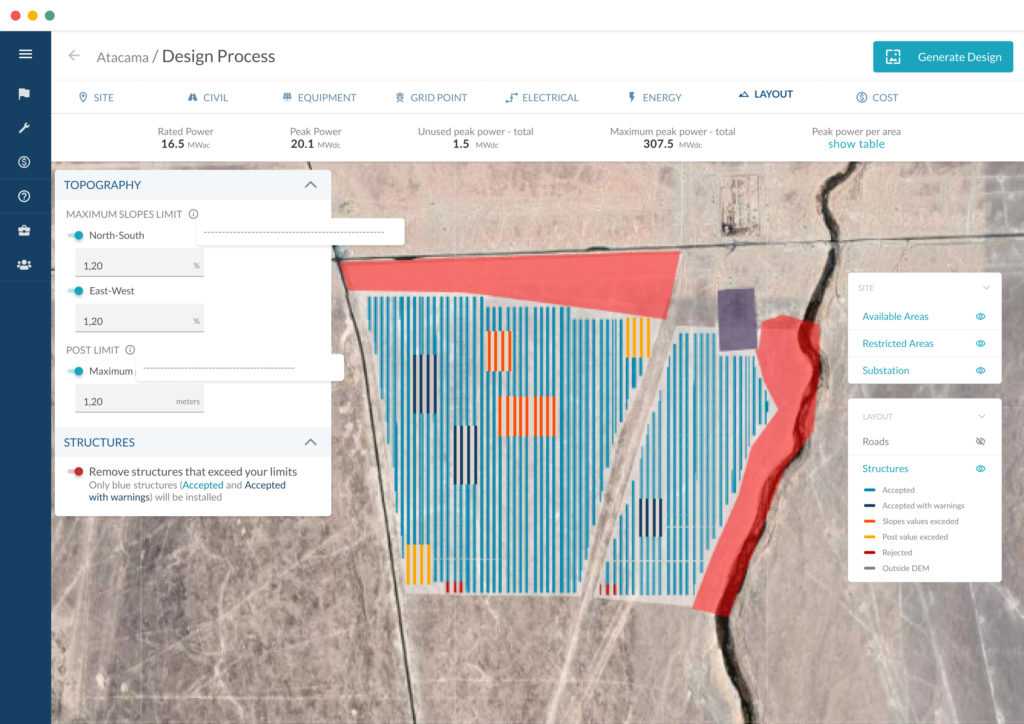

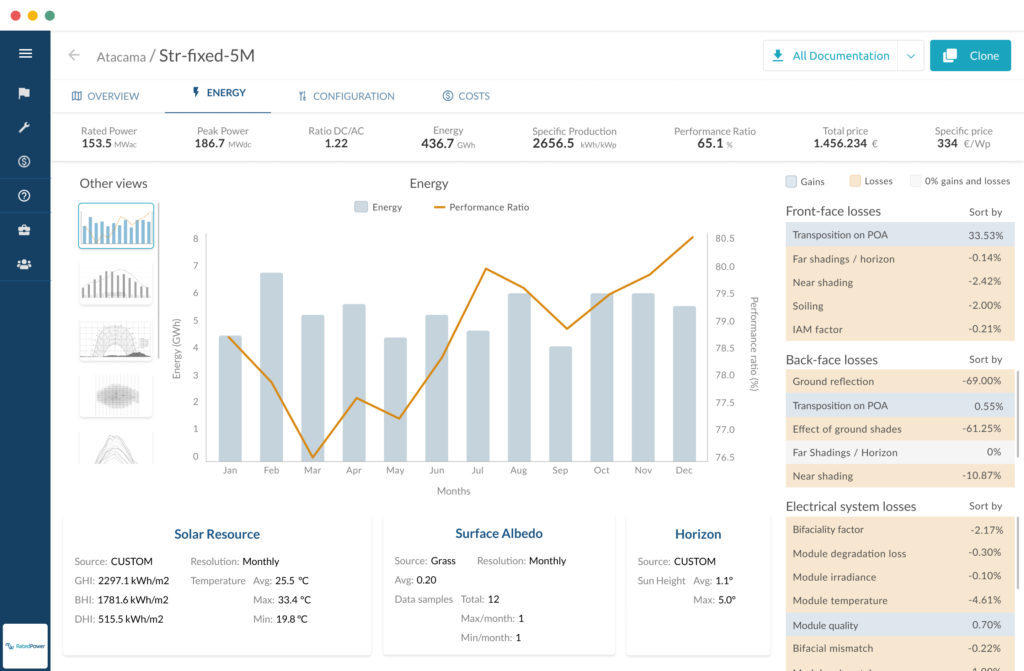

As well as helping designers make development decisions, software allows them to accurately assess energy yield and improve site performance with shading and civil analysis tools. But advancements in solar technology, such as the introduction of trackers and bifacial modules, have presented hurdles for software providers required to continuously update their offering to incorporate the latest industry trends.

“This is not simple,” says Mario Bennekers, product manager at RatedPower, which created its pvDesign software to automate and optimise the design and engineering of solar plants. “For example, to develop the bifacial calculation we had to completely adapt our energy model, as well as our modules and structure database,” he says.

In a recent analysis of project simulations carried out with its software in 2020, RatedPower observed a rise in mock-ups using bifacial modules as the year went on. While 56% of simulations in the US featured bifacial modules last year, just 6.5% in the UK and 3% in Germany included the technology.

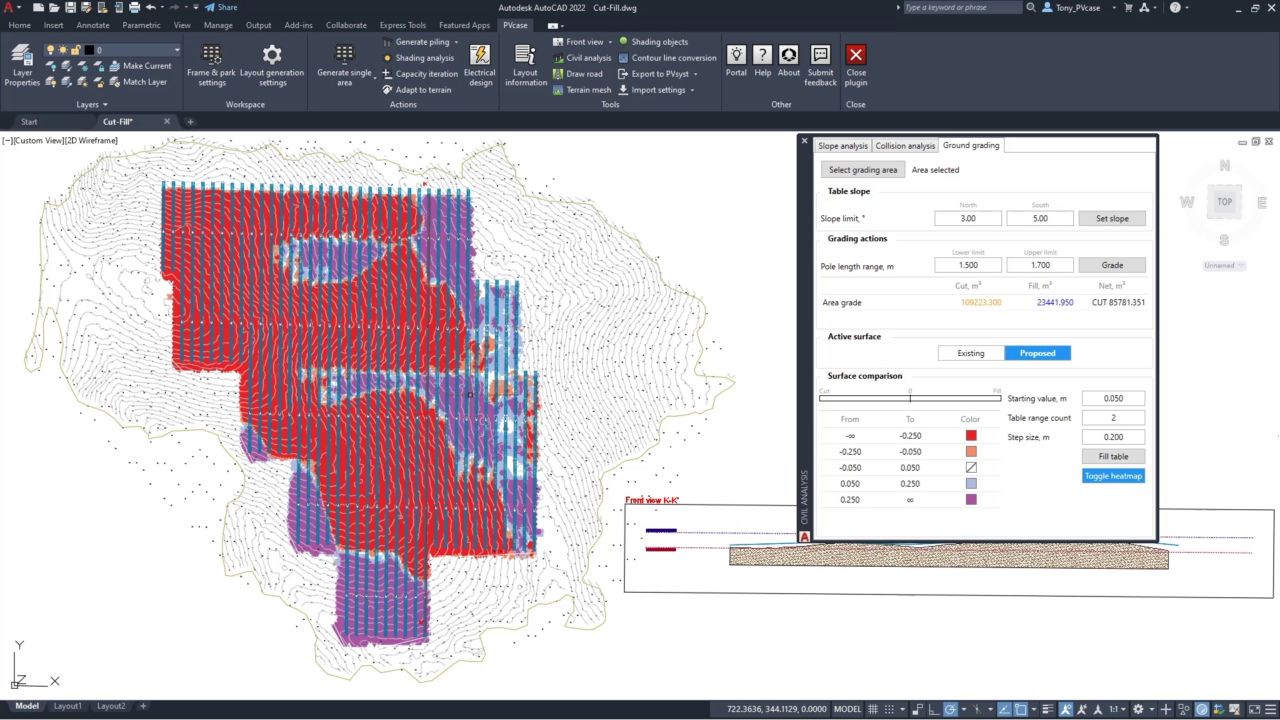

Introducing new products, keeping older products up to date as well as catering to a user base from different parts of the world are among the challenges that PVcase, another solar design software provider, has been faced with.

CEO and founder David Trainavicius says users of the company’s software are increasingly working with larger installations and need more help dealing with areas such as mechanical piling and the civil parts of their designs.

“During the first years of software development, our clients were mainly looking for a time-saving tool without caring too much about terrain-based PV,” he says. “Now, with PV-suitable flat land becoming harder to find in many regions, clients are looking for terrain-based layouts and civil analysis solutions.”

According to Trainavicius, the software provider has seen a “massive shift towards overall digitisation of solar engineering processes”, with solar companies looking for more convenient ways to approach feasibility studies, design, construction, and operations and maintenance.