Solar Media head of research Finlay Colville noted that a greater emphasis on domestic manufacturing “changes the whole supply chain,” on the first day of the UK Solar Summit, held today in London.

He began by outlining broad market trends that have shaped the current solar landscape. Chief among them is the “manufacturing downturn” unfolding in 2024 due to drastically low component and module prices, which Colville predicted last year. In a downturn – “driven by a lack of profitability in manufacturing” – manufacturers still need to supply the market, and so their priority becomes “cost, cost, cost,” he said.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Solar module costs are split between silicon and non-silicon across the supply chain. Colville says that the issue that caused the downturn was that in 2022-23, the industry expected non-silicon costs, those stemming from the ingot to module in the supply chain, to drop. They didn’t, and silicon costs from overwhelmingly Chinese polysilicon production had almost bottomed out already. This put huge pressure on the profit margins of module manufacturers and drove them to lower module prices however they could.

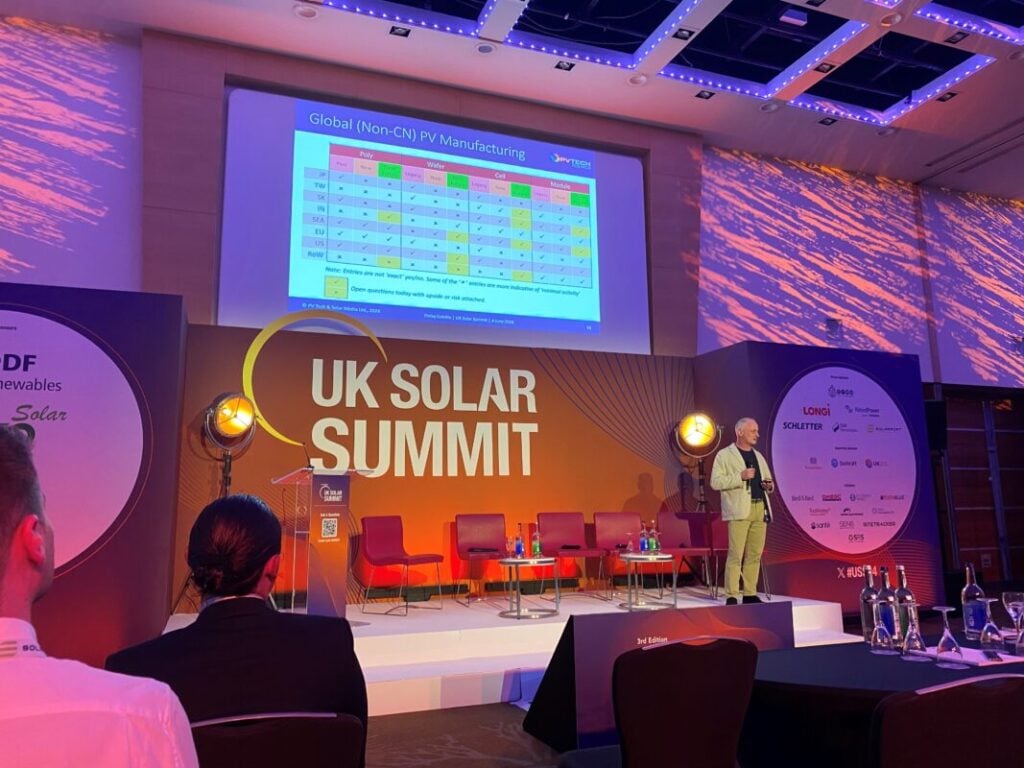

The second major factor is the emergence of trade disputes around the solar industry, particularly in the US and India, against China. The US’ imposition of a number of trade tariffs on Chinese PV imports, most recently the emerging antidumping and countervailing duty (AD/CVD) tariffs, may limit imports of solar cells from Chinese-owned companies operating in Southeast Asia to the US.

In response, the US solar sector is looking to expand its own manufacturing capacity, with the Solar Energy Manufacturers for America (SEMA) Coalition calling for a “strengthening” of an onshore supply chain earlier this year.

“How do you nurture domestic manufacturing?” asked Colville. “Either you just finance the whole sector, or you have to put barriers in to stop any product coming into the country at any cost. The US is choosing the second option … but it’s much more strategic in India.”

“Apart from products going into the US and India, everywhere else will buy products from China. The only other thing that’s driving traceability is corporate purchasing, where every company has an environmental, social and governance (ESG) department … and sets buying conditions.

“But they are nowhere near as detailed, as rigid, as comprehensive as what you get in countries where there are trade policies in place. It’s very superficial, it’s largely a box-ticking exercise.”

You can read the full coverage of the UK Solar Summit, including the full version of this story, on our sister site, Solar Power Portal.