Community solar in the US is projected to grow substantially over the next decade and represents a means of expanding access to underserved communities who are being left out of the energy transition. Sean Rai-Roche explores the drivers of community solar and what obstacles need to be overcome to support its rollout.

In the race to deploy terawatts of solar power capacity across the US as a means to achieve the country’s clean energy targets, an often neglected area of deployment is community solar. There is at present around 4GW of community solar deployed in the country but the potential market size is more than ten times that when accounting for the various project pipelines that currently exist. And the speed of deployment is increasing.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Last year saw 1,154MW of community solar deployed in the US, up 29% year-on-year. And experts have commentated on a ‘paradigm shift’ when it comes to how the technology is viewed, with simpler, streamlined business models emerging and increasing financier appetite coupled with greater consumer appreciation driving the sector forward.

This paradigm shift has seen thinking move away from the idea that utility-scale solar parks are the fastest and most cost-effective form of PV deployment and towards a greater focus on new business models that join utility-scale and local solar with storage to maximise customer savings. According to organisation Local Solar For All (LSFA), under the US’ current power targets, leveraging expanded local solar and storage can save the US US$473 billion by 2050 and shatter traditional business models dominated by utilities.

“Without better models, our traditional utility models will add hundreds of billions of dollars in unnecessary cost while leaving millions of jobs and billions of dollars of local economic development on the table,” LSFA said.

PV Tech spoke with experts, developers, trade bodies and more to discuss the potential evolution of the community solar industry in the US, what the newly passed Inflation Reduction Act (IRA) means for future deployment and access and what barriers need to be overcome to unleash its potential.

An overview of community solar in the US

What is community solar?

The US Department of Energy (DOE) defines community solar as any PV project or purchasing programme “in which the benefits of a solar project flow to multiple customers such as individuals, businesses, non-profits and other groups. In most cases, customers are benefitting from energy generated by solar panels at an off-site array.”

Under the system, customers can either buy or lease a portion of the plant – the systems are not residential rooftop arrays – and usually receive an electric bill credit for power generated by their share of the community solar system.

Most community solar subscribers will receive two bills—one from the community solar programme and the other from the local utility for the traditional power they’ve used, although some states are looking to simplify the process and combine the bills.

“Community solar can be a great option for people who are unable to install solar panels on their roofs because they don’t own their homes, have insufficient solar resources or roof conditions to support a rooftop PV system,” the DOE says. And this is also a key point – community solar is not rooftop solar, usually reserved for the wealthy who can afford it, but is a form of community organisation focused on clean energy supply.

How much community solar does the US have and need?

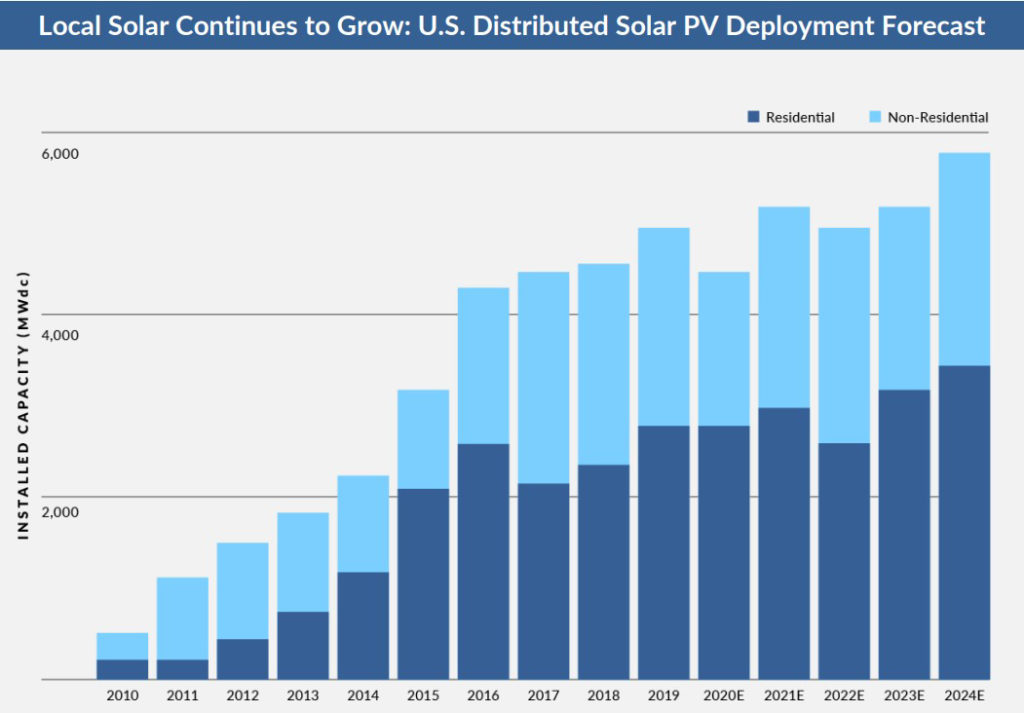

According to data compiled by the Solar Energy Industries Association (SEIA) and research firm Wood Mackenzie (WoodMac), there was more than 4GW of distributed solar in the US in 2020. Of this, however, the majority was residential solar. The only year where deployment of non-residential solar surpassed residential solar was in 2017.

Nonetheless, both types are growing fast and the above organisations estimate that more than 4GW of distributed PV – both residential and non-residential – will be installed per year through to 2024, with residential solar doing most of the heavy lifting. A recent WoodMac report into community solar forecast growth of at least 7GW in the next five years.

LSFA said in the US the “cleanest, lowest cost grid” requires 223GW more local solar by 2050 and would be essential in unlocking the full potential of renewable assets as well as diversifying the US’ grid infrastructure and power system.

Inflation Reduction Act a boon for community solar

The IRA that was passed by the US Congress and signed into law by President Joe Biden in mid-August will be a major boon for the community solar sector, analysts and experts told PV Tech.

The IRA extends the solar investment tax credit (ITC) for another ten years at a rate of 30% which would “help accelerate community solar deployment”, according to SEIA, through lowering capital costs of projects. Energy law firm Lowndes notes how the IRA “expands the ITC to solar facilities located in low-income or Native American communities”.

Moreover, the IRA gives an advanced manufacturing production credit to promote the domestic production of PV cells and modules, which could help address module shortages and supply-side constraints in the US solar market.

SEIA notes how community solar “installations were down an incredible 59% from Q4 2021 to Q1 2022,” which it said reflected “challenges with interconnection, price increases and supply chain constraints”. Addressing these supply-side constraints through the greater buildout of a US solar supply chain will support the roll-out of community solar in the US.

Jeff Cramer, president and CEO of the Coalition for Community Solar Access (CCSA) said the passing of the IRA would “unleash billions of dollars in private capital to build clean energy infrastructure across the country and lower energy bills for millions of Americans – especially those most in need.”

“The bill provides unprecedented long-term certainty for the market and incentives for states to deploy more community solar and storage projects. We will look back on this bill as the fuel that accelerated the country’s shift to clean, resilient power.”

Cramer said the legislation “doubles down” on the vital role that community solar will play in US energy security through some of its provisions. Crucially, the solar ITC extension includes provisions such as low- to moderate-income (LMI) bonus credits and the inclusion of interconnection costs, and US$7 billion in incentives for states to create or expand distributed solar programmes.

“Ultimately, the act will help to lower costs and increase customer bill savings. It will lower costs because the tax credit now includes interconnection costs, and it will increase customer bill savings by offering a bonus tax credit to provide access to LMI customers,” Cramer said.

And this leads onto another key facet of community solar – its expansion of access to underserved communities who are locked out of more dominant means of acquiring clean energy.

Expanding access to clean energy for all

If you are a renter or live in social housing, investing in solar PV is probably quite far down your wish list, especially given the upfront capital costs. But community solar is a vehicle to change this.

“In the US, the vast majority of American electricity customers don’t have access to solar directly on their properties or on their roofs. And so community solar serves as an opportunity to directly access the benefits local solar without the need of having it on your roof,” Cramer explains.

Those households that can install residential solar systems are typically middle-class residents who own their own homes. And there is little recourse for people in marginalised, poorer communities to access clean energy and reduce their carbon footprints. But things are changing.

In July, the DOE, in collaboration with the Department of Health and Human Services (HHS), launched the Community Solar Subscription Platform to connect families with solar energy and lower electricity bills through the Low-Income Home Energy Assistance Program (LIHEAP) and other low-income assistance programmes.

“Community solar, which allows multiple customers to benefit from a shared solar energy system, provides a solution for individuals who cannot get rooftop solar panels,” the DOE said, adding that its target was to power 5 million homes and provide 20% savings on a subscriber’s energy bills, up from 10% on average today.

“Every American community, especially those that face disproportionately higher energy burdens, deserves the economic and health benefits that come with increased access to affordable clean energy,” US Secretary of Energy Jennifer Granholm said at the time of the launch.

“This is why DOE is working across the federal government to open up community solar that will rapidly lower electricity bills for households that need it most.”

A patchwork system of access

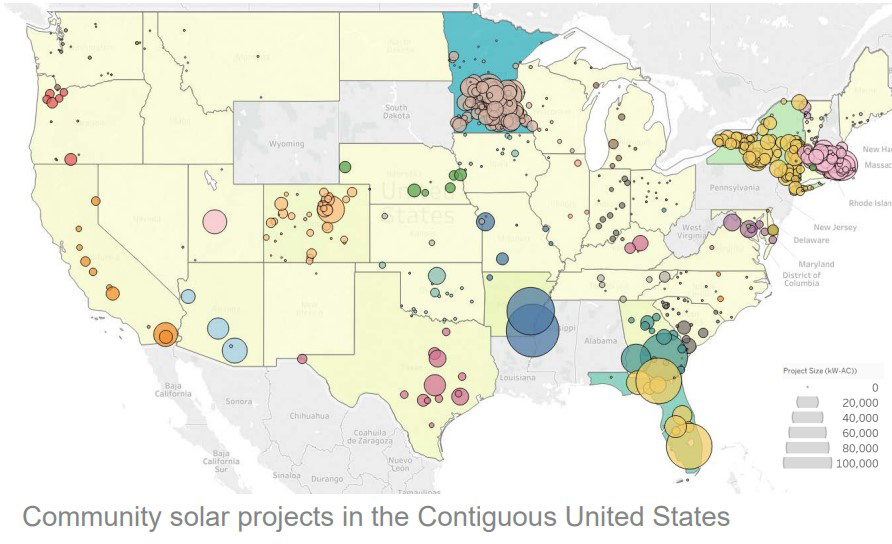

WoodMac is predicting at least 7GW of US community solar is expected to come online in the next five years. But this deployment is not spread evenly across the US, with states like New York far outstripping others where access is poor.

“New York accounted for nearly half of all community solar installations in 2021 due to its proactive work in establishing and expanding incentive frameworks like the NY-SUN Megawatt Block programme,” explains Will Giese, Southeast regional director at SEIA.

New York singlehandedly has more than 1GW of community solar, its governor, Kathy Hochul, announced in May this year.

According to the DOE, around a third of US states have “enabling policies” for community solar, meaning they have “passed legislation that created a third-party market for community solar requiring project developers and utilities to follow certain regulations in order to enrol customers and develop community solar installations.”

This patchwork system is, says Cramer, a result of state inertia. States have regulatory authority over their distribution systems and state legislatures pass a bill that creates a community solar programme that allows for third-party community solar developers to plug systems into the grid to enable customers to benefit. But for a variety of reasons, legislators don’t always act, he says, and there is still a huge amount of red tape in many US states that prevents greater community solar deployment.

This lack of maturity in community solar markets in many states does have its upsides, however. “This market sector is mostly underdeveloped, or in some states completely untapped, whereas residential, commercial, or utility-scale markets might be more developed,” says Giese. “Therefore, financers of solar projects may be more willing to finance projects in a new market segment, such as community solar, than in other more saturated markets.”

Interconnection problems

Long interconnection queues have been a thorn in the side of the utility-scale solar industry for years. And community solar is no different, with experts identifying interconnection problems as a major barrier to overcome to achieve greater deployment.

In April, a Lawrence Berkeley National Laboratory (LBNL) analysis showed there was almost 1TW of renewable energy capacity – of which 700GW was solar – and an estimated 427GW of storage active in US interconnection queues at the end of 2021, with wait times growing year-on-year and solar PV experiencing particularly long queues.

In a recent whitepaper outlining the reforms it believes are needed in the US interconnection system, SEIA said “outdated interconnection policies pose a major threat to solar and storage deployment” across the US and that policies “have not kept pace” with the demands of a new energy market that has seen interconnection applications for solar and storage “skyrocket”.

“Interconnection continues to be a significant challenge for community solar growth,” says Giese. “Grid upgrades are often necessary to connect these projects to the grid, and in many states, the study process can result in delays or upgrade costs that make projects uneconomic.”

Under the recently passed IRA, interconnection costs for projects under 5MW – which covers most community solar projects – will be subject to the ITC and Cramer said this would help boost community solar deployment and get more projects connected.

However, the US’ interconnection problems won’t go away anytime soon despite the work of the DOE, the Federal Energy Regulatory Commission and the i2X initiative, launched by the DOE earlier this year to ease grid connection issues. Interconnection problems remain a significant hurdle to overcome to enable greater solar deployment, and in particular community solar.

A key piece of the puzzle

Although utility-scale solar is the engine room of the US’ transition to a decarbonised society, community solar should play a critical and supportive role in helping to drive that change. Appetite for the resource is growing as more people tune in to the benefits of solar and the IRA should turbocharge growth in the sector moving forward. Meanwhile, government programmes such as the i2X initiative should start to address the US’ interconnection problems and enable greater connection to the country’s grid system.

But current access to community solar is uneven and more needs to be done by federal and state authorities to ensure those wanting to increase their community’s energy security are able to do so. Community solar not only represents an effective form of distributed generation that can support the US’ wider energy transition, but it is also an egalitarian form of infrastructure that can connect poor and marginalised communities with solar PV.

There is often a lot of lip service paid to the idea of a ‘just transition’ but it is unfortunately not always backed up by spending on concrete policies. Community solar embodies the idea of a just transition and can help get swathes of the US population get on board with a project that they might feel they have a role in. The opportunity is there, but it requires the will to seize it.