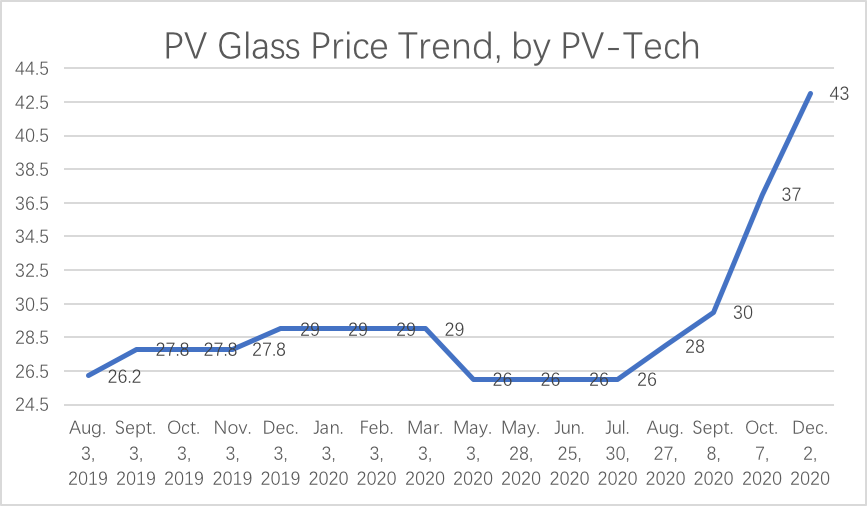

Quotes for PV glass have soared this month, reaching a price of RMB43/㎡ according to prices compiled by PV InfoLink, with some small-scale suppliers even quoted prices of RMB50/㎡.

The table below shows the price movement of mainstream PV glass since last August.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Historic data indicates that while PV glass prices in China remained within the range of RMB20-3/㎡ between 2013 and 2019, it has soared in the second half of this year saw a total of 80% price rise, compared to that of July. Some small manufacturers even quote a price as high as RMB50/㎡, as supply cannot meet demand.

According to institutions like the China Photovoltaic Industry Association (CPIA), packaging accounts for nearly 50% of the total cost of modules, among which glass accounts for 19% of that packaging cost. A module manufacturer in China has done a calculation: a 166 uni-facial module requires 2.2 ㎡ of glass on average which, based on the current price, costs almost RMB100, equivalent to a cost of RMB0.2/W, effectively double the RMB0.1/W it cost in July.

In the long term, with solar installations increasing around the globe and the rising demand for thinner glass due to the permeability of double-glass modules, along with the development of thin-film solar glass industry driven by the popularisation of green buildings, the market demand for glass is likely to stay high.

Leading glass enterprises expand capacity to seize the momentum

China’s market share of solar glass has stayed above 90% for years on the global market. The top 5 glass producers – namely Xinyi Solar, Flat Group, Caihong Group, CNBM and CSG Holdings – shared 68.5% of the market in 2019.

Against the supply-demand tension, leading glass enterprises vied for earlier improvements in technology and capacity to further boost their respective market shares. CSG, for example, intends to invest RMB494 million (US$75 million) in a low-E glass production line that can manufacture 2.1 million square meters of insulating glass and 3.5 million square meters of coated glass per year. Flat plans to invest a total of RMB2.17 billion (US$330 million) in projects like its module cover glass phase 2 project with an annual capacity of 750,000 tons and a backsheet glass project with an annual capacity of 42 million square meters.

Capacity expansion plans

| Company | Current Capacity | Investment (billion RMB) | Capacity Planned |

|---|---|---|---|

| Xinyi Solar | Unknown | Unknown | One additional thousand-ton level production line planned for each season in 2021-2022 |

| CSG A | Five electronic glass production lines | 0.494 | 2.1 million square meters of insulating glass, 3.5 million square meters of coated glass per year |

| 3.15 | Four 1,200-ton solar glass production lines in light-weight, high transparency panel manufacturing base at its Anhui Solar Facillity, construction to be finished in 24 months | ||

| Flat | Solar glass 5,290 tons/day | 2.17 | Module cover glass phase 2 project with an annual capacity of 750,000 tons |

| Caihong New Energy | Unknown | 0.5 | 5 deep processing lines for ultra-thin, dual-film, big-size photoelectric glass |

| Unknown | Plans to build a solar glass kiln and supporting facility with pull volume 750 tons/day | ||

| Luoyang Glass | Unknown | 0.186 | Add a 32.4-million-square-meter backsheet glass deep processing production line |

| Almaden | Unknown | 0.877 | Construction of a smart deep processing line for big-size, high-power, ultra-thin solar glass, technological improvement,construction of a smart deep-processing line for BIPV anti-glare coated glass |

| Unknown | An annual capacity of 100 million square meters of special photoelectric glass to be achieved upon the completion of Fengyang Base Project | ||

| Kibing Glass | Unknown | 1.373 | 1,200t/d high-transparency backsheet material and deep processing in Shaoxing |

| 1.027 | 1,200t/d high-transparency module substrate material production line in Zixing | ||

| Topray Solar | Four glass lines, daily melt volume 900T/D | Unknown | Technological improvement for 2 240-ton solar glass production lines in Chencheng, which produce 18 million square meters of 1.8-2.5 mm glass annually |

Leading module companies “lock” orders in advance

Statistics show China now has over 11,000 solar glass-related enterprises registered, and the number is still growing. As of December 2019, China’s solar glass capacity stood at 25,360 t/d, with 6,900 t/d to be added in 2020.

However, as some overseas projects failed to meet capacity expectations due to the impact of COVID-19, and with China’s solar industry working flat out in Q4 2020, downstream enterprises are overwhelmed, especially by the spiralling glass price.

Flat recently revealed that it expects solar glass shortages of around 15% next year. ”With a completely open policy, the supply-demand balance will not be achieved earlier than 2022,” it said.

Against such uncertainties in the glass market, some leading module enterprises that have close collaboration with the glass sector advanced orders for what they look set to need in the future. This August, LONGi announced a long-term purchase agreement for RMB 6.5 billion of solar glass signed between a subsidiary of CSG and 12 subsidiaries of LONGi.

As early as March this year, Caihong New Energy signed a Strategic Cooperation Agreement with JA Solar, supplying JA with about RMB2.1 billion of products including glass.

And yesterday (18 November), Trina Solar confirmed a major purchase order with Almaden, procuring 85 million m2 of solar glass at a purchase price of RMB2.1 billion (US$320 million).

Larger entites are therefore signing alliances in order to cement their lead, while other module manufacturers are said to be “sighing with expectation” over the ongoing supply and pricing constraints.

At the beginning of November, six leading solar enterprises in China appealed to the state with a joint statement for fewer restraints on glass production expansion. In fact, China’s Ministry of Industry and Information Technology (MIIT) approved the displacement of existing capacity by new solar glass projects at the end of October. Conducive to the advancement and restructure of the industry, it helps the glass industry use excess capacity as well as avoiding disorganized expansion.

The industry has also welcomed some good news earlier this month. An MIIT official responded to the statement on 7 November, confirming that the Ministry is working on a revision of policies to properly ease the limit on capacity displacement conditions. PV Tech understands the authority is drafting a document on promoting a healthy and sustainable development of the solar glass industry. A policy different from that of traditional float glass is expected to release new capacity soon, ease the supply-demand tension, and thus prevent the price from increasing further.