After two difficult years of oversupply and dwindling profitability, China’s PV manufacturers will be entering 2026 hoping for a change of fortunes. However, the ongoing difficulties faced by Chinese manufacturer Eging PV highlight the challenges they face in getting back on the front foot amid a persistent overcapacity environment.

In late December, it emerged that Eging was facing the prospect of having to repay a large sum – RMB140 million (US$20 million) – awarded by a local authority in China’s Anhui province for a flagship wafer, cell and module plant due to its limited progress on the project.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

On 28 December 2025, Eging PV announced that the company, together with its subsidiaries Changzhou Eging PV and Chuzhou Eging PV, had received a hearing notice from the Management Committee of Quanjiao County Economic and Technological Development Zone on the same day.

The Management Committee of Quanjiao County Economic and Technological Development Zone alleged that Eging PV had failed to fully perform the previously signed agreements, leading to project delays and the failure to fulfil the terms of the agreements. It said it intended to terminate the investment agreement and supplementary agreement, recover the RMB140 million invested funds, terminate its obligation to make additional investments and hold the company liable for breach of contract, including the repayment of construction costs, rent and capital occupation expenses.

The origins of the dispute trace back to 2022. Eging PV originally planned to invest in a 10GW PV wafer, 10GW PV cell and 10GW PV module project in Quanjiao County, Chuzhou City, Anhui Province. Its holding subsidiary, Changzhou Eging PV, jointly established the project company, Chuzhou Eging PV, with JiaChen Fund, an investment vehicle of Quanjiao County. The project company has a registered capital of RMB 1.5 billion. Changzhou Eging PV contributed RMB800 million, holding a 53.33% stake, while JiaChen Fund contributed RMB700 million, holding a 46.67% stake. To date, Changzhou Eging PV has contributed RMB160 million of the registered capital for Chuzhou Eging PV, while JiaChen Fund has contributed RMB140 million.

Eging PV’s Chuzhou project broke ground in November 2022 and began phased production in July 2023. As a result of cyclical structural overcapacity and weak market conditions in the PV industry over the past two years, coupled with a continuous decline in capacity utilisation rates, the project has only completed the first phase of the PV cell project, with a capacity of 7.5GW. The remaining cell capacity, as well as the second and third phases of the wafer and module projects, remain unbuilt.

This means the industrial base, originally planned to be built in three phases, has not only failed to reach full production as scheduled but has not even been completed, leaving the 10GW module project half-finished.

According to available information, Eging PV was founded in 2003 and is among China’s first batch of long-standing PV companies. The company’s core business is the R&D, production and sale of high-efficiency c-Si solar cells and modules. It has also expanded its operations into the PV power plant sector. It went public via a backdoor listing in 2011 and was once known as the “first PV module stock” in China’s A-share market.

Continuous losses and the profitability dilemma

At present, effectively resolving disputes and relieving liquidity pressure is the primary task facing Eging PV.

However, buffeted by cyclical fluctuations in the PV industry and intensifying market competition, Eging PV has come under growing performance pressure in recent years. In 2024, the company recorded operating revenue of RMB3.478 billion, a year-on-year decrease of 57.07%; its net profit attributable to the parent company was negative RMB2.09 billion, and its net profit after deducting non-recurring items was negative RMB2.092 billion.

In the first three quarters of 2025, the company recorded total operating income of RMB1.556 billion, a year-on-year decrease of 42.58%; its net loss attributable to the parent company was RMB 214 million, compared with a loss of RMB572 million in the same period last year; its net loss after deducting non-recurring items was RMB212 million, compared with a loss of RMB 575 million in the same period last year.

Eging PV stated that the sustained losses were mainly due to the sharp year-on-year decline in both the module selling price and sales volume.

From an overall operational perspective, the suspension of the Chuzhou project and the potential liability issues have emerged at a time when Eging PV is already under sustained performance pressure. The proposed investment repayment is calculated at RMB140 million, which is equivalent to approximately 65% of the company’s net loss attributable to the parent company in the first three quarters of 2025. If the administrative decisions are ultimately implemented, together with potential expenditures such as construction costs, rent and capital occupation expenses, the company’s current profits and cash flow will be further strained, which may even lead to a larger loss.

In addition, on December 26, Eging PV disclosed details regarding its cumulative litigation and arbitration cases. There were 10 cases where the listed company and its consolidated subsidiaries acted as plaintiffs/applicants, involving a total amount of RMB26.3 million; and 13 cases where they acted as defendants/respondents, involving a total amount of RMB44.8 million.

On 7 January 2026, Eging PV issued its latest announcement, forecasting that the net profit attributable to the parent company for 2025 will be negative, and the loss amount is expected to exceed the previous year’s audited net assets. According to the preliminary projections of the finance division, the net assets as of the end of 2025 could be negative.

A larger problem at play

The question of whether such a long-established PV company can navigate the industry downturn and survive is one to watch closely as 2026 unfolds, hinting at the broader challenges facing China’s PV manufacturers.

“The last 24 months have been exceptionally tough for solar manufacturers and specifically Chinese manufacturers (which make up over 80% of the global manufacturing capacity). One can get into the intricacies of protectionist policies in the US or ESG requirements in the EU and so on, but the reality is that the real issue is oversupply,” said Moustafa Ramadan, PV Tech’s head of market research.

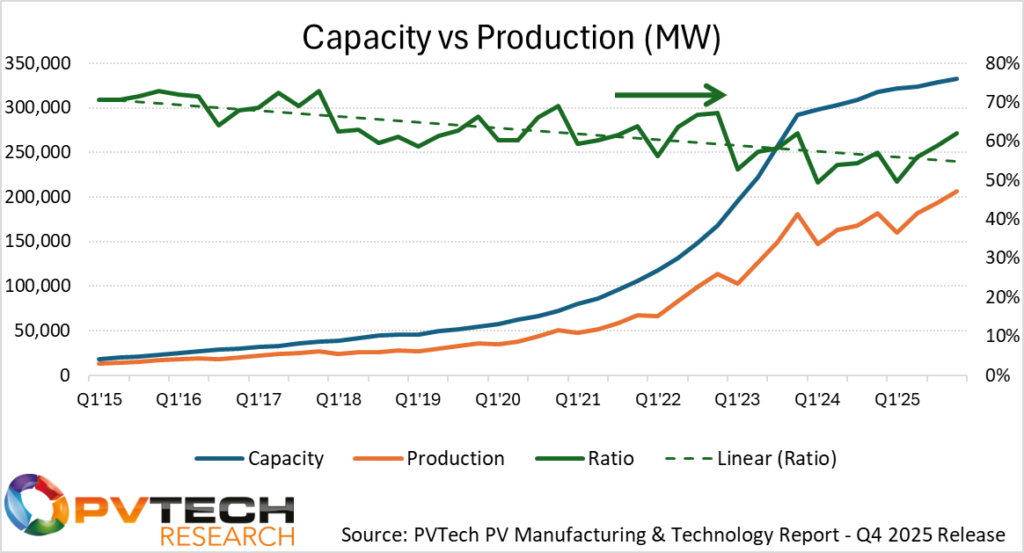

PV Tech’s analysis shows that the utilisation rate of PV capacity – the actual production divided by total production capacity – has been trending downwards since Q1 2015. It reached below 60% in 2024 and only started recovering slowly.

“This means that today, something between 35-40% of the solar capacity is just sitting idle. All this idle capacity is a cost burden on the manufacturers,” Ramadan said. “More importantly, in the current market, it can also be argued that the lower-quality part of the idle capacity is now a stranded asset that should be retired. However, as it stands, this overcapacity shifts the microeconomics for manufacturers to a loss-minimising dynamic, where every player is simply trying to sell at cost. It puts the entire global market into a negative oversupply loop.”

Despite efforts by Chinese authorities and individual companies to solve the problem, these will take time to materialise and highlight, again, why Eging has been struggling with its project, which was started in 2022, said Ramadan.

“Back then, solar was a completely different market, with healthier profit margins, and most players were trying to expand to capture the maximum market share,” he said. “Now, companies are looking to limit capacity expansion and focus on finding new markets for their existing pipelines.”

To learn more about the solar PV market or about managing your supply chain risk in these times, please reach out to our market research team here.