Europe has to find a balance between a rapid need to scale up PV manufacturing capacity and innovation to remain competitive, according to a report from The European Technology & Innovation Platforms for Photovoltaics (ETIP PV).

The white paper, PV Manufacturing in Europe: Ensuring resilience through industrial policy, which is an update of a previous paper written in May 2023, addresses some of the challenges policymakers face in terms of resilience for the domestic solar manufacturing industry.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

If for the short-term resilience of the industry scaling up and reaching cost competitiveness is the most pressing issue, investing in research and innovation (R&I) as well as high-quality products to reach market at scale is also important for the long-term resilience of the PV European market, according to ETIP PV.

The European Commission’s ambition to scale up domestic solar manufacturing capacity was shown in December 2022 when it launched the European Solar PV Industry Alliance (ESIA). At the time, the alliance aimed to reach an annual capacity of 30GW across the entire value chain by 2025.

This would also need to be accompanied by support for European solar equipment manufacturers, the report said, due to the lack of multi-GW scale integrated PV manufacturing in Europe, increased competition from Asian machine manufacturers and the technology options for R&D investment.

Risk is especially prevalent if selecting a technology with a low market penetration or investing in developing tools that will not generate turnover. Thus a de-risking factor and commitment from solar companies to invest in the future development of their products and services is necessary, said ETIP PV.

The main challenge for policymakers and stakeholders in the solar industry is how to effectively implement resilience requirements, while considering the impact of these measures on new domestic investments in Europe and the cost of new PV projects in the region.

With the cycle of PV technology having a short span, in five years or less a new technology could have been introduced and investments in the then-current one could be rendered obsolete or at least not be able to compete at the same level in terms of performance.

Moreover, the report highlights the current challenge in Europe, in terms of industrial policy, for the PV industry to keep abreast of emerging new technologies such as perovskite. “A coordinated effort will be required to convert the years of European leadership in perovskites innovation into industrial competitiveness in the coming years, building the foundation of sustained resilience for the European PV sector, as a whole,” the report said.

Cost of Ownership (CoO) difference with new technologies

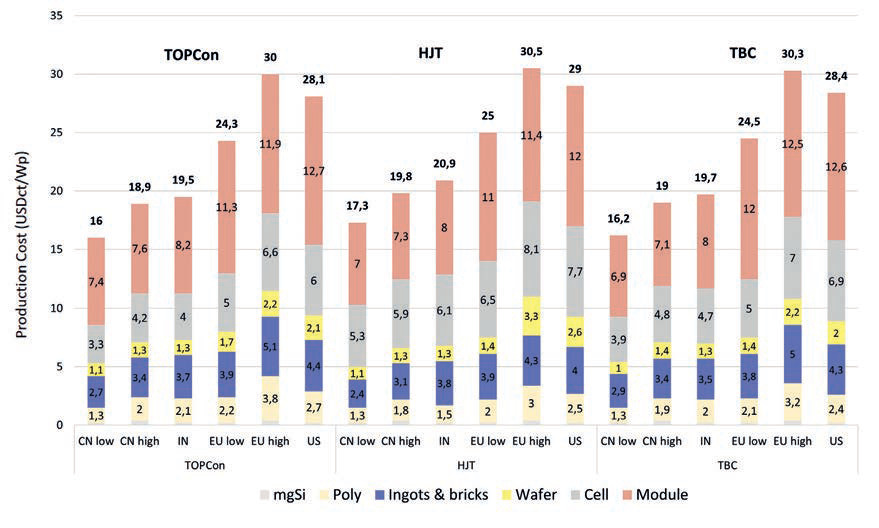

One key aspect in terms of cost of resilience is the suite of new technologies that have entered the market; TOPCon is emerging as the dominant force, with heterojunction (HJT) and interdigitated back contact (IBC) also gaining market share and replacing passivated emitter and rear cell (PERC).

The price difference between regions and technologies, mainly China versus Europe and the US, can vary in the range of US$0.10/Wp in terms of cost of ownership, as shown in the picture below. The cost variation in manufacturing is due to several factors, including material cost differences, labour costs and equipment and building depreciation costs between regions.

Another contributor in shaping the impact of resilience measures in Europe is the cost of capital and the capacity factor of the module, as they will have a significant impact on a PV project’s development costs. With the current high interest rates in Europe, this impacts even more a project’s developer and adds to the challenges of setting resilience.

“In a context of very high interest rates (e.g. 11%), a utility-scale product in a Northern European climate could be faced with projects whose LCOE is up to 25% higher for ‘resilience’ in the case of modules that are 15 cEUR/Wp more expensive to produce. This could have a significant impact on development rates.”

“Collapse of the global prices of PV modules driven by massive overproduction accelerated ongoing trends (e.g. the market shift away from PERC) and presented new major challenges for European manufacturers that are unable to compete with the low-priced modules arriving on the market. The collapse of prices throughout the PV value chain is a direct threat to many manufacturing EU PV companies, notably SMEs that constitute the core of the European industrial basis for PV,” reads the report.

India’s policies halted

The report takes India as a case study, which applied several policies – including the basic customs duty(BCD), Approved List of Models and Manufacturers (ALMM) and the production linked incentive – to build up its domestic solar manufacturing capacity. These attracted interest from domestic investors (major conglomerates and domestic PV manufacturers ramping up capacity) and foreign companies.

The idea of protecting domestic manufacturers through trade measures was ultimately put on hold, as it became clear that tariffs had a negative impact on solar deployment rates in various segments of the Indian economy. This was due to a lack of a sufficiently robust domestic industry to step in to fulfil the high demand. The ALMM scheme was therefore relaxed until 2025, notably emphasising the lack of high-power modules from the list of ALMM manufacturers to satisfy the needs of utility-scale projects in the Indian market.

This setback did not prevent Indian solar manufacturing from growing in 2023 and filling technical gaps in the domestic supply chain, according to the report. By the end of 2023, the Indian solar industry had an annual nameplate capacity of 37GW for modules and 6GW for solar cells, with the latter expected to grow to 25GW by 2025.

A similar story can be seen in the case of the Inflation Reduction Act in the US and the imbalance of capacity announced for modules and cells compared to higher upstream components (mainly polysilicon). The advisory board Clean Energy Associates (CEA) discussed this in a guest blog last month on PV Tech, which can be read here. “The IRA is not proving successful along the whole value chain,” said the ETIP PV.