Germany could install 500GW of new solar agrivoltaics (agriPV) capacity on its most “suitable” land, more than double the total installed capacity targeted to be in operation by 2030.

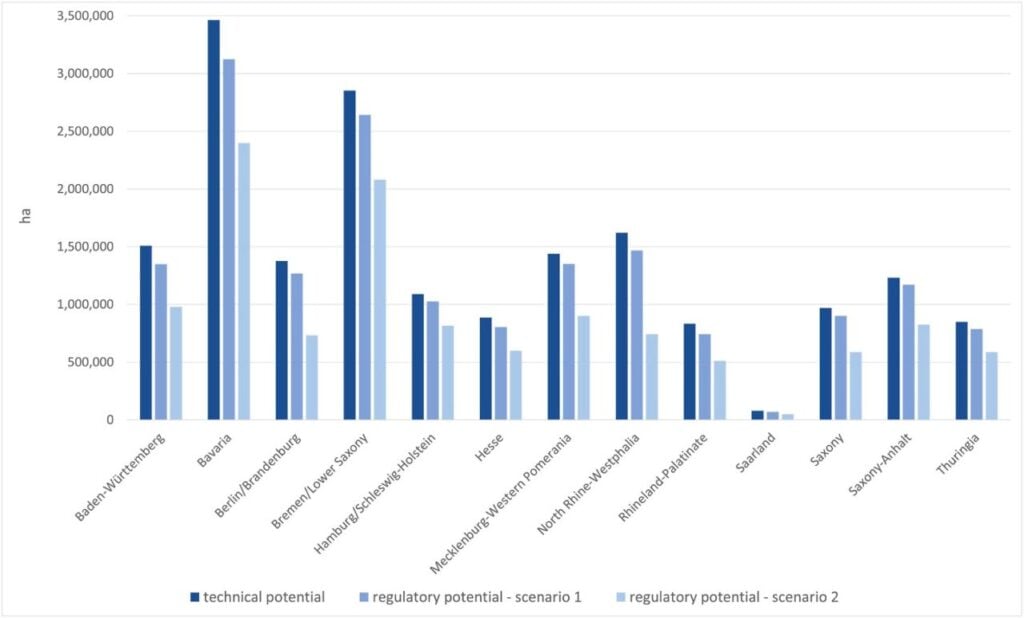

This is according to leading research organisation the Fraunhofer Institute for Solar Energy Systems (Fraunhofer ISE), which published a study on agriPV potential today. The research breaks down the agriPV potential across the German states by three metrics: technical potential, including the total agriPV capacity that the state could feasibly support.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

‘Scenario 1’ excludes protected areas such as nature reserves from the forecast; and ‘Scenario 2’ also excludes areas with less strict protection policies in place, such as flora and fauna conservation areas, giving each state three scenarios for its agriPV future.

Fraunhofer ISE founds that Bavaria and Bremen/Lower Saxony, comprising the former city and the latter state, had the most agriPV potential, with close to 3.5 million hectares and just under three million hectares of usable agriPV land in the technical potential scenario, which includes the least restrictions on new agriPV development.

Even in the most strict forecast scenario, Scenario 2, these regions have agriPV potential of close to 2.5 million hectares, and just over two million hectares, respectively, and are the only regions to break the two million hectare mark in this scenario. The full results can be seen in the graph below from Fraunhofer ISE.

The report finds that, if Germany installs all of the agriPV that it could under the Scenario 1 case, the agriPV sector would add a phenomenal 7,900GW of new solar capacity to the country’s energy mix; even in the more restrictive Scenario 2 case, agriPV alone would add 5,600GW of solar to Germany’s domestic electricity generation.

“These studies provide a solid data basis for political decision-makers and interest groups to promote the expansion of renewable energies and contribute to achieving climate goals,” said Anna Heimsath, head of the modules and power plants analysis department at Fraunhofer ISE.

These figures are particularly significant considering Germany’s solar installation targets. Last week, the German Bundesnetzagentur (Federal Network Agency) announced that cumulative solar capacity in operation in Germany had reached 107.5GW, half of the 215GW the government is mandated to have in operation by 2030 as part of its climate change targets.

While it is unlikely Germany will capitalise on all of its most appropriate agriPV land, the fact that just using the most suitable land would almost quintuple the country’s operational solar capacity is striking.

Grid questions remain a challenge

However, Fraunhofer researchers noted that challenges need to be overcome if Germany is to realise this potential.

“This is the first study in Germany to consider all types of agricultural land to identify suitable locations—permanent grassland, arable land, and permanent crops such as fruit, vineyards, or berries,” said Salome Hauger, author of the Fraunhofer ISE study. “An important finding of the study is the role of grid expansion: the lack of grid connection points is a limiting factor for many areas.”

Hauger’s comments well-documented criticisms of Europe’s grid infrastructure; earlier this year, José Andrés Visquert, global head of grid at renewables developer BayWa r.e., told PV Tech Premium simply that: “we need more grid”.

Germany, in particular, has also seen government support for new solar installations slow. In the results of last week’s innovation tender, the total capacity awarded tenders fell by almost 100MW compared to the previous tender, held in October 2024. This compares to bids submitted for over 2GW of capacity, suggesting there remains considerable interest in developing new renewable power projects in Germany.