The size of PV projects and increasingly complex market conditions in which they operate demand greater sophistication in plant performance modelling. Marcel Suri explores the datasets that will help improve the accuracy of PV output estimation and reduce the gap between projected and actual performance.

For two decades, solar energy project design and evaluation has centred around annual energy yield as the most important metric. Defined as the theoretical energy production of a PV plant under typical weather and system assumptions, energy yield is a concept that is largely focused on maximising the quantity of energy produced by a solar power plant per year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

However, as the solar sector evolves in response to real-time market demands, volatile pricing and increasingly complex grid requirements, this once-reliable metric is no longer sufficient on its own. A new paradigm is emerging – one that prioritises quality over theoretical maximum output, and focuses on the optimal performance of the PV power plant, the timely delivery of energy and long-term operational resilience.

PV performance becomes the new standard – encompassing not just how much energy a plant can produce, but when, how reliably and how profitably it can do so.

The limitations of energy yield as a standalone metric

While annual energy yield remains a technically meaningful parameter, its relevance in business modelling and real-world operations is limited. Historically, developers could assume that all energy generated would be sold at a predictable price, regardless of when it was delivered. Under those conditions, maximising total annual production was a logical goal. This is no longer the case.

In today’s competitive energy market, the value of electricity is highly volatile. Energy generated during periods of low demand or high offer may reach negligible prices – or may not be accepted at all. Worse, energy delivered outside of contractual delivery windows in power purchase agreements (PPAs) can lead to financial penalties. In short, a high theoretical yield does not guarantee commercial success.

Modern PPAs and grid codes increasingly require alignment between forecasted and actual production, often down to hourly or sub-hourly intervals. PV asset owners and operators are now directly responsible for forecasting accuracy and delivery performance, particularly during peak demand windows or critical grid events. Deviations from forecast can lead to financial penalties, dispatch curtailment or additional balancing charges.

As a result, performance – defined as the ability of a PV power plant to consistently deliver energy at the right time, under real-world conditions and in line with market or contractual expectations – has emerged as a more actionable and financially relevant metric. This shift has significant implications for PV system design, monitoring and forecasting.

Accurate forecasting is central to succeeding in performance-based markets. In many regions, deviations from intraday and day-ahead forecasts can lead to financial penalties or curtailment. For that reason, developers and investors face greater pressure to design projects that are predictable, resilient and where performance simulations and financial models match the new reality.

Designing for optimal PV performance

To optimise for real-time performance, PV systems must be designed not just for maximum annual output, but for temporal alignment, weather resilience and long-term system health.

Temporal alignment

Optimal PV performance begins with aligning the system’s output with realtime demand. Rather than peaking at noon, when wholesale electricity prices are typically the lowest, a well-designed plant maximises production during periods when demand and prices spike. This shift is increasingly important in markets with time-of-use tariffs, dynamic pricing or capacity-based incentives.

One of the most effective ways to meet the temporal demand is by integrating battery energy storage systems (BESS). While PV generation is inherently tied to solar availability during the day, BESS enables time-shifting of energy delivery to match it with higher-value periods, such as early evening hours. This flexibility not only enhances profitability in markets with variable pricing but also supports grid stability and improves the overall dispatchability of solar energy.

When properly sized and integrated into the system design, BESS can transform a PV power plant from a passive generator into a responsive energy asset.

BESS integration also requires adjustments in the system design and modelling, including dispatch strategies and energy forecasts. Accurate simulation of charge/discharge cycles is essential for optimal sizing of inverters and system availability. Degradation modelling becomes more complex as cycling patterns impact both battery life and long-term system output.

Additionally, revenue stacking – combining energy arbitrage with services, such as frequency regulation, capacity payments or grid balancing – further underscores the need for high-resolution data. Without it, the economic modelling of hybrid PV+BESS systems remains incomplete and potentially misleading.

Resilience to critical events

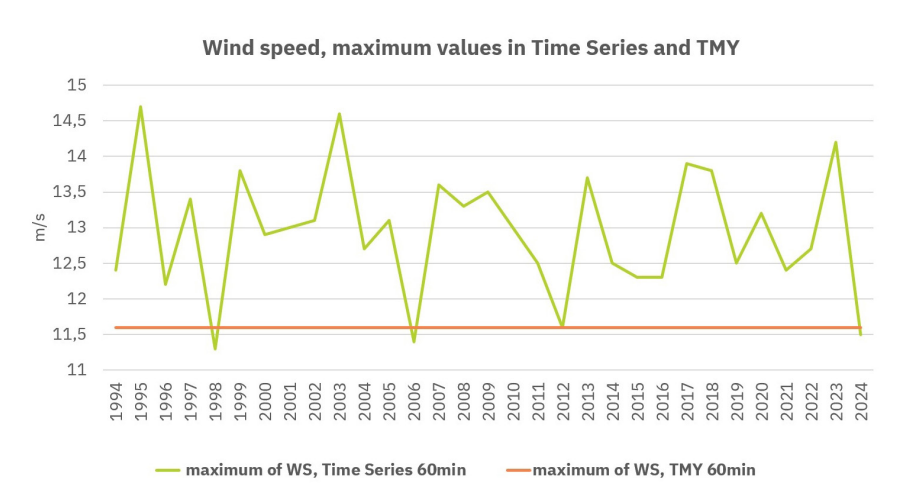

Many PV system designs still rely on the use of TMY (Typical Meteorological Year) datasets, which only provide ‘typical’ or ‘average’ weather conditions, obscuring the risk of extreme weather events, such as sudden temperature changes or strong winds. Figure 1 shows the difference in actual wind speed versus wind speed as recorded as TMY.

This may lead to inverter overloads, overvoltage, shutdowns or even damage. For example, if events of very low air temperature are not accounted for in the design, overvoltage can occur – causing system faults or hardware damage. Such technical failures can undermine a project’s performance and jeopardise the PV power plant’s financial viability.

Designing for resilience also means anticipating non-meteorological stress factors that are amplified during critical events, such as grid-induced voltage spikes, mechanical strain from thermal cycling or increased soiling after sandstorms or wildfires. These risks can be mitigated through better inverter protection settings, thermally tolerant cable routing, reinforced mounting systems and adaptive cleaning schedules.

Just as engineers design bridges for 100-year floods, PV systems must be specified for rare but plausible operational extremes – not just average conditions. In the context of long-term performance guarantees and insurance coverage, the return on resilience-focused design is substantial.

System health and longevity

Integral to PV performance is long-term asset health. There are a large number of solar power plants that under-deliver against expectations. Poor design choices can cause thermal or electrical stress, accelerating the degradation of modules and inverters. When solar power plants underperform due to preventable wear and tear, it signals a misalignment between design assumptions and realworld conditions.

Investors are increasingly focused on this alignment. A project with a strong theoretical yield is no longer enough – financial stakeholders now demand more robust modelling of PV performance. That means more than just P50 and P90 yearly energy production estimates. Figure 2 demonstrates some of the factors affecting energy loss that can be reported on at PV projects.

In today’s high-stakes environment, where electricity markets are volatile, and operational risks are more visible, the emphasis has shifted from theoretical output to real-world resilience. Lenders and insurers want to see simulations that take into account variability, extremes and uncertainty. Investors expect to see credible simulations based on realistic meteorological data and risk mitigation strategies.

This trend also reflects the growing importance of performance stability over time. Investors understand that a solar project with a high theoretical yield may still underperform financially if its output is misaligned with market pricing, or if it is vulnerable to curtailments, voltage issues or environmental stressors.

What can PV developers do to ensure optimal PV design?

PV developers must move beyond outdated, empirical models and low-resolution datasets. This includes using advanced PV simulation software that works with highresolution time series data instead of the hourly TMY datasets.

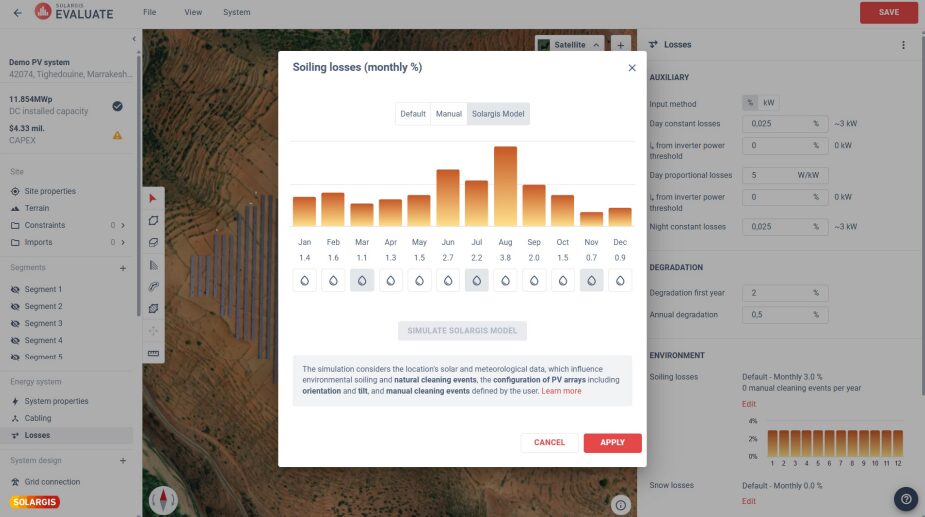

High-resolution 15-minute time series data capture temporal variability and enable more accurate modelling of real-world operating conditions. It can better capture site-specific conditions and model the system behaviour more accurately, resulting in PV designs that reflect actual operating conditions and support modern business models. Figure 3 includes a graph showing soiling losses at a project site.

Another critical layer is software built on advanced physical modelling. Technologies, such as ray tracing and the Perez all-weather model, enable more accurate calculation of shading in complex terrain or densely packed layouts. Unlike the simplified view factor model, ray tracing simulates the exact path of sunlight through a 3D environment, making it possible to accurately model PV output for bifacial PV systems and uneven surfaces.

Factors such as soiling and snow losses also have a significant impact on PV performance, particularly in dry, dusty, or high-latitude environments.

Software solutions must be capable of simulating soiling losses dynamically, based on site-specific, high resolution time series data, PV model configuration and local weather conditions such as wind and precipitation. Realistic modelling of soiling losses helps developers schedule cleaning and maintenance more effectively.

Ultimately, these improvements result in a more accurate PV output estimation, reducing the gap between projected and actual performance. For bankability assessments, that accuracy is essential.

Performance as a strategic advantage

The goal is to build PV systems that are healthy, reliable and profitable. In today’s market, a high performing solar asset is one that delivers energy when it’s most valuable, withstands operational stress and is long-term efficient. Designing for that reality is no longer optional; it’s the new standard.

As energy markets grow more dynamic and expectations rise, stakeholders across the value chain, from developers to financiers to grid operators, will increasingly demand performance-oriented metrics. Those who embrace this shift early will be best positioned to thrive in the next generation of solar energy projects.

Being able to predict and consistently deliver energy, not just in quantity, but at the right time and under the right conditions, is becoming a core differentiator for PV projects. Advanced forecasting and PV evaluation lead to better decisions and healthy PV assets that are ready for active collaboration with electricity markets.

Author

Marcel Suri is an entrepreneur and co-founder of the solar data and software company Solargis. He is an expert in solar resource, photovoltaics and geoscience. Holding a PhD in geography and geoinformatics, Marcel has made significant contributions to solar energy through science and peer-reviewed research. Driven by a passion for innovation, Marcel is dedicated to improving the efficiency of digital tools and data resources and analytics that mitigate weather-related risks and elevate industry standards.