Sky-high electricity prices and an increasing urgency to curb fossil fuel led to a surge in European solar additions last year. Jules Scully charts how the continent’s ongoing energy crisis is affecting EU renewables policy and PPA appetite.

With Russia’s invasion of Ukraine triggering a rapid shift in energy policy and wholesale electricity prices reaching record highs in recent months, many European countries are looking to supercharge solar deployment to wean themselves off imported fossil fuels.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Speaking at the SolarPower Summit event last March, the European Union’s (EU) energy commissioner Kadri Simson talked of a renewed political will and a practical need for boosting the continent’s renewables capacity. “Solar has also become an instrument, not just for boosting renewables and for our energy independence, but also to shield citizens from volatile prices,” she said.

Given that the energy crisis has spurred increased renewables deployment targets and that some governments are working to reduce barriers to add new capacity, solar installs across Europe soared last year. Trade association SolarPower Europe forecasted that the EU would hit 40GW of installations, 48% higher than 2021, while research organisation Wood Mackenzie expects utility-scale PV additions in 2023 to be 70% higher than 2021.

Europe’s energy crisis has created a mindset shift, according to Axel Thiemann, CEO of renewable energy producer Sonnedix, who says while previously there was a focus on the intermittency risk for renewables, now there is a realisation that supply risk for conventional electricity generation is not to be underestimated.

“In the past, people were thinking of energy transition as something that should be done, but now you see a clear shift in the perception that it has become a must,” Thiemann tells PV Tech Power. “Therefore, in the long term the energy crisis has created a more favourable environment for investing in solar due to the increased targets to reduce carbon emissions.”

With Europe’s gas crisis turning into a power crisis, pricing and volatility have surged, reaching “stratospheric levels” at the end of August, research from advisory firm Pexapark found. It revealed that German and French front-year power contracts broke €1,000/MWh (US$1,034) for the first time.

A study from consultancy EnAppSys said that in many EU countries day-ahead prices in Q3 2022 were between two and four and a half times as high as Q3 2021, which was itself seen as an expensive quarter compared to the preceding third quarters. While such prices have led to renewed calls for faster renewables deployment, they have also slashed payback times for newly installed projects. Considering the average monthly spot prices for August in some European countries were all well over €400/MWh, the economics for utility-scale renewables “appear to be compelling”, Rystad Energy said in research published in October.

The consultancy found that for a generic 250MW solar asset in Germany, a long-term electricity price of €50/MWh would have a payback period of 11 years. However, a price of €350/MWh or above results in a payback period of just one year.

If the high prices remain, Rystad said developers and financiers alike “should be trying to get projects up and running as quickly as possible and with maximum exposure to wholesale prices”.

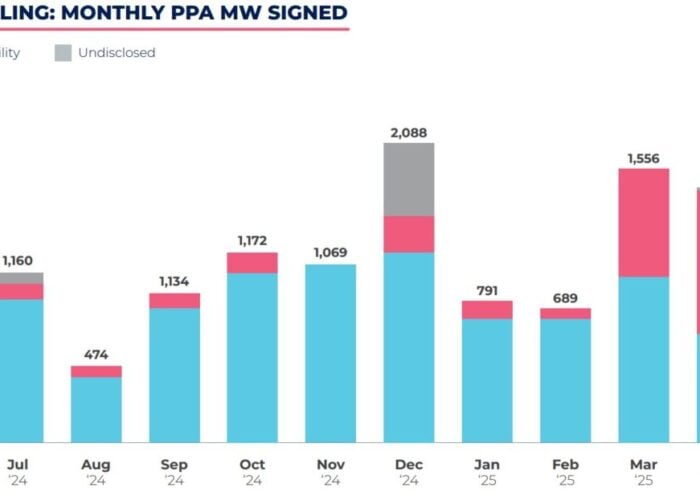

Meanwhile, with Europe’s energy crisis showing no signs of relenting and electricity prices soaring, this has put upward pressure on power purchase agreement (PPA) prices, which were already on the rise due to escalating demand and development costs. That’s according to renewable transaction infrastructure provider LevelTen Energy, whose blended European P25 Index – an average of the P25 wind and solar PPA price indices in European countries – increased by 11.3% between Q2 and Q3 2022, reaching €73.54/MWh.

PPA appetite on the rise

Gabriel Umaña Gomez, customer success manager, Europe, at LevelTen says that buyer demand for solar PPAs remains very high as European companies seek to hit sustainability targets and insulate themselves from high wholesale electricity prices.

But while such prices are generally not reducing appetite for PPAs, Umaña Gomez warns that some corporate buyers are hesitating due to broader inflationary pressures and market uncertainties. “As long-term contracts with values dependent upon wholesale electricity markets, PPA economics can be more difficult to predict during periods of extended market volatility,” he says.

Corporations across Europe are actively seeking PPAs because of the high power prices and the fluctuation, and they generally accept that PPAs come at a premium because of the rising demand, says Joop Hazenberg, director at the RE-Source Platform, an alliance of stakeholders representing clean energy buyers and suppliers.

“Also, more and more sectors notably from energy-intensive industries are very impatient to sign a PPA and there is general frustration that there are not enough projects on the market. So I would say that the appetite is only increasing,” says Hazenberg, noting that the market has flipped in the past year to become a sellers’ market.

Illustrating this trend is a plan by German renewables company BayWa r.e. to tender 10TWh of green electricity, describing the move as a “turning point” for Europe’s PPA market. The company said it will issue Europe’s first tender initiated by a developer for corporate PPAs, with the energy to come from a portfolio of renewables projects in Germany and Spain. The tender was due to take place last autumn, but at the time of writing there have been no further announcements.

Although PPA appetite may be increasing, demand could take a hit as the allure of high electricity prices means some developers opt to sell more output in the merchant market, potentially securing higher returns.

“This is reducing capacity available for PPAs amid an already strained supply/ demand dynamic, placing further upward pressure on PPA prices,” says Umaña Gomez. The LevelTen report suggests that banks – growing more accustomed to renewable economics and current wholesale conditions – are increasingly comfortable financing projects on a merchant basis.

Nonetheless, Sonnedix’s Thiemann believes the recent price volatility will create a step change in PPA demand for the foreseeable future, helping the roll-out of renewable energy more broadly. While Sonnedix has seen increased interest from existing and new customers who are looking to contract green electricity for the long term, Thiemann warns that the industry faces headwinds in the form of regulatory uncertainty.

“It is clearly necessary to protect the end customers,” he says. “But changing price caps and windfall taxes on top of supply chain tightness, increasing capex and increasing interest rates are making investments currently difficult to assess.”

EU caps solar project revenues

Following proposals put forward by the European Commission (EC) aimed at helping energy consumers reduce their bills, EU countries confirmed in September they would introduce a revenue cap on ‘inframarginal’ electricity producers – technologies with lower costs, such as renewables – which are providing electricity to the grid at a cost below the price level set by more expensive marginal producers.

Such operators “have made unexpectedly large financial gains” because of the role of coal and gas as price-setting marginal sources that currently inflate the final price of electricity, according to the EC. “These companies are making revenues they never accounted for, they never even dreamt of,” EC President Ursula von der Leyen said during her State of the Union speech in September.

Ministers from the EU’s 27 member states agreed to cap the market revenues of such generating plants at €180/MWh, with the policy in place from 1 December 2022 until June 2023. With the vast majority of long-term PPA prices falling below €180/ MWh, the cap will not impact the way settlements occur for most contracts, says Umaña Gomez.

Solar developers that focus on government tenders or PPAs shouldn’t be affected much by the policy, says Daniel Tipping, a solar analyst at Wood Mackenzie. He believes the caps are more likely to stall merchant solar deployment.

The new regulation also includes the possibility for EU member states to implement a lower revenue cap and differentiate between technologies. If countries do deviate from the EU-wide cap, it could have a distorting effect on the renewable energy market that could halt investments, according to the RE-Source Platform. “We are very worried about the cap, and it may greatly harm existing and future PPA contracts,” says Hazenberg.

RE-Source said in a paper that while many PPAs are signed at prices below the value of the EU cap, the way that many PPA contracts are structured could make them subject to the cap, compromising existing contracts and preventing the signing of new ones.

Concerns have also been raised by Italian utility Enel, which said in a statement sent to PV Tech Power: “Enabling member states to maintain or introduce additional national measures that deviate from the European inframarginal cap risks creating a mix of uncoordinated provisions that could ultimately undermine investments in the clean energy sector.”

Despite the uncertainty stemming from the revenue cap, Europe’s solar sector will be boosted by REPowerEU, the EC’s plan to make Europe independent from Russian fossil fuels well before 2030. Released alongside the plan in May, the EU Solar Energy Strategy sets a target for the bloc to reach 740GWdc of installed solar PV by 2030.

Among the initiatives put forward by the EU Solar Energy Strategy include shorter permitting procedures and encouraging greater rooftop deployment via the European Solar Rooftops Initiative. It also includes the launch of a European Solar PV Industry Alliance that aims to facilitate the expansion of a resilient industrial solar value chain in the EU.

Tipping says that although permit timelines are being shortened, many developers have complained that not enough has been done to help reach the REPowerEU 740GWdc solar target.

Progress was made in early November when proposals were unveiled that would see solar farms below 50kW of capacity be exempt from environmental impact assessments. The EC tabled a temporary emergency regulation that would also see solar deployed on artificial structures – buildings, car parks, transport infrastructure, sheds – and co-located storage systems have a maximum deadline of one month for permitting.

Demand goes through the roof

As homeowners and businesses seek insulation from high energy bills, rooftop solar deployment is surging. Residential solar build in Europe was on track to reach 10.4GW in 2022, a 42% rise on 2021, research organisation BloombergNEF predicted.

“Demand for residential and commercial PV is quite literally through the roof,” says Dries Acke, policy director of SolarPower Europe. “Installers are struggling to keep up with demand, with the wait times for installations going up to years in some parts of Europe.”

Citing figures from French distribution system operator Enedis, Acke says there were 60,000 new prosumers in France last year, compared to 3,000 prosumers added to the grid in 2015.

Solar demand from households, small and medium-sized enterprises and public administrations to benefit from cheap renewable energy, especially through self-consumption schemes, has never been so high, says Daniel Bour, president at French PV trade association Enerplan.

France takes ‘impressive’ PV policy action but permitting problems persist

France has made a host of legislative changes to speed up solar deployment since the energy crisis began, but permitting delays mean many PV projects are currently on hold.

The country has enabled the rapid commissioning of 2.7GW of solar awarded in tenders, while new projects backed by contracts for difference schemes will be able to sell electricity on the market for 18 months before locking in their contracts.

In addition, legislation approved by the French Senate in November will require existing and new car parks with at least 80 spaces to be covered by solar panels.

Daniel Bour, president at French PV trade association Enerplan, says the country’s solar sector “has seen an impressive number of changes to its legislative and regulatory framework”, some of which have allowed project developers to better manage the impacts of the crisis, thanks to the swift application of the policies.

However, when it comes to permitting procedures, delays in some of the government’s changes have led “hundreds of megawatts of projects to be put on hold, awaiting much-needed clarifications”, Bour says.

A similar trend is being seen in Spain, where trade association UNEF expected self-consumption solar deployment in the country to reach 2GW last year, a 67% increase on 2021.

There was “a dramatic increase” in both residential and commercial installations last year across most major European markets, with skyrocketing electricity rates offsetting the impact of increasing technology and installation costs, says Juan Monge, principal analyst, EMEA power and renewables, Wood Mackenzie.

With REPowerEU mandating rooftop solar on all existing public and commercial buildings larger than 250m2 by 2027, the outlook for the commercial and industrial solar sector appears promising.

While there is perhaps increased urgency among governments to mitigate the energy crisis and ramp up renewables additions, experts contacted by PV Tech Power caution that the solar industry faces significant headwinds in areas such as recruitment and a lack of domestic manufacturing.

“The energy crisis is happening right at the same time where many governments, TSOs and other public stakeholders are launching restrictive rules, further payments and costly technical requirements,” says Thorvald Spanggard, head of project development at Danish renewables developer European Energy.

These challenges, Spanggard says, are in addition to long grid connection queues, sky-high construction costs and a strained supply chain.

With the number of solar jobs across the EU set to at least double by 2030, the EU Solar Energy Strategy recognises that there is already a lack of skilled workers.

Residential and commercial installers in markets such as Spain, Germany and Italy have admitted it has become challenging to cope with the spike in solar demand due to a lack of available installation crews and local expertise, says Wood Mackenzie’s Monge.

The EU Solar Energy Strategy calls for a partnership to develop a vision of upskilling and reskilling measures to support solar’s expansion. This could include training cooperation between companies along the value chain, social partners, training providers and regional authorities.

Despite challenges such as these as well as the threat of revenue caps and windfall taxes, the REPowerEU strategy illustrates Europe’s commitment to supporting the solar sector to achieve the installation targets.

Volatility in power markets, government interventions, geopolitical interests, the prospect of increased interest rates and maybe a recession are not helping in the short-term to create a stable investment environment, says Spanggard, but medium term “we are more positive than ever that we can play a key role in solving the energy crisis and the green transition”.