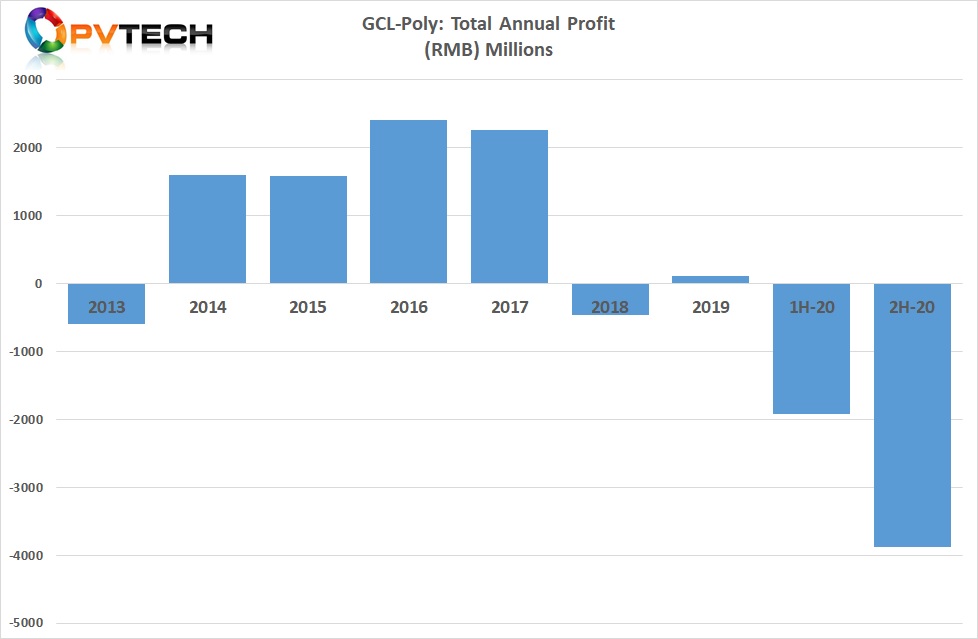

Major polysilicon and wafer producer GCL-Poly Energy Holdings expects to report a net loss for 2020 not less than RMB5.8 billion (US$891 million).

The net loss warning is the largest GCL-Poly has announced, dwarfing losses made in 2013 and 2018.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

GCL-Poly Group had reported a net loss in the first half of 2020 of RMB1,924 million (US$281.8 million), with its key Solar Material business unit (polysilicon and wafers) making losses of RMB2,023 million (US$296.2 million).

These first half year losses were attributed to a 51.1% decline in actual silicon rod production as the company disposed of a 31.5% equity interest in Xinjiang GCL polysilicon plant with a nameplate capacity of around 50,000MT in 2019. The Xinjiang plant also suffered a major incident while under annual maintenance during this period.

The company was also impacted by COVID-19 with weak demand in the first half of the year, resulting in rapidly falling polysilicon average selling prices (ASPs), which fell to US$7.56/kg in that reporting period, down from US$9.01/kg in the prior year period. Wafer ASPs followed a similar downward path.

Although GCL-Poly had noted the start of a rebound in polysilicon ASPs at the end of the first half 2020 reporting period, the company was bullish on the polysilicon business unit returning to profitability in the second half of the year.

Based on GCL-Poly’s profit warning, second half year net losses increased to not less than US$596 million, however the company did not provide insight into a profitable position for the Solar Material business unit as a whole.

The sale of the Xinjiang GCL polysilicon plant in 2019 boosted GCL-Poly’s balance sheet by RMB4.4 billion (USUS$676 million), resulting in a very small net profit for the year of around RMB110 million (US$17 million).

GCL-Poly said that its full-year 2020 expected net losses were partially attributable to the sale of Xinjiang GCL in 2019, due to the absence of the Xinjiang GCL disposal gain in its 2020 financial year.

The company also noted that the expected net losses were partially attributable to impairment provision on assets, while the expected increase in the net loss was partially offset by the exchange gain caused by the depreciation of the USD against the RMB for USD denominated indebtedness.