The German Federal Network Agency (Bundesnetzagentur) has announced the winners of the government’s most recent tender for new solar projects, with 2.2GW of ground-mounted projects receiving approval.

The auction round ended on 1 March, and saw the government award significantly more capacity than in earlier auctions, with the Bundesnetzagentur offering 326 bids with 2.2GW of capacity, up from 1.6GW in the previous round in December 2023. Even this expanded offering was oversubscribed, with developers making 569 bids and 4.1GW of total power capacity submitted, meaning that almost half of the applications, by capacity, did not translate to successful bids.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The tender comes as Germany looks to dramatically expand its solar sector. Last year, the government updated its National Energy and Climate Plan (NECP) to increase Germany’s solar installation target from 98GW to 215GW by 2030, an ambitious project that will require significant new solar capacity to be built, as shown in the graph below.

As was the case in the previous auction, the majority of the successful bids were made for projects in Bavaria, with 156 projects in the southern state receiving support, with a combined capacity of 806MW. This was almost triple the number of bids awarded to Bavaria in the previous auction, where the state received 63 such awards, for a combined capacity of 604MW. In the most recent auction, Schleswig-Holstein and Lower Saxony received the next-most capacity, with projects winning bids totalling 221MW and 199MW respectively.

The latest German auction also saw the average volume-weighted award price of successful bids fall, compared to the previous auction, from €0.0517/kWh (US$0.0553/kWh) in December to €0.0511/kWh (US$0.0547/kWh) in March. This is the third consecutive auction for which prices have fallen, which stood at €0.0647/kWh (US$0.0693/kWh) prior to December, and the falling prices suggest that making such bids is becoming more financially attractive to potential developers.

The next ground-mount solar auction bidding round is set to close on 1 July 2024.

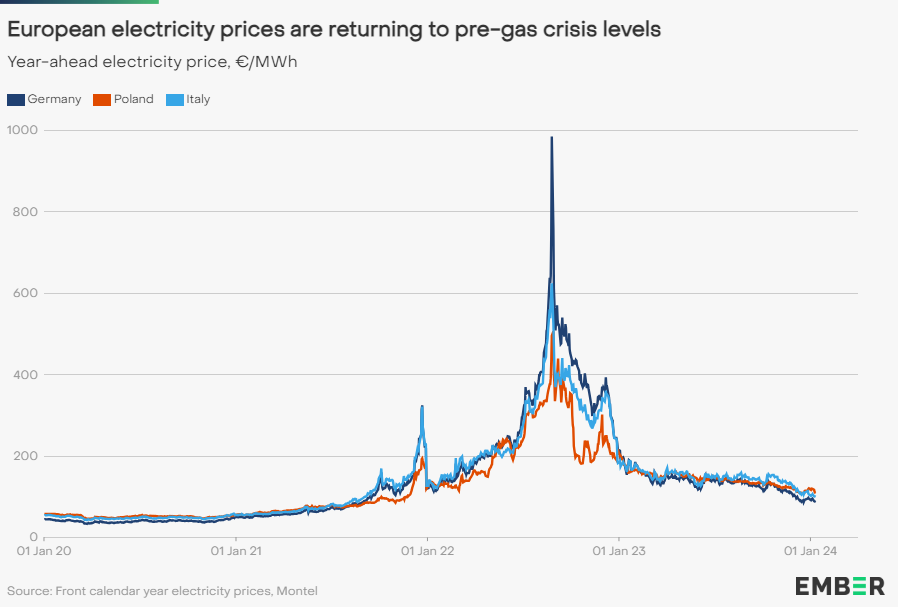

This trend of power prices falling gently but consistently mirrors the broader trend in European power prices, with many countries seeing power prices fall closer to pre-pandemic levels as the impacts of Covid-19 fade.

Figures from Ember suggest that Europe could see an increase in electricity demand in 2024 of 2-3%, driven by “easing price levels,” as shown in the graph below. While Dutch bank ING notes that “going back to power prices seen in the period 2016-2019 will probably not be possible in the short term unless a severe economic recession breaks out,” the gradual easing of prices could help attract additional investment to European renewables in general, and solar in particular.

Earlier this year, Bloomberg New Energy Finance analyst Jenny Chase told PV Tech Premium that a key challenge for the solar sector is “finding good projects which are attractive to investors,” and the continued stabilisation of prices across the European solar sector will only help to this end.

Ground-mount projects also saw significantly lower award prices than other parts of the German solar sector in the most recent auction. In October 2023, the Bundesnetzagentur completed an auction for 191MW of solar projects on buildings and noise barriers, at which the volume-weighted average award price was €0.0958/kWh (US$0.1026/kWh).

This auction was also oversubscribed, with developers bidding for 373MW of capacity, suggesting that there is considerable interest in new project installations across the German solar sector.

“The auction was again very well subscribed,” said Klaus Müller, president of the Bundesnetzagentur, of the auction ending in March. “The bid volume has been well above the auction volume for the past four rounds. Although the volumes auctioned have increased, competition in this segment is stable.”

Earlier this week, the German Federal Network Agency opened the latest auction for rooftop solar, which is set to close on Monday, June 3. The auction seeks nearly 260MW of capacity.

Moreover, German module manufacturer Solarwatt has reportedly decided to close its 300MW module assembly plant in the country, in yet another strike for the European solar manufacturing industry, after solar manufacturer Meyer Burger decided to close its module assembly plant earlier this year.