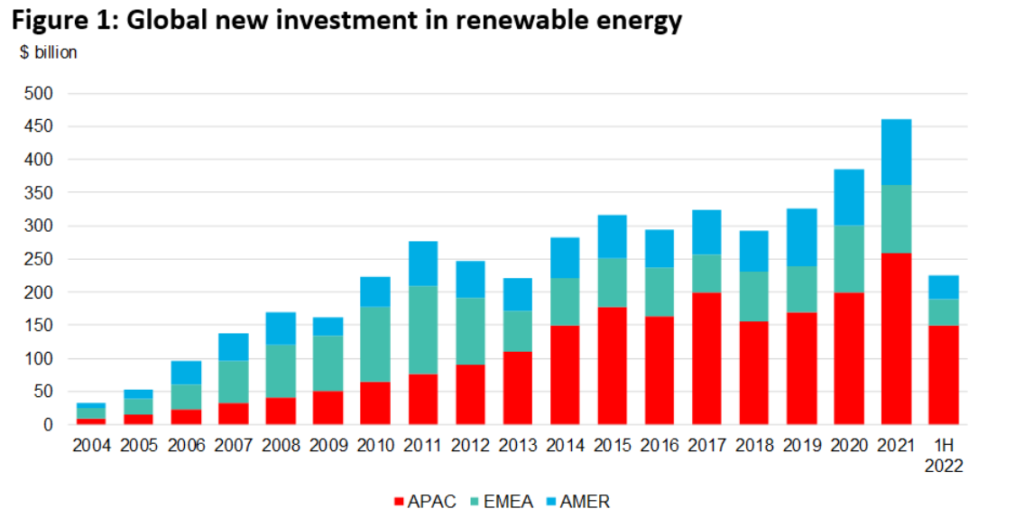

Global investment in renewable energy reached a record half-year figure of US$226 billion in H1 2022, driven by soaring demand for clean energy technologies amid the ongoing energy and climate crisis, according to a BloombergNEF (BNEF) report.

The Renewable Energy Investment Tracker 2H 2022 report, which covers both project investments and corporate fundraising, revealed that investment in new solar projects rose to a record-breaking US$120 billion in H1 2022, up 33% from H1 2021.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The surge was driven by increased investment in renewable energy projects, venture capital and private equity funding, BNEF said.

Despite ongoing supply chain and geopolitical issues, BNEF said “investor appetite is stronger than ever”, which it put partly down to the extremely high energy prices currently being seen in most global markets.

“Policy makers are increasingly recognising that renewable energy is the key to unlocking energy security goals and reducing dependence on volatile energy commodities,” said Albert Cheung, head of analysis at BloombergNEF.

“Despite the headwinds presented by ongoing cost inflation and supply chain challenges, demand for clean energy sources has never been higher, and we expect that the global energy crisis will continue to act as an accelerant for the clean energy transition.”

H1 also saw an all-time record for venture capital and private equity investments into renewables and energy storage, with US$9.6 billion raised, which was up 63% on the previous year.

One category that saw falling investment, however, was public equity issuances. After a strong H1 2021, public market issuances for renewable energy companies dropped 65% in H1 2022, accounting for US$10.5 billion. While the Q2 figure, at US$3.9 billion, is the lowest quarterly total since Q2 2020.

As expected, China led the way and posted huge investment growth in both wind and solar project finance, with the country’s large-scale solar investments totalling US$41 billion in H1 2022, up 173% from the year before.

The U.S emerged as the second-largest solar market investing US$7.5 billion, followed by Japan at US$3.9 billion.

Nannan Kou, BNEF’s head of China analysis, said: “Green infrastructure is the most important investment area that China is relying on to boost its weak economy in the second half of 2022.”

“The investment growth trend follows China’s strategy to build new renewable generation capacity so that it can replace its existing coal fleet. China is well on track to hit its 1.2TW wind and solar capacity target by 2030.”