According to Mercom Capital Group, the only bright spot in the global solar funding sector in the first quarter of 2020 was PV power plant project merger and acquisitions (M&A), as corporate project funding declined sharply year-on-year.

Mercom’s latest report, out this week, indicates that more than 12GW of solar projects were acquired in the first quarter of 2020, compared to 5.9GW in the same period of 2019. Acquisitions were also higher in Q1 2020 than the 10.1GW changing hands in the fourth quarter of 2019.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

At 12 deals, the year's first quarter featured fewer M&A transactions than Q1 2019 (18 deals all in all). The quarter boasted, however, 55 large-scale solar project acquisitions (eight disclosed for US$4.1 billion), compared to 54 large-scale solar project acquisitions (20 disclosed for US$1.4 billion) in Q1 2019.

The Q1 2020 transactions included involved ‘Solar Downstream’ companies, with one separate transaction involving a PV module manufacturer.

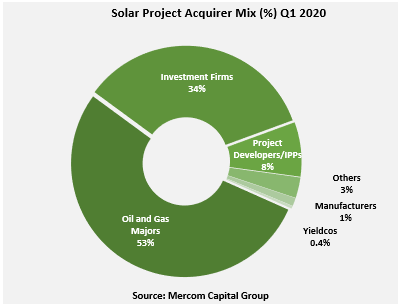

Interestingly, oil and gas majors were said to be the most active project acquirers in the first quarter of 2020, acquiring 6,452MW of solar projects, while investment firms acquired 4,149MW of projects. Specialist project developers were also active, acquiring a total of 937MW of projects in the quarter.

Corporate funding decline

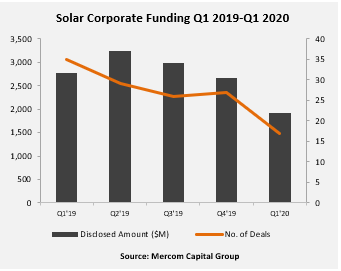

Mercom noted that total corporate funding (venture capital, public market, and debt financing) declined 31% from the prior year period. Only US$1.9 billion of funding was secured in Q1 2020, compared to US$2.8 billion in the prior year period, due primarily to the pandemic.

Raj Prabhu, CEO of Mercom Capital Group, said: “Funding levels dropped in Q1 as the Coronavirus pandemic brought the global economy to a halt. Most large economies are shut down and there is minimal activity in solar markets. Solar project M&A was the bright spot in this time of uncertainty, proving once again that solar is a safe long-term bet. The worst may be yet to come, but hope is that activity picks up in the second half of the year.”

PV Tech has set up a dedicated tracker to map out how the COVID-19 pandemic is disrupting solar supply chains worldwide. You can read the latest updates here.

If you have a COVID-19 statement to share or a story on how the pandemic is disrupting a solar business anywhere in the world, do get in touch at [email protected] or [email protected].