Green hydrogen has become key to many international decarbonisation plans in recent years, as the cost of renewable energy continues to fall and people look for alternatives to gas for difficult to decarbonise sectors. But challenges remain with integrating the gas and the nascent technology around it into the energy system.

In a report on the technology published in December 2020 Francesco La Camera, director-general of IRENA, said renewable or green hydrogen could become a game changer helping to decarbonise economies globally. “Cost-competitive green hydrogen can help us build a resilient energy system that thrives on modern technologies and embraces innovative solutions fit for the 21st century,” he added.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

But as large scale projects begin to emerge, challenges with economics, efficiency grid connections and the surrounding networks still present hurdles, despite the flexibility of the fuel.

Grid constraints and new networks

As electricity systems transition from large centralised generation to more distributed renewable energy sources, many have been pushed to their limits. This has led to grid constraints, often meaning expensive network upgrades are required, as well as connections for renewable energy projects often being oversubscribed.

For example, in June 2020 the Spanish government passed a new law to ease grid connections in a move designed to boost the renewable energy sector. It estimated that there had been up to 430GW of grid access applications filed in the country in the 16 months leading up to the law, creating a backlog, in particular with international companies buying connections with no intention to develop. The new law – which includes a five-step process that companies must complete or lose their connection – could facilitate a €90 billion boost to investment over the next ten years for renewables.

Spain’s grid connection challenges mirror those seen around the world, but are particularly stark given the maturity of the solar market in the country. This same maturity, and positive permitting framework, has allowed it to be one of the front runners in green hydrogen development, with companies such as Iberdrola announcing large-scale projects such as its Puertollano (Ciudad Real) plant, which will combine a 100 MW photovoltaic solar plant, a 20 MWh lithium-ion battery system and one of the largest electrolytic hydrogen production systems in the world at 20MW.

The same grid connection challenges faced by pure play renewable energy projects are true of green hydrogen projects, with additional complexity coming from the multiple pathways within large scale developments. Depending on the project, generation from multiple sites, consumption, storage and power exporting may all be factors to be taken into account when integrating it with the wider system.

ENGIE and Total announced in January 2021 that they are developing what will be France’s largest green hydrogen development. The 100MW Masshylia project will consist of an expansive solar photovoltaic installation and a 40MW electrolyser that will produce five tonnes of green hydrogen per day. The hydrogen will be used at Total La Mede biorefinery, helping to avoid 15,000 tonnes of CO2 emissions per year. Despite the hydrogen element not playing into the grid directly, the solar photovoltaic sites – which will be located at the La Mede site and around the region given the scale of installation needed – will need to use both existing and new grid networks, presenting a challenge to ENGIE.

Olivier Machet, SVP of business development at ENGIE’s hydrogen business unit explains that firstly a direct connection with a specific PV farm near the electrolyser is needed, before additional connections with other farms in the region are considered. They will utilise the grid network already in place in the region for this, while relying entirely on the solar generation at part of the project.

“We will need to specifically develop a new electricity line for this project, because we are going to need certain power,” says Machet. “And this will take time because you need to build a new line and so on. So it can be an issue, but it’s worth it to have this specific project with its additional solar renewable generation, when compared to other projects we can see today developed in France and other countries in Europe or anywhere. It’s very specific.”

Many large-scale projects thus far have been located near to industrial off-takers, which provides easier electricity grid access in addition to the proximity and ease of direct offtake agreements.

“We could have taken electricity from the grid, and it could have been simpler. But our objective is to have an innovative project.”

Olivier Machet, engie

In Australia, Austrom Hydrogen is developing a 3,600MW combined solar and battery storage site that will fuel green hydrogen production in the Callide area of Queensland. The site was chosen in particular because of its proximity to existing power infrastructure, as well as strong irradiation in the area.

By constructing the solar array in the Callide area, the company can use a mix of existing and new infrastructure to get the green electricity to the hydrolyser with minimal line loss. Additionally, the site’s proximity to Gladstone Port eases export of the hydrogen.

It is clear that in order for a large-scale green hydrogen project to be financially viable currently, ease of grid connection is essential. Given the high demands on power networks, projects will generally require some level of network development, but choosing locations where there is existing robust grid capacity can ease the integration of the multitude of elements required for a green hydrogen project.

Securing the green premium

Whilst the construction of a new segment of grid undoubtedly adds cost and complexity to the project, renewable hydrogen projects come with numerous benefits, bolstering the business case for such projects.

Machet says: “We could have taken electricity from the grid, and it could have been simpler. But our objective is to have an innovative project and to ensure that the electricity price will not be exposed to electricity market price nor to the guarantee of origin price volatility.”

It is therefore key that while green hydrogen remains more expensive than its blue and grey cousins, its environmental credentials remain key selling points. Research from the International Energy Agency suggests that a kilogram of green hydrogen, which contains about 33.3kWh of power, costs €3.50 to €5, or between €0.10/kWh and 0.15/kW. In comparison grey hydrogen comes in at just €1.5/kg or €0.045/kWh, indicating a clear price advantage.

As Machet says though, the added value of a green product must be taken into consideration within the cost equation. This may help green hydrogen production going forwards, with organisations opting to pay a premium in order to decarbonise.

“Costs for producing green hydrogen have fallen 50% since 2015 and could be reduced by an additional 30% by 2025 due to the benefits of increased scale and more standardized manufacturing, among other factors,” said Simon Blakey, IHS Markit senior advisor for Global Gas. This can be aided by using dedicated renewables as a feedstock he continued, together with economies of scale with the average size of project by 2023 expected to be 100MW, ten times the size of today’s projects.

ENGIE’s La Mede project will hope to benefit from the reduced cost of solar PV – which has fallen dramatically by 80% in just the last ten years – as well as the economies of scale of a project 100MW large and the support of pursuing a green option. In order to ensure the seamless integration of the numerous elements to secure the success of the project, software development will be key.

Machet says that the company needed to develop specific tools to ensure the security of the hydrogen delivery, making sure all the elements of the project will be integrated. “We will develop specific tools to ensure the traceability of the production because we want to be compliant with the future Renewable Energy Directive (RED II),” he says. “Therefore, we need to ensure that the electrons are traced, through the entire chain from PV farm to the production of hydrogen.”

The company has developed a digital piloting system to tackle this capable of managing the continuous supply of hydrogen with real-time management of solar electricity production. This is central to the project’s green credentials and to the stability of the generation, allowing each part of the system to work together to ensure the continuous flow of hydrogen to the biorefinery.

For other green hydrogen projects being developed, being connected to the grid in such a way that the renewable energy generated is seamlessly managed whether it be powering the electrolyser or feeding into the grid will be essential.

On and off-grid solutions

Even outside of mains grid connection, hydrogen offers an interesting option for renewable energy systems. In 2017, Enel hailed the success of what it said was the world’s first emissions free “plug-and-play” commercial-sized micro-grid powered by solar PV together with hydrogen and lithium storage.

The Hybrid Energy Storage System (HyESS) comprises a 125kWp solar PV installation along with a 450kWh hydrogen storage system and 132kWh of lithium storage, installed in the Antofagasta region of Chile. Together these elements are able to provide green energy 24 hours a day, and can run completely independently of the grid.

While the facility can work both on-grid and off-grid, it highlights the ability for green hydrogen to enable green electricity, both day and night, in almost any location. With green hydrogen’s potential for longer duration storage than lithium-ion, it can complement off-grid clean energy solutions, easily integrated into renewable energy systems in remote locations.

A new path to flexibility?

Generating green hydrogen through surplus renewable energy may present some grid connection challenges, but it also offers a wealth of benefits for the grid. By capturing surplus solar electricity generated during periods of high irradiation for example, green hydrogen can both limit curtailment to balance the grid and provide energy storage.

Because of this, ensuring access to the grid will remain of high importance for new hydrogen projects. “We need to plan for this on the basis that green hydrogen electrolysis can provide a flexible demand source that can be used to help alleviate grid constraints in areas of high renewable energy deployment,” Grace Millman, energy analyst at UK-based trade body Regen, says.

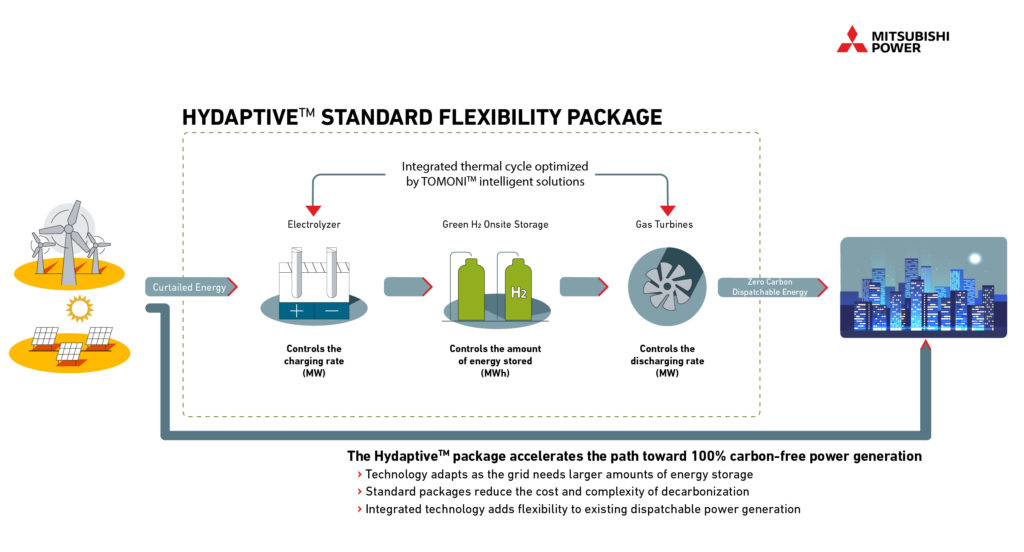

Thus far, this remains largely theoretical, but a number of companies are working towards commercialisation. For example, in 2020, Mitsubishi Power launched two integrated green hydrogen solutions, with so-called ‘Hydaptive’ and ‘Hystore’ package. Hydaptive is designed to provide flexibility to the grid by offering a near-instantaneous power balancing resource. A hydrogen plant and a natural gas fuelled gas turbine power plant are integrated together with electrolysis to produce green hydrogen and onsite storage. Three projects around the US were launched using the technology, to explore the ability for green hydrogen to increase the flexibility of grids.

One of these projects is taking place at a 600MW site operated by Danskammer Energy in Newburgh, New York, announced in September 2020. Danskammer’s CEO William Reid said at the time they were committed to helping New York meet its climate targets, selecting Mitsubishi’s technology to “ready our facility to be a hydrogen-based zero-carbon power generator.”

“By partnering with Mitsubishi Power for integrated green hydrogen generation and storage technologies, we hope to provide leadership in developing short- and longduration energy storage infrastructure in New York State.”

Integrating renewables and green hydrogen onto national grids is widely expected to be mutually beneficial, with a report from UK-based energy consultancy Aurora in June 2020 suggesting that in the UK, using such a system could reduce the need for alternative flexibility services in winter months and increase revenues for clean power generators by around £3 billion per year by 2050.

Utilising green hydrogen can therefore add another string to the bow of renewable energy sources, but policy changes will be needed to maximise this opportunity, with little or no policy framework for green hydrogen connected to the electricity grids in many countries.

Hurdling policy barriers

In the UK, power to gas – as electrolysis to create green hydrogen would be considered – is not formally recognised by the electricity industry or government as a form of energy storage according to the European Union Horizon 2020 research and innovation programme-funded HyLaw project. While authorities are looking to establish a legal status for the technology to facilitate storage options, it remains a barrier to grid connected green hydrogen projects.

Therefore despite the “huge amount of interest in green hydrogen electrolysis at the moment”, explains Regen’s Millman, projects are still only at an innovation level. “Our research has identified 19 operational green hydrogen innovation projects across the UK, with a further 21 in the pipeline,” she says. “Most of these are small scale (0.5 – 5 MW), focusing on areas like transport and industrial processes.”

HyLaw highlights similar challenges throughout much of the EU, with a lack of legislation currently acting as a barrier to grid integration in countries including Spain, France and Italy. Globally, policy changes can work to increase the potential of green hydrogen flexibility services, with research from IRENA arguing that: “Policy makers should aim to provide a platform to monetise the flexibility offered by electrolysers, while also allowing revenue stacking from all services provided by the electrolyser.”

Already we are seeing this legislation come through, with increasing support for green hydrogen through government initiatives such as the European Union launching its hydrogen strategy in 2020 that targets 40GW of electrolysers by 2030. The likes of Australia, Chile, Japan, New Zealand and others have also launched national hydrogen strategies.

In terms of providing storage and flexibility services, green hydrogen may still be held back due to competition from battery energy storage. Currently, surplus renewable generation can be stored in lithium-ion battery cells with 80% to 90% of that used to charge, also available to discharge. But green hydrogen has a much lower efficiency level, with approximately 40% to 50% of the electricity used by the electrolyser for hydrogen production available for use when discharging.

Whilst this is expected to improve, with a strong focus of the development of electrolysers currently, this is still a consideration for renewable energy projects assessing which storage option to pursue.

There are other advantages, such as the duration of the storage of hydrogen – offering the possibly of energy storage that lasts through seasons (see p.75) – but it is a consideration when looking to maximise surplus renewables. Unlike industrial green hydrogen projects like ENGIE’s La Mede or Austrom’s Callide project, should generators wish to develop green hydrogen for use in the wider grid, the barriers go further than grid constraints and will require further policy support.

New technology, familiar challenges

Challenges around system integration remain for large-scale green hydrogen, but many are not particularly different from those large-scale renewable energy projects face. With supportive policy coming into play, this should largely be addressed as nations buildout a framework for the fuel.

The advantages of green hydrogen are clear, and with the cost of the technology set to come down dramatically over the coming years, more projects are likely to come to the fore. In particular, we could see green hydrogen playing a role in flexibility as well as decarbonising industry. “The hydrogen value chain is complex with multiple distribution channels, markets, and competitors,” adds Regen’s Millman. “This is good news in terms of the opportunity to develop an exciting new industry, but it does mean that policy makers need to tread very carefully when thinking about market-building policy interventions.”

“There needs to be a whole value chain approach to hydrogen, which is underpinned by the development of consumer markets, as well as investment in production, storage, and distribution infrastructure, which will require support and planning.”

As such, governments should look to establish firm policy around green hydrogen that allows it to integrate into the electricity sector, in particular the storage and flexibility spaces, in order to truly capitalise on the development of this green giant.